GBP/NZD Rate Near 3-Year Highs but Risk of Correction Rising

- Written by: James Skinner

"GBP has broken out of its 2-week downtrend, fuelled by market expectations of a 5½% terminal BoE cash rate, which is up there with NZ" - ANZ.

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate extended its recent rally to some of its highest levels since the onset of the pandemic this week but the risk of a correction has risen alongside Sterling while the scope for a setback might only be likely to grow further in the days and weeks ahead.

New Zealand's Dollar gave further ground to most major currencies including the Pound in the opening half of the holiday-shortened week but losses were shallower than those following last Wednesday's Reserve Bank of New Zealand (RBNZ) interest rate decision.

"USD is firmer across the board overnight, with AUD and NZD leading losses as Chinese data again disappointed. The manufacturing and non-manufacturing PMIs were both weaker than expected," says Adam Cole, chief FX strategist at RBC Capital Markets.

Kiwi Dollar losses have built since last Wednesday when the RBNZ surprised on the 'dovish' side of expectations by raising its cash rate to 5.5% but signaling through updated forecasts that it's now likely to remain unchanged around current levels for the foreseeable future.

Above: Pound to New Zealand Dollar rate shown at daily intervals alongside NZD/USD.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

"When looking at the combination of slumping growth, fading inflation momentum and restrictive monetary policy settings, the evidence points to an RBNZ that is clearly not just pausing, but is done with rate hikes for this cycle," says Robert Robis, chief fixed income strategist at BCA Research.

The decision was in line with the RBNZ's earlier forecasts but came across as 'dovish' relative to expectations that had risen after the government incorporated increased investment spending and funding of the rebuild from recent natural disasters into the annual budget announced earlier this month.

"NZD/USD can soon dip below 0.6000 if milk prices decline as we expect. Fonterra, New Zealand’slargest dairy product exporter expect a price of $NZ7.25-8.75 per kgMS for the 2023/24 season," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

"By contrast, our ASB colleagues expect a milk price of $NZ7.00," he adds.

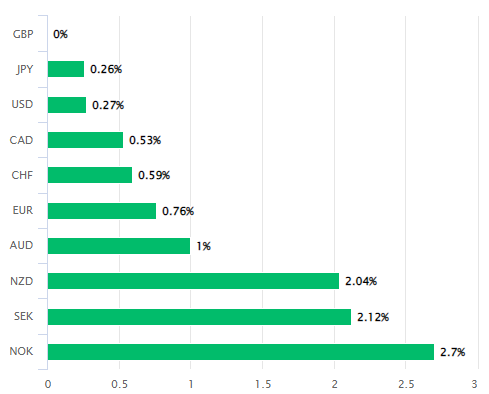

Above: Pound relative to G10 over last 5 days. Source: Pound Sterling Live.

New Zealand's Dollar was close to the worst-performing advanced economy currency for the week to Wednesday though its losses against the U.S. Dollar and an outperforming Pound have been most pronounced with GBP/NZD reaching its highest levels since April 2020.

