GBP/NZD Eyes 2.0400, RBNZ and Milk Price Forecasts Weigh

- Written by: Gary Howes

- GBPNZD sees follow-through upside Thursday

- 2023 highs at 2.0400 in contention

- Breakdown in AUDUSD to 0.6000 seen at CBA

- Fonterra milk price forecasts too optimistic says ASB

Image © Adobe Stock

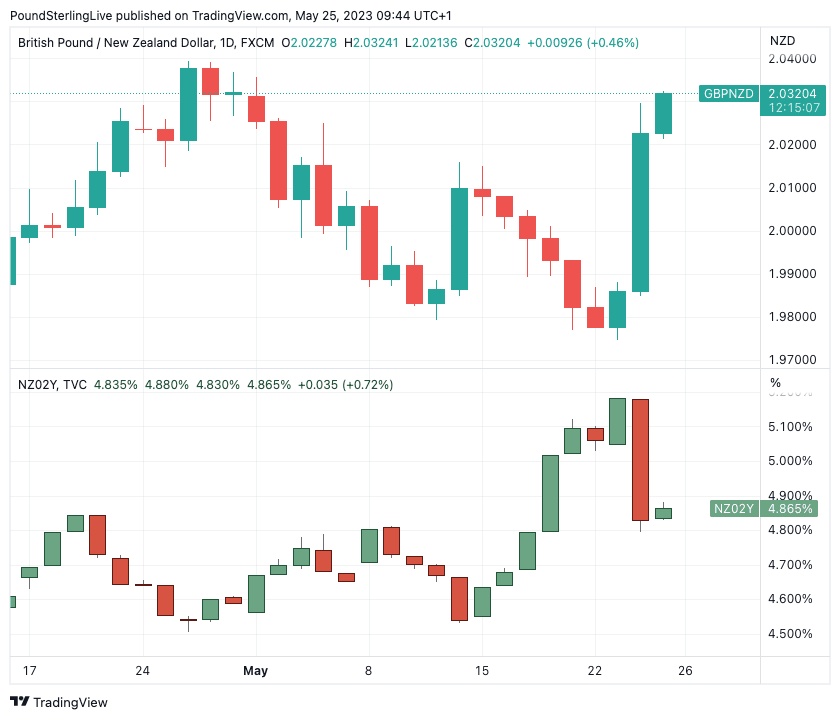

The Pound to New Zealand Dollar exchange rate (GBPNZD) looks set for a retest of 2023's highs, but the strength of the recent rebound could mean a break of resistance of 2.0400 ultimately transpires over the coming days.

The Pound registered its strongest one-day advance against the New Zealand Dollar in eight months with a 1.95% rally that followed the Reserve Bank of New Zealand's (RBNZ) signal that it was now done raising interest rates.

The RBNZ hiked by 25 basis points but delivered a statement that left little doubt amongst market participants that the peak in interest rates would now rest at 5.5%.

This was a surprise for a market that was expecting either a 25bp or 50bp move with an eventual peak of 5.75% - 6%.

"The general tone of the Statement points to the RBNZ being comfortable that it has done enough to get on top of inflation, particularly as there is still a lagged impact of past monetary tightening yet to come through. We think the RBNZ is now done," says Nick Tuffley, Chief Economist at Auckland Savings Bank (ASB).

The development prompted a sharp fall in the yield paid by New Zealand government bonds, in turn prompting a selloff in the New Zealand Dollar.

The below chart shows GBPNZD's rally as two-year NZ government bond yields fell:

Interest rate differentials are therefore an important driver for this pair and given UK bond yields have risen in the wake of Wednesday's UK inflation release, GBPNZD can move higher.

Sterling extended its advance against the New Zealand Dollar again at the time of writing on Thursday by 0.40%, confirming some follow-through momentum and putting GBPNZD on course to test the 2023 highs and the strong resistance zone at 2.0400.

But, a break of this resistance level could be possible if the Kiwi's decline against the U.S. Dollar can extend.

"NZD/USD hit our end‑June forecast of 0.6100. NZD/USD can dip below 0.6000 in coming weeks," says Joseph Capurso, foreign exchange strategist at Commonwealth Bank of Australia (CBA).

Such a 100 pip move lower in NZDUSD would provide a mechanical aid for further GBPNZD gains, prompting a GBPNZD breakout to fresh highs just below 2.0500.

Beyond the RBNZ, commodity prices are another potential concern for the New Zealand Dollar going forward.

Economists at ASB are bearish about the outlook for milk prices, suggesting weakness for the country's premier foreign exchange earner after Fonterra, New Zealand’s largest dairy product exporter, lowered its milk price forecast.

The 2022/23 season guidance now sits in a narrow band: moving from $NZ8.00‑8.60 per kgMS to $NZ8.10‑8.30 per kgMS.

For the 2023/24 season, Fonterra expect a price of $NZ7.25‑8.75 per kgMS.

By contrast, ASB expects a milk price of $NZ7.00 per kgMS.

Capurso says if ASB's bearish view proves correct it "will pull NZD down."

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes