Pound / New Zealand Dollar Support at 1.9511 as 1.9840 Stymies

- Written by: James Skinner

- GBP/NZD supported at 1.95, could test 1.9840

- On late GBP recovery, lethargic show from NZD

- GBP/NZD at risk in any corrective USD setback

- Border delays weigh on NZD, BoE bets lift GBP

Image © Adobe Stock

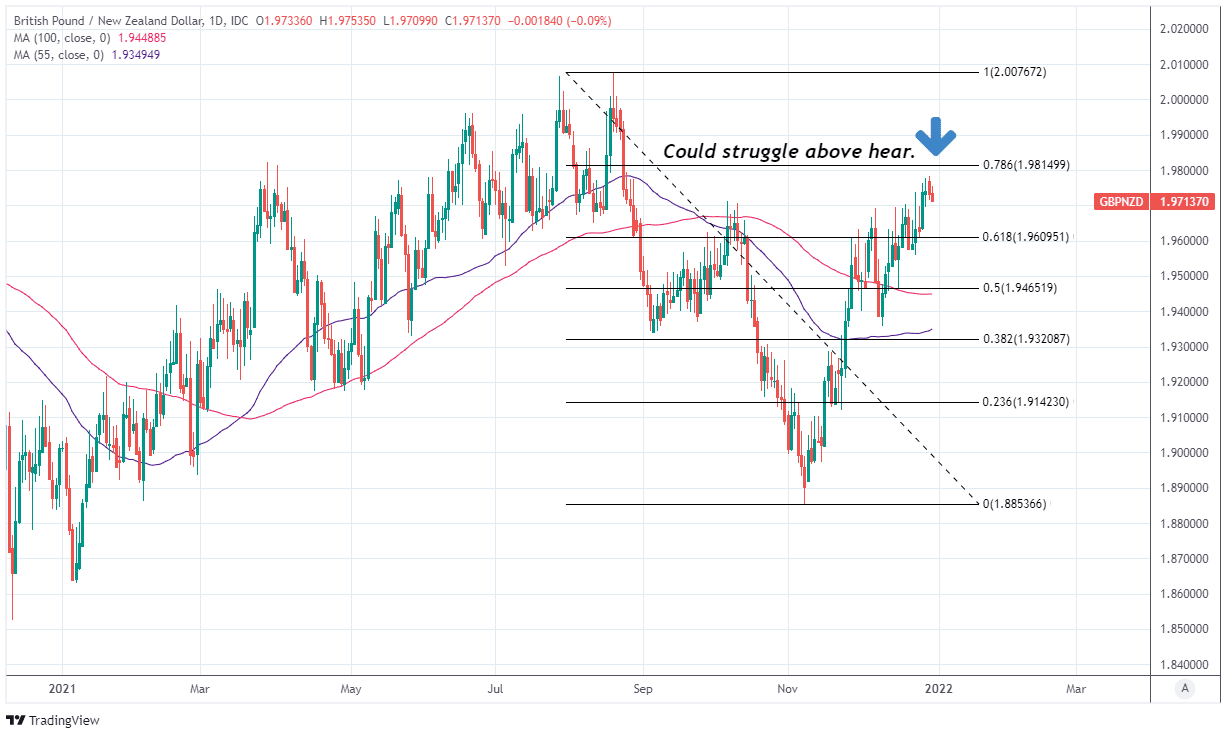

The Pound to New Zealand Dollar exchange rate remained near three-month highs and was on course to end 2021 with a more-than three percent gain in the final week of the year but could now struggle to extend its December rally beyond the nearby 1.98 level.

Pound Sterling was the best performing major currency in the final week of 2021 after being lifted by a favourable shift in market expectations for interest rates at the Bank of England (BoE) by mounting hopes that the Omicron strain of coronavirus could be milder than its predecessors.

Studies from England, Scotland, and South Africa suggested ahead of the festive break that risk of hospitalisation could be between 15% and 80% lower with the omicron strain than it was with the delta variant, according to research.

This has forced the market to reverse its recent downgrades of expectations for the BoE’s Bank Rate next year and helped to extend the Pound-to-New Zealand Dollar rate’s recovery back from early November’s lows near 1.8853, which could yet see it trade as high as 1.9840 over the coming weeks.

GBP/NZD benefited in December from the risk averse mood whipped up in the market by the arrival of the Omicron strain, although it was also lifted by a somewhat lethargic performance from the Kiwi Dollar.

“Overall, economic data out of New Zealand has been softer of late, RBNZ rate hike expectations have been scaled back, the phased border reopening has been delayed due to omicron, and risk off flow has soured sentiment. All of this has been behind this latest wave of Kiwi underperformance into year end,” says Joel Kruger, chief FX strategist at LMAX Group.

Above: GBP/NZD shown at daily intervals. Approaching resistance from 78.6% Fibonacci retracement of August decline.

- GBP/NZD reference rates at publication:

Spot: 1.9723 - High street bank rates (indicative band): 1.9033-1.9171

- Payment specialist rates (indicative band): 1.9545-1.9624

- Find out about specialist rates, here

- Set up an exchange rate alert, here

New Zealand’s Dollar was a laggard over the festive holidays after the government announced in late December that a planned easing of border restrictions will be delayed in the new year as part of Wellington’s response to lingering uncertainties about the Omicron strain of coronavirus.