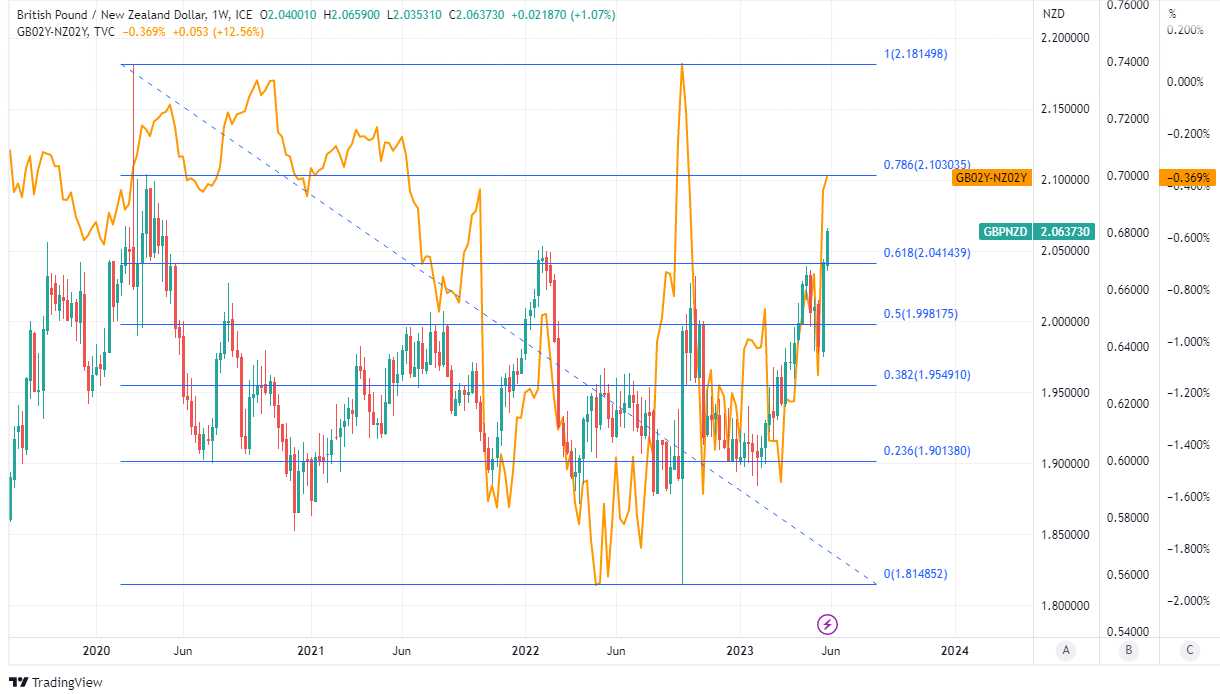

"GBP has broken out of its 2-week downtrend, fuelled by market expectations of a 5½% terminal BoE cash rate, which is up there with NZ. This could be a real theme for GBP and this cross," says David Croy, an FX strategist at ANZ.

GBP/NZD has rallied hard since Office for National Statistics figures suggested last week that all of April's inflation decline might have resulted from earlier falls in energy prices while appearing to reveal an acceleration of inflation within the domestic side of the economy.

Overall inflation fell from 10.1% to 8.7% last month but the more important core inflation rate rose from 6.3% to 6.8%, leading prices in interest rate derivative markets to suggest a high risk of the Bank of England (BoE) Bank Rate being raised from 4.5% to 5.5% this year as result.

Above: Pound to New Zealand Dollar rate shown at weekly intervals with Fibonacci retracements of 2020 fall indicating possible areas of technical resistance for Sterling and spread or gap between 02-year UK and NZ government bond yields highlighting change in relative interest returns. Click image for closer inspection.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

"The surge in Gilt yields brought back memories of the mini-budget crisis last autumn and the premiership of Liz Truss, but instead of unfunded tax cuts, the blame now is laid at the door of inflation and the BoE," says Kenneth Broux, an FX strategist at Societe Generale.

The prospective rub for Sterling, however, is in the effect that newly-increased expectations for Bank Rate could have on the UK economy, given that rates charged to mortgage borrowers are based on the market-implied rate and not the actual Bank Rate.

This means households can now expect to be charged 5.5% or more when renewing fixed-rate mortgages, which is an increase from the normal level of between 0.1%% to 0.75% seen over the last 15 years and implies monthly mortgage repayments that could swallow almost the entirety of some incomes.

"The jump in swap rates will bring more pain for fixed rate mortgage holders and higher repayments. An estimated 640,000 fixed rate deals will reset in

2H. Headline inflation slowed to 8.7% from 10.1%," Broux writes in a Tuesday market commentary.

Above: Pound to New Zealand Dollar rate shown at monthly intervals with Fibonacci retracements of 2025 downtrend indicating possible areas of technical resistance for Sterling, alongside selected moving averages. Click image for closer inspection.

Monthly repayments on a 25-year mortgage with a 75% loan-to-value ratio and a 5.5% Bank Rate would approach £1,707 (NZ$ 3,500) and 61.5% of the median pre-tax income if measured in annual terms.

In addition, the labour market has recently shown signs of cooling and the UK economy is widely projected to underperform many peers this year, while the speculative market has reportedly been a large buyer of Sterling, which could mean it's vulnerable to profit-taking.

"Net GBP speculators’ positions have now been positive for six consecutive weeks. This marks a notable improvement in sentiment relative to the start of the year.But already appetite for GBP has started to waver," says Jane Foley, head of FX strategy at Rabobank.

"Very sticky UK inflation data have triggered concerns that the BoE may have little option but to push the economy into recession in order to control price pressures," she adds.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes