GBP/NZD Week Ahead Forecast: Slide Back Below 1.92 Possible

- Written by: James Skinner

- GBP/NZD extends rebound with probe above 1.95

- But risking reversal lower post-Fed, BoE decisions

- Slide below 1.9200 possible if NZD/USD rebounds

Pine timber being exported from Wellington, New Zealand. Photo by James Anderson, World Resources Institute.

The Pound to New Zealand Dollar exchange rate has lifted sharply from its early April lows in recent weeks but could be at risk of sliding back to, or perhaps even beneath the 1.92 level in the wake of this week’s Federal Reserve (Fed) and Bank of England (BoE) policy decisions.

Sterling tumbled near to 2021 lows beneath 1.88 during the early days of April but a stronger U.S. Dollar and mounting risks to the Chinese economic outlook have since enabled GBP/NZD to climb out of its earlier trough.

The Pound to New Zealand Dollar rate climbed back above the 1.95 handle on Tuesday but would be likely to come under pressure later in the week if the Fed defers an announcement about quantitative tightening (QT) on Wednesday and if the BoE dampens appetite for Sterling on Thursday.

“A 25bp hike is widely expected and slightly more than fully discounted for this week’s MPC meeting. We expect GBP to take its cues from longer-term rate expectations and clues from the number of dissenting members in favour of unchanged rates and the message from the BoE’s long-term inflation forecast, which is again likely to be below target based on market rates,” says Adam Cole, chief FX strategist at RBC Capital Markets.

“SONIA forwards are priced for close to 200bp of hikes over the next year, which goes far beyond our expectations. On the other side of a GBP short, we fade NZD underperformance in April. NZD was the worst-performing G10 in the month, despite NZ rates markets not participating in the repricing lower that affected some G10 markets. Short positioning in NZD is extreme relative to the other commodity currencies,” Cole also said on Tuesday.

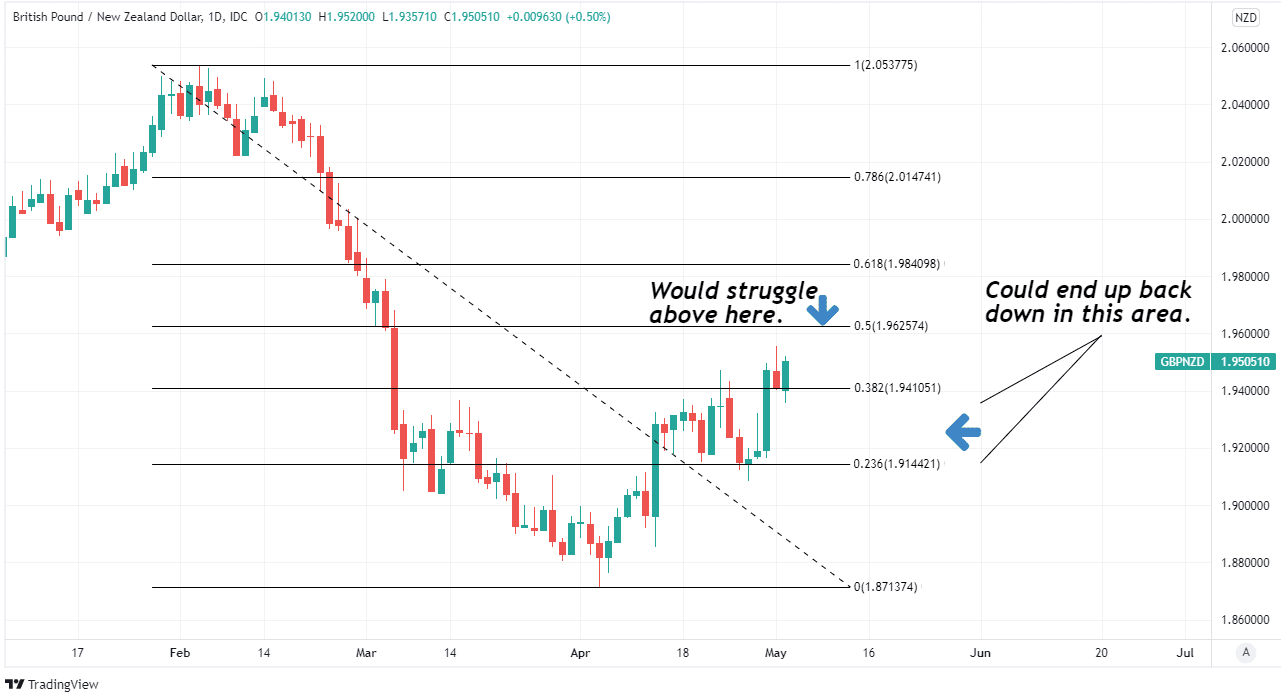

Above: Pound to New Zealand Dollar rate shown at daily intervals with Fibonacci retracements of February decline indicating possible areas of short-term technical resistance for Sterling and support for the Kiwi. Click image for closer inspection.

