Pound / New Zealand Dollar Rate Confined to 1.94-to-1.97 Range Short-term

- Written by: James Skinner

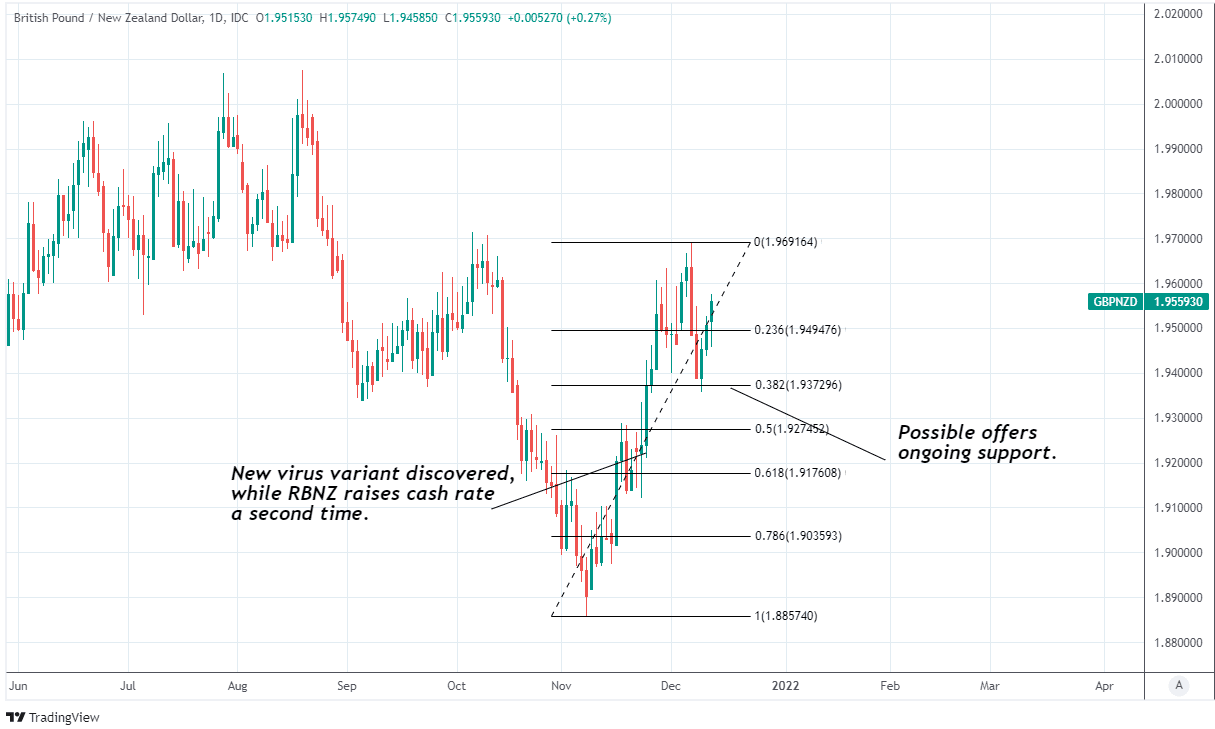

- GBP/NZD’s 1.94-1.97 range could hold short-term

- Choppy conditions likely in an action-packed week

- NZ’s Q3 GDP data may offer support to NZD/USD

- Constraining GBP/NZD ahead of key BoE decision

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate was on course for a hat-trick of gains at the open of the new week but could struggle to escape from its recent trading range spanning the gap between 1.94 and 1.97 over the coming days.

Sterling was higher against the Kiwi and most other major currencies in the opening session of the new week, placing the Pound-to-New Zealand Dollar rate on course for a third successive gain while still leaving it short of December’s peak around 1.97.

This staid outlook for a range-bound confinement of GBP/NZD belies an action-packed economic calendar that features on the Kiwi side a third-quarter GDP report, half-yearly economic update from Treasury and a public appearance by Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr.

“GDP will be more noise than signal, but we and the consensus expect it to “only” fall by 4.5% q/q, whereas the RBNZ has -7% pencilled in. If we are right, perhaps 0.6750 does become summer’s line in the sand?,” says David Croy, a strategist at ANZ.

New Zealand’s highlights will themselves be followed closely behind by December’s interest rate decision from the Bank of England and along the way there’s also a host of other data due from the UK too, some of which could impact the outlook for BoE interest rates in 2022.

Above: Pound-to-New Zealand Dollar rate at daily intervals with Fibonacci retracements of November recovery indicating possible areas of technical support.

- GBP/NZD reference rates at publication:

Spot: 1.9609 - High street bank rates (indicative band): 1.8923-1.9060

- Payment specialist rates (indicative band): 1.9433-1.9511

- Find out about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

Croy and colleagues were looking on Monday for New Zealand’s GDP report to help the main Kiwi exchange rate NZD/USD to establish a foothold around above last week’s lows at 0.6750, which could happen if the number emerges substantially stronger than the RBNZ’s forecast.

This may lead the market to view it as indicating upside risks to the inflation projections and interest rate assumptions that will be updated by the bank over the coming months and could in turn have implications that either limit GBP/NZD’s climb or perhaps even weigh on it outright.

That data is preceded on Tuesday by the latest round of key economic figures from China, which might be beneficial for Asia Pacific currencies if like the PMI surveys for last month it hints of a final quarter stabilisation in the world’s second largest economy following almost a year of slowing growth.

“News of the Omicron variant has diminished expectations for a December rate hike from the BoE, though the market is still positioned for a fair amount of tightening next year,” writes Jane Foley, head of FX strategy at Rabobank, in a Monday review of data detailing the positions of speculative traders.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

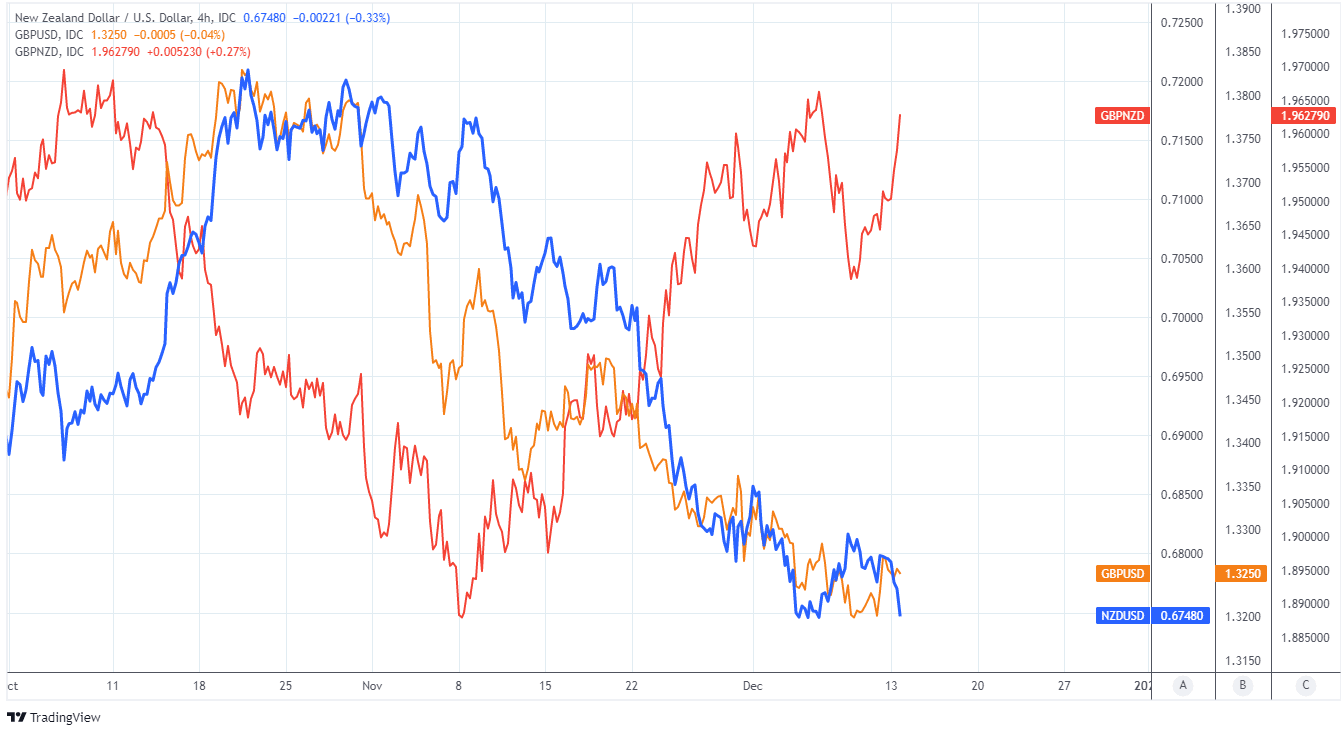

GBP/NZD closely reflects the relative performances of NZD/USD and GBP/USD and so price action this week will also depend heavily on Thursday’s interest rate decision from the BoE and the impact that it has on GBP/USD.

This will be partly a function of the bank’s reading of the risks posed by the Omicron strain of the coronavirus and their implications for inflation as well the outlooks for employment and economic growth, which all contribute to the BoE’s thinking about interest rates.

“Labour market and CPI data are arguably the headline grabbing data at the start of the week which should underpin the volatile backdrop for GBP,” says Kamal Sharma, an FX strategist at BofA Global Research.

“We expect the BoE to keep rates unchanged next week and signal they are likely to hike in February ('coming months') if Omicron risks subside,” Sharma and colleagues wrote in a Friday research note.

Above: NZD/USD and GBP/USD shown at 4-hour -13-2021-GBP-NZD-USD-4Hoursily intervals with GBP/NZD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Financial markets no longer expect the BoE to lift Bank Rate from 0.10% to 0.25% on Thursday so in the absence of a surprise move investors and Sterling will likely focus keenly on any remarks or commentary relating to the prospects of a rate rise coming in the early months of the new year,

The danger for Sterling is that Thursday’s update offers little if any guide on what to expect during the coming months due to uncertainty about the outlook for the economy, which has been further increased in recent days by signs that the UK government is wavering on its February 2021 commitment to a reopening roadmap that had been billed as irreversible when it was unveiled.

Everyone eligible aged 18 and over in England will have the chance to get their booster before the New Year.

— UK Prime Minister (@10DowningStreet) December 12, 2021

Get Boosted Now to protect yourself, your friends and your family.https://t.co/4OUMUKLWlg pic.twitter.com/jLdfJclItv

This is in light of the Omicron variant, which already prompted a renewal of albeit modest restrictions last week and could yet see “Plan B” morph into a more stringent “Plan C” or something even worse come the new year should the new coronavirus strain prove to be as troublesome as earlier iterations of the disease or if take up of booster vaccines is insufficient in the interim.

Only time will tell how the BoE reads the evolving outlook for the UK economy although in the interim the U.S. Dollar likely stands to gain from Wednesday’s Federal Reserve interest rate decision. This could act as an offsetting influence to any increases in NZD/USD and GBP/USD, which would be supportive of the Pound-to-New Zealand Dollar rate if typically correlations hold.

All in all there’s myriad competing and sometimes offsetting factors that are likely to have influence over the Pound and New Zealand Dollar over the coming week, which is another reason why GBP/NZD may be likely to remain confined to its recent 1.94-1.97 range.