Pound / New Zealand Dollar Forecasters Eyeing 2.10 for March 2022

- Written by: James Skinner

- GBP/NZD supported above 2.0300

- Could advance further this quarter

- ANZ forecasts top of 2.10 in March

- As NZD/USD continues to struggle

Image © Adobe Stock

The Pound to New Zealand Dollar rate has remained buoyant near two-year highs in recent trading but may be set to advance further over the coming weeks, according to strategists at ANZ.

Pound Sterling traded briefly above the 2.05 handle against the New Zealand Dollar last Friday, its highest since May 2020, but remained elevated near to that level early in the new week as the Kiwi struggled for traction against many other major currencies.

New Zealand’s Dollar plumbed the bottom of the major currency league table throughout January and struggled this week to extend its early February rebound, which has helped the Pound to Kiwi exchange rate to cement its grip on the recently-recovered 2.03 handle.

“The NZD is being buffeted by opposing cross-currents. Commodity prices are booming and the recovery remains robust. Annual inflation has risen sharply (to 5.9%) and the unemployment rate has fallen to a modern-era record low of 3.2%,” says David Croy, a strategist at ANZ.

“This has, in turn, cemented the need for RBNZ to lift the OCR. While higher interest rates are normally a positive, it’s less so when other countries are also raising rates. Additionally, fears of a “hard landing” and housing market vulnerabilities are weighing,” Croy wrote in a Tuesday research briefing.

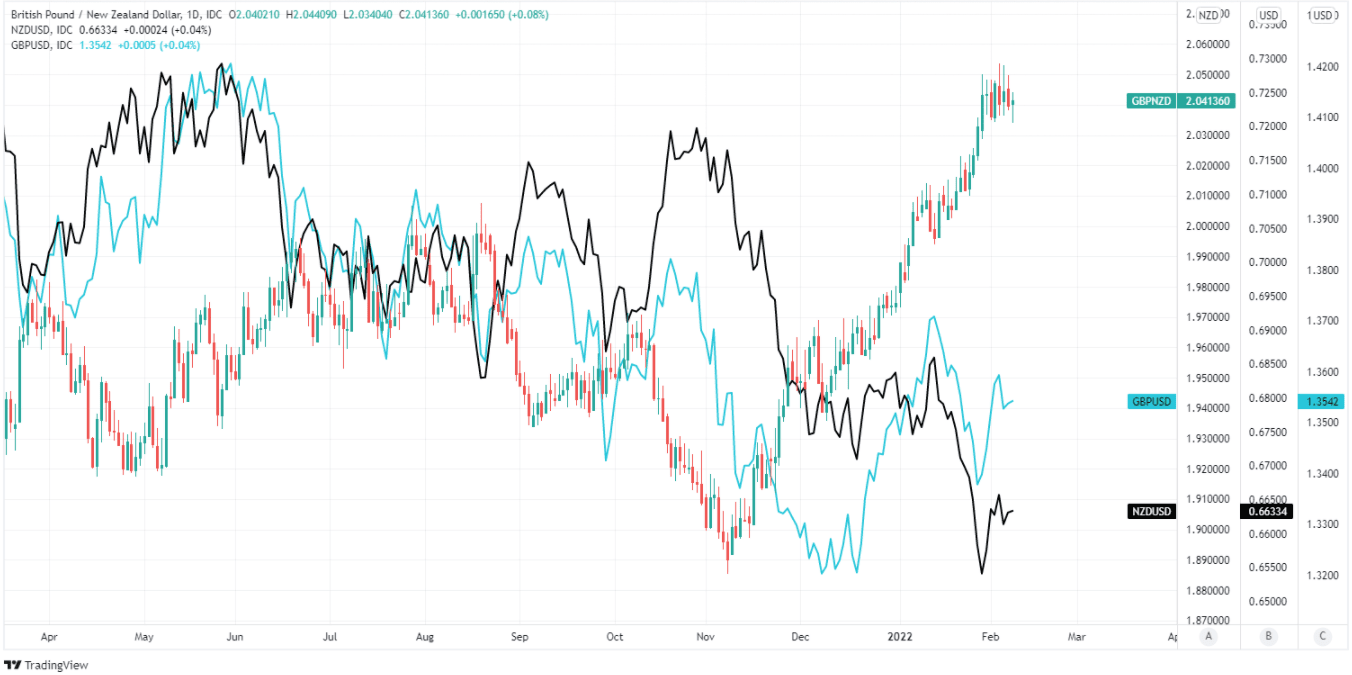

Above: GBP/NZD shown at daily intervals with GBP/USD and NZD/USD.

- GBP/NZD reference rates at publication:

Spot: 2.0417 - High street bank rates (indicative band): 1.9700-1.9845

- Payment specialist rates (indicative band): 2.0233-2.0315

- Find out about specialist rates, here

- Set up an exchange rate alert, here

With Sterling having steadied above the 1.35 level against the U.S. Dollar, the Pound to New Zealand Dollar rate could be likely to remain well supported above 2.03 this week unless in the interim NZD/USD is able to make a break back above the 0.67 level it ceded during the early weeks of January.