Above: Pound to New Zealand Dollar rate shown at daily intervals with Fibonacci retracements of February decline indicating possible areas of short-term technical resistance for Sterling and support for the Kiwi. Click image for closer inspection.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Cole and the RBC team said the likely dampening effect of Thursday’s BoE decision could lead the Pound to New Zealand Dollar rate to fall back below 1.92 this week when suggesting on Tuesday that clients of RBC sell the exchange rate and target a fall to 1.91 in the days and weeks ahead.

The BoE is widely expected to lift Bank Rate to a post-financial crisis high of 1% this Thursday while many in the market expect the bank will also announce plans to begin actively selling government bonds acquired as part of its quantitative easing programme in what would mark a further development of the quantitative tightening process in the UK.

But the potential spoiler for Sterling is that an announcement on bond sales is far from assured, if not somewhat unlikely, and the BoE’s economic forecasts are likely to signal growing disagreement with market assumptions about the outlook for Bank Rate later this year.

This would contrast with the Reserve Bank of New Zealand (RBNZ), which has telegraphed unapologetically that it’s likely to lift the Kiwi cash rate from 1.5% to more than three percent over the coming year as part of its effort to rein in inflation, after already lifting it from 0.75% thus far in 2022.

“The RBNZ will publish its financial stability report today (10pm London time). But more focus will be placed on the NZ Q1 2022 labour market report (11:45pm),” says Carol Kong, a strategist at Commonwealth Bank of Australia.

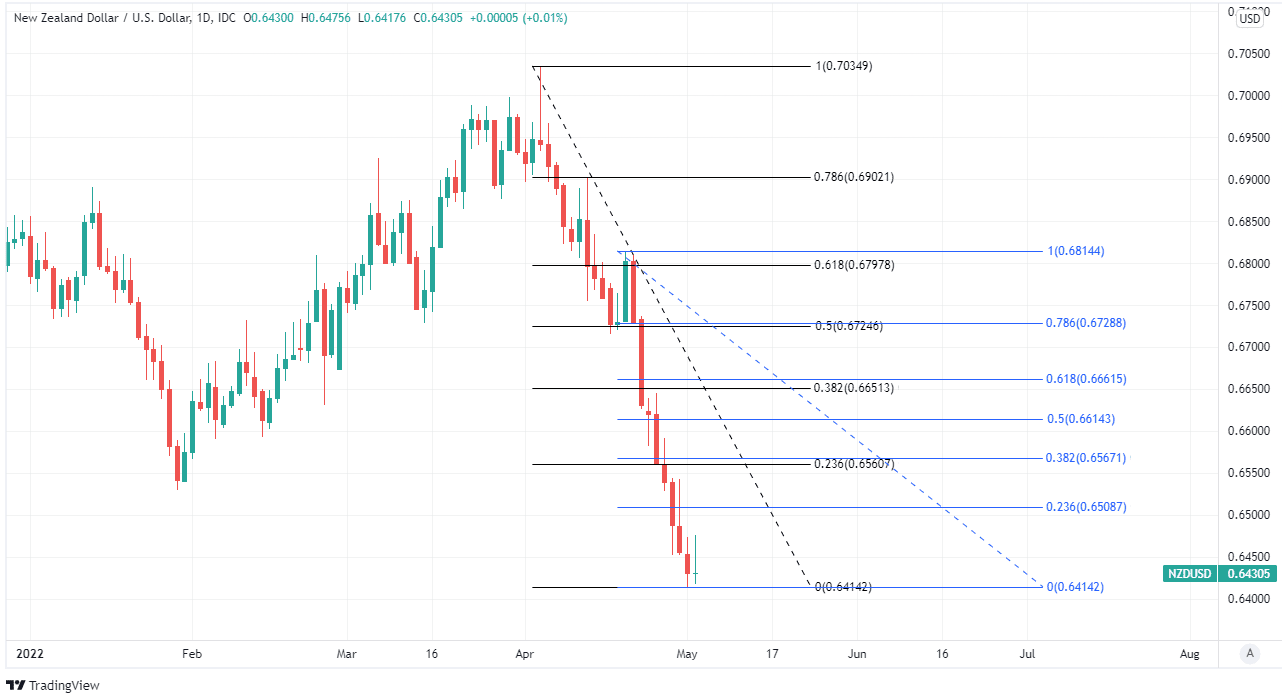

Above: NZD/USD shown at daily intervals with fibonacci retracements of April’s two respective legs lower indicating possible areas of short-term technical resistance to a Kiwi Dollar rebound. Click image for closer inspection.

