New Zealand Dollar Could Face Losses of up to 3.0%: RBC Capital Markets

- Written by: James Skinner

- NZD/USD seen at 0.66 if virus scuppers RBNZ rate cycle

- Would lift GBP/NZD to 2.06 & close to 2020’s crisis highs

- Significant economic setback could derail RBNZ’s outlook

- But hopes remain of limited outbreak, quick containment

Image © Adobe Stock

- GBP/NZD reference rates at publication:

- Spot: 1.9958

- Bank transfers (indicative guide): 1.9258-1.9397

- Money transfer specialist rates (indicative): 1.9776-1.9816

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

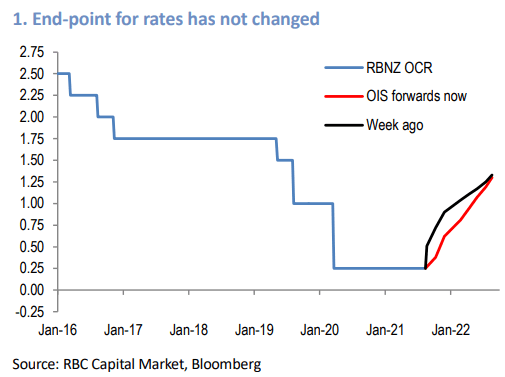

The New Zealand Dollar would face losses of up to three percent against the U.S. Dollar, with bullish implications for GBP/NZD, if economic damage resulting from the current coronavirus containment process becomes significant enough to completely derail the Reserve Bank of New Zealand (RBNZ) from a still-widely-expected cycle of interest rate rises.

New Zealand’s Dollar showed remarkable resilience in the week to Friday when it was set to end the period around the middle of the performance rankings for the G10 contingent of major currencies, having outperformed all other commodity-sensitive counterparts in the bucket.

The Kiwi outperformed the Canadian and Australian Dollars as well as the Norwegian Krone this