This potentially deprives the local economy of a shot in the arm of its own during the early months of 2022 and has helped lift the Pound-to-New Zealand Dollar rate in recent trading because the Kiwi tourism industry previously pulled in 5.8% of national GDP for 2019.

The country had been set to allow New Zealand residents and citizens of Australia to travel freely between both countries without an obligatory spell in a managed isolation facility upon arrival from January 17, with the country opening up to foreign travelers from elsewhere in April.

“NZD/GBP is due to consolidate after weakness through November-December. Like the NZD, GBP faces a number of near-term headwinds. The recent COVID surge is not helpful for UK recovery thematic,” says Jason Wong, a senior markets strategist at BNZ.

The reopening of New Zealand’s prized tourism sector could yet provide the economy with a substantial stimulus in the early months of 2022 if it’s confirmed that the Omicron strain of coronavirus poses a lesser threat to public health than other but for the length of time that delays persist they could constrain the Kiwi and lead GBP/NZD to remain elevated near late December’s highs.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

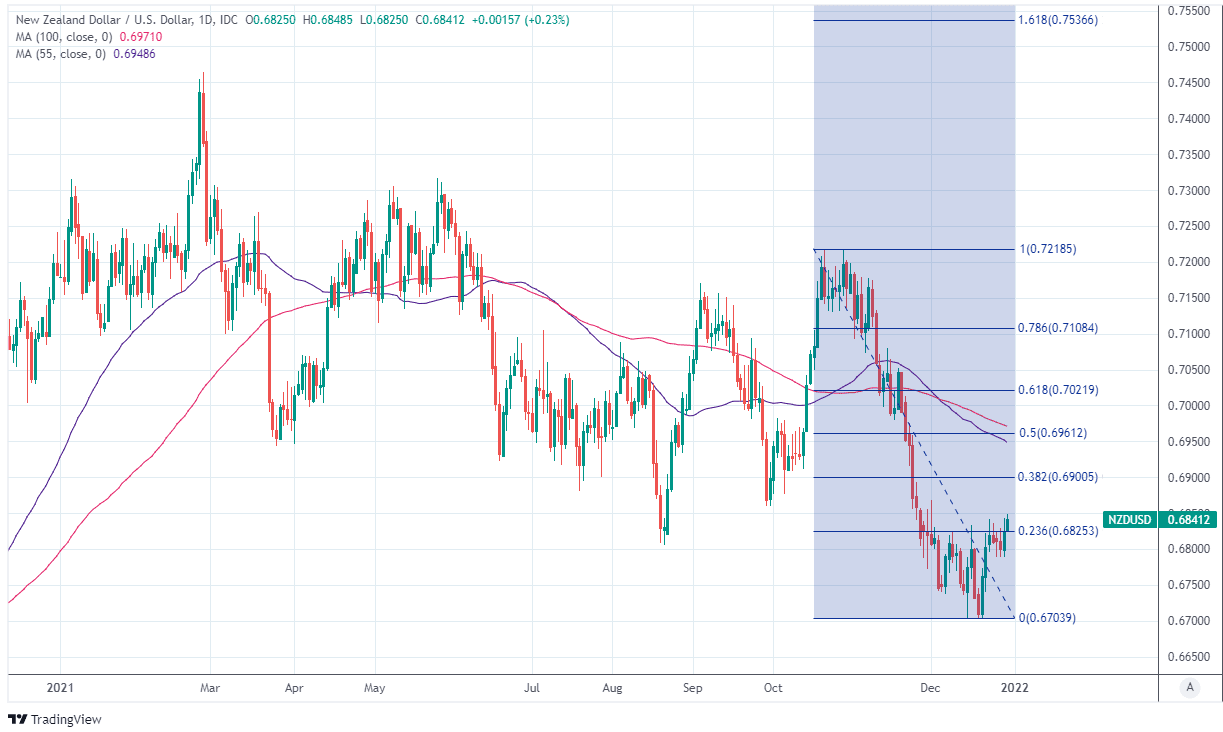

Much about the Pound-New Zealand Dollar rate outlook depends for the weeks ahead on trading in main Kiwi exchange rate NZD/USD, which has lagged behind the December rally in GBP/USD and helped to extend GBP/NZD’s advance in the process.

“We need to see sentiment for the USD to sour before NZD/USD returns sustainably into the 0.70s, which is not expected short-term, given the Fed’s gradually more hawkish tilt,” BNZ’s Wong wrote in a Wednesday research note.

The Pound-to-New Zealand Dollar rate could be likely to find itself well supported above the 1.95 level for the length of time that NZD/USD remains contained beneath 0.7000, especially in light of GBP/USD’s year-end rally.

An NZD/USD recovery above 0.70 could be necessary to push the Pound-Kiwi rate beneath 1.95 in the new year, which might be unlikely if analyst’s bullish views on the U.S. Dollar are anything to go by because Sterling often benefits from gains in the greenback.

Meanwhile, any renewed climb in U.S. Dollar exchange rates could potentially help to extend GBP/NZD’s advance further and likely as far as 1.9840 if for any reason the main Kiwi pair NZD/USD is forced into a retest of its own December 20 low around 0.6702.

Above: NZD/USD shown at daily intervals. Breaking above resistance from 23.6% Fibonacci retracement of November decline.