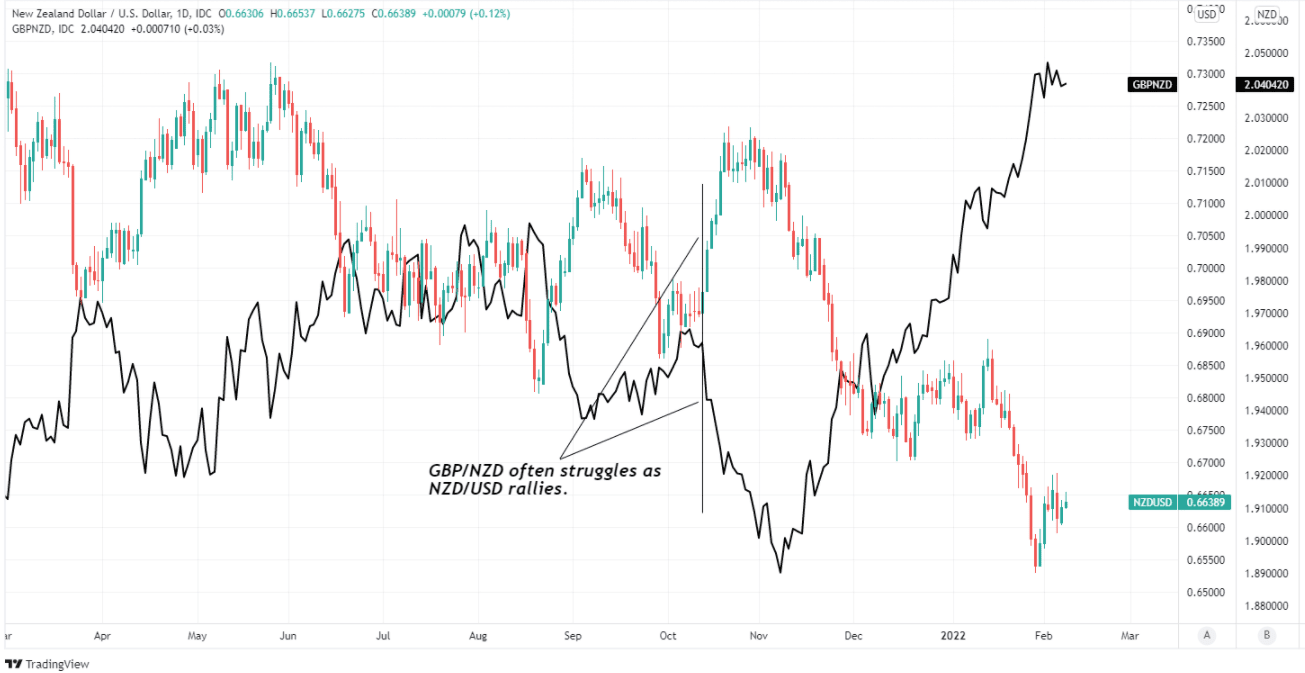

Some analysts say the latter is unlikely in the near future, however, and have warned that fresh NZD/USD losses may be seen over the coming weeks.

“We remain of the view that this NZD/USD strength is still corrective and we look for an attempt to find a fresh cap here for a resumption of the core downtrend,” says David Sneddon, head of technical analysis trading strategy at Credit Suisse.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"Support is seen at .6595 initially, back below which can see the risk turn lower again for a fall back to .6566/61 ahead of the .6529 recent low and then our .6511/.6488 objective," Sneddon also wrote in a recent research briefing.

GBP/NZD tends to closely reflect the combined performance of NZD/USD and its Sterling equivalent GBP/USD, and would be likely to climb further if Credit Suisse and ANZ are right to expect that NZD/USD will fall back to 0.65 in the weeks ahead.

New Zealand’s Dollar fell close to three percent against the U.S. Dollar during the opening weeks of the new year, explaining a large portion of the 3.7% increase seen in the Pound to New Zealand Dollar rate during the same period.

Above: NZD/USD shown at daily intervals alongside GBP/NZD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“Domestic fundamentals look good, and if that were all that mattered, the Kiwi might be a lot higher. But global factors have been more influential,” ANZ’s Croy wrote on Tuesday.

“We note, for example, that interest rates are set to rise across the globe, and not just here – most notably in the US,” Croy and colleagues also said.

New Zealand's Dollar is one of the more sensitive among major currencies to changes in U.S. bond yields and to market demand for the U.S. Dollar, both of which have been on the rise thus far in 2022.

The above relationship between the Kiwi and U.S. assets is one reason why NZD/USD could be at risk of further declines as the March policy decision of the Federal Reserve draws near over the coming weeks, which would be supportive of GBP/NZD.

Source: ANZ Research.

“Our forecasts do call for gradual NZD/USD strength over 2022, but we are no longer as bullish as we were and have recently downgraded our track,” ANZ’s Croy says.

The Fed cut its interest rate from 1.75%, to 0.25% during March 2020 in an effort to support companies and households as the economy closed down in response to the coronavirus, but with the economy and labour markets recovered from that episode, the bank’s attention is now squarely on inflation.

U.S. inflation has risen to multi decade highs over the last year and although it’s widely expected to recede sharply during the months ahead, the Fed has readied itself to withdraw 2020’s interest rate cuts in order to ensure inflation falls back toward the targeted two percent level over coming years.

That’s lifted the U.S. Dollar to the benefit of Sterling, and is a big part of why ANZ forecasts suggest that NZD/GBP could fall to 0.4740 by the end of March, which would see the Pound to New Zealand Dollar rate trading around the 2.10 level.

"We now see NZD/USD topping out at 0.70 at year-end, down from 0.72 in our earlier forecasts. But if US growth and inflation continue to surprise to the upside, even 0.70 might be a challenge," Croy and colleagues also warned on Tuesday.