New Zealand Dollar Rally Leaves the Pound Clutching for Support

- Written by: James Skinner

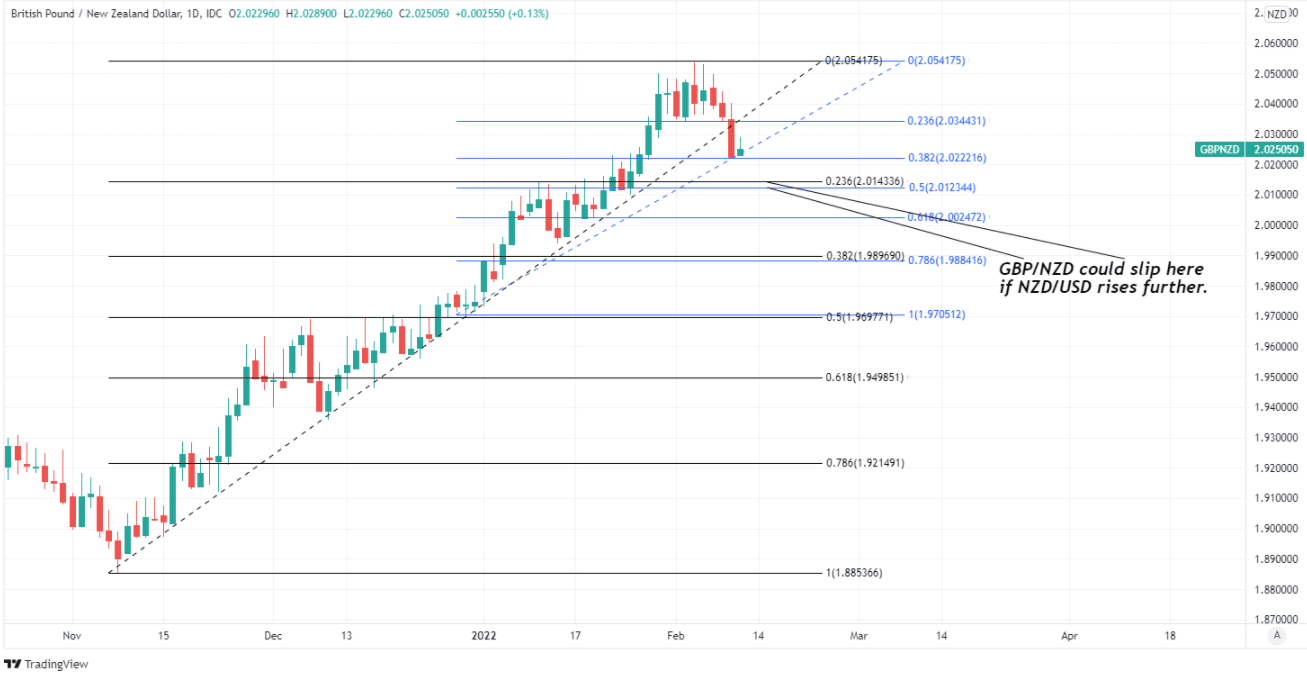

- GBP/NZD eyeing supports near 2.0140

- After NZD/USD’s rally prompts setback

- Inflation expectations in focus for NZD

- Further uptick could weigh on GBP/NZD

- Stalling or falling number would support

Image © Adobe Stock

The New Zealand Dollar has delivered a hat-trick of gains against the Pound that have curbed a multi-month rally in GBP/NZD and are threatening to push the Sterling exchange rate to three-week lows around 2.0140.

The Pound to New Zealand Dollar rate was clutching for support around 2.0250 on Thursday after being toppled amid a three-day rally by NZD/USD, which attempted to rise back above the 0.6700 level in the penultimate session of the week.

“The strong rally in the AUD overnight helped lift the Kiwi up to just below 0.67, with the former buoyed by gains in metals and a bounce in generalised market risk appetite,” says David Croy, a strategist at ANZ.

“NZD/GBP put in a decent performance overnight, but is still within very established ranges. Both currencies seem undervalued, so it’s mixed,” Croy and colleagues wrote in a Thursday market commentary.

The Kiwi’s rebound came amid gains for commodity prices and widespread declines in U.S. Dollar exchange rates that helped to pull GBP/NZD lower from 2.05 at the opening of the week, although economic data due from New Zealand on Friday is now the main risk to Sterling ahead of the weekend.

Above: Pound to New Zealand Dollar rate shown at daily intervals with Fibonacci retracements of January and November rallies indicating possible areas of technical support for Sterling.

- GBP/NZD reference rates at publication:

Spot: 2.0295 - High street bank rates (indicative band): 1.9585-1.9727

- Payment specialist rates (indicative band): 2.0111-2.0194

- Find out about specialist rates, here

- Set up an exchange rate alert, here

The Reserve Bank of New Zealand (RBNZ) is set to release its survey of inflation expectations for the first quarter around 02:00 London time on Friday and the Pound to New Zealand Dollar rate could potentially be vulnerable to further declines if expectations have risen again this quarter.

Last quarter the survey suggested that Kiwi businesses expected prices of their goods and services to rise by around 2.96% in each of the next two years, implying that inflation would remain close to the top end of the RBNZ’s one-to-three percent target band toward the end of its multi-year forecast horizon.

This would vindicate the bank’s swift move last year to prepare businesses and households for a now-underway cycle of interest rate rises.

“The RBNZ’s inflation expectations survey could post a 30-year high tomorrow. That could motivate markets to price even more into rates and the NZD, even though pricing is already quite full,” says Imre Speizer, head of NZ strategy at Westpac.

“NZD/USD has recently been boosted by the pullback in the USD (in turn, partly related to the ECB’s hawkish shift), and should test 0.6705,” Speizer and colleagues wrote in a Tuesday research briefing.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

While financial markets have already priced-in a greater degree of monetary tightening for the coming years than the RBNZ has guided for in its forecasts and economic assumptions, this week’s risk is that Friday’s survey leads investors and traders to anticipate that the bank could bring forward some of the likely increases in its benchmark cash rate.

The cash rate was already lifted to 0.75% in November last year and is widely expected to rise to 1% on February 23, although the risks is that financial markets bet on a larger increase to something like 1.25%, which could potentially lift NZD/USD on Friday and weigh further on the Pound to New Zealand Dollar rate in the process.

“NZD/GBP’s decline since late Nov. persists but looks mature. There is potential for a retest of the 0.4870 low [2.0533 high for GBP/NZD], but caution below that. The BoE delivered a hawkish hike last week, with more to come,” Westpac’s Speizer said in a note to clients.

GBP/NZD tends to closely reflect the relative performance of NZD/USD and its Sterling equivalent GBP/USD, and without an offsetting increase in the latter, GBP/NZD would be likely to slip as far as the rough 2.0140 level on Friday if NZD/USD manages a break above 0.67.

Above: NZD/USD shown at daily intervals with major moving-averages and Fibonacci retracements of November decline indicating possible areas of technical resistance to any further Kiwi recovery.