Above: NZD/USD shown at daily intervals with fibonacci retracements of April’s two respective legs lower indicating possible areas of short-term technical resistance to a Kiwi Dollar rebound. Click image for closer inspection.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

“Given another 50bp hike by the RBNZ is already fully priced for later this month, we do not expect the labour market report will induce a large NZD reaction. Instead, NZD will likely remain heavy in the face of a strong USD and ongoing concerns about the Chinese economy.” Kong said on Tuesday.

While the spread of coronavirus containment measures in China is a headwind to the New Zealand Dollar and other similar currencies, the Kiwi also stands to benefit much more than Sterling if Wednesday’s Fed decision tamps down U.S. government bond yields and stalls the U.S. Dollar’s rally.

There is a risk that it could too, and this would be taking place just ahead of Thursday’s BoE decision, which would likely need to include a significant ‘hawkish’ surprise in order to rejuvenate market appetite for Sterling and avert further declines in GBP/NZD.

“NZD was sitting right on minor support at 0.6460 yesterday; that has clearly broken and it’s now on support at 0.6410 (the 123.6% Fibo extension of the retracement of the January-April rally),” says David Croy, a strategist at ANZ, in reference to NZD/USD.

“From a technical perspective, a break of 0.6410 risks a move to 0.6335, but let’s see how sentiment holds up. If the Fed does frame near term aggressive hikes as likely to limit the terminal rate, that could slow the USD’s ascent or turn it around,” Croy and colleagues also said on Tuesday

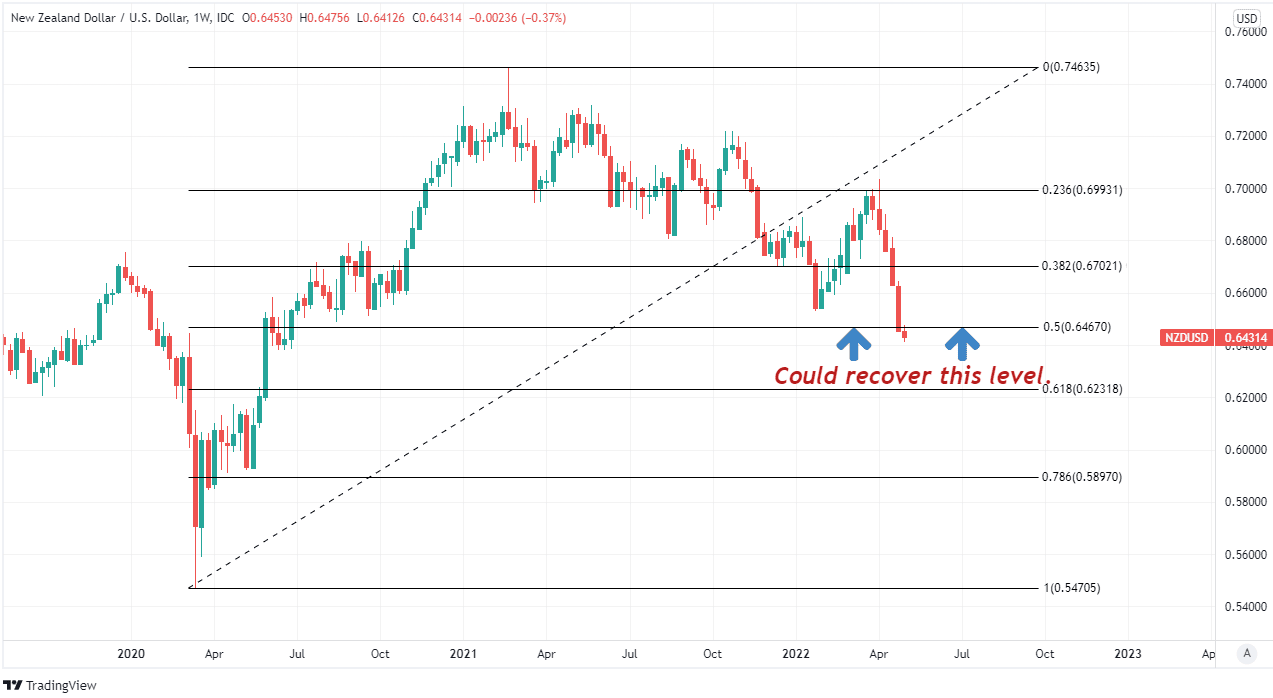

Above: NZD/USD shown at weekly intervals with fibonacci retracements of 2020 rally indicating possible areas of medium-term technical support for the Kiwi Dollar and resistance for the U.S. Dollar. Click image for closer inspection.

Above: NZD/USD shown at weekly intervals with fibonacci retracements of 2020 rally indicating possible areas of medium-term technical support for the Kiwi Dollar and resistance for the U.S. Dollar. Click image for closer inspection.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes