GBP/NZD Week Ahead Forecast: Back at 2.0, but Fresh Highs Maybe Out of Reach

- Written by: Gary Howes

- GBPNZD lower in May

- But NZD's rally could be fading

- However, fresh 2023 highs for GBPNZD likely out of reach

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate (GBP/NZD) is trading back at the psychologically important 2.0 level at the start of a new week which could see the Kiwi currency resume some of its 2023 underperformance.

For sure, May has been a month of strength for the New Zealand Dollar with advances coming against the majority of its peers.

But a sizable 2.0% slump ahead of the weekend suggested the recent strength was at risk of fading, allowing the likes of the Pound, Euro and Dollar some relief.

"In almost textbook demonstration of the old adage, the Kiwi has gone up the stairs and down the elevator in May," says David Croy, FX Strategist at ANZ. "The Kiwi is also falling for domestic reasons following lower inflation expectations data."

The Reserve Bank of New Zealand said last week two-year inflation expectations fell to 2.79% from 3.30% in the first quarter, potentially easing pressure on the committee to raise interest rates further, thereby denying the NZD support via the interest rates channel.

"The domestic rates market ended the week with lower yields led by the front end following the release of the RBNZ inflation expectations data... the downward momentum in expectations will give the RBNZ some comfort it is getting traction and is close to the peak in the official cash rate," says Stuart Ritson, currency strategist at Bank of New Zealand.

"The Kiwi is now struggling as markets question how high the OCR needs to go," says Croy.

Money market pricing shows investors are prepared for one further hike from the RBNZ, which would take the peak in the OCR to 5.5%, taking it higher than any other developed G10 central bank.

However, markets are also seeing at least one rate cut coming before year-end; the NZD could come under pressure should this expectation deepen.

Friday's sharp retreat in the New Zealand Dollar nevertheless comes at a time of short-term outperformance for the Kiwi which still holds an advance against its major peers for May.

Ray Attrill, Head of FX Strategy at NAB reflects that the NZD has been "inexplicably strong in the month through Thursday".

The strength is reflected in GBPNZD's retreat from multi-month highs on April 27 at 2.040 through to the Thursday, April 11 low at 1.9791.

The New Zealand Dollar now holds a 1.35% advance on the Pound for May, with gains against the Dollar standing at 0.75% and against the Euro the gain is nearly 2.0%.

Attrill says his guess is that some of the strength can be explained by insurance flows related to Cyclone Gabrielle.

But "on Friday the kiwi displayed all its flightless qualities," he notes, with NZD/USD slumping by 1.7%, almost 1% more than any other G10 pair.

"What goes up must come down is about the most intelligent thing we have to say here," he adds.

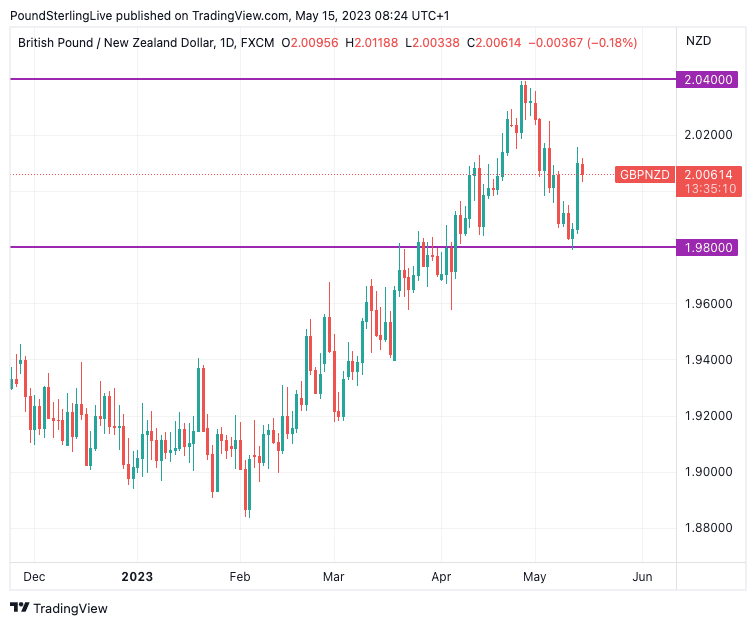

Above: GBPNZD at daily intervals.

GBPNZD rose 1.18% on the day to 2.009, where we find it on Monday.

Pound Sterling Live notes the rebound in GBPNZD could mean the recent decline is now over and opens the door to a period of consolidation to set in.

The obvious level of support now sits at 1.98 and this would form the lower end of our near-term forecasts.

Looking at the upside, a return to the year's high at 2.04 cannot be ruled out over the coming days. The recent May retreat does however suggest upside momentum in GBPNZD has faded somewhat and a break to fresh highs is unlikely at this juncture.

ANZ's Croy says the NZD is likely to struggle against both the Euro and Pound over the coming days thanks to "the sense that the RBNZ will be one and done"... "markets still expect more than one hike from the BoE (and ECB)".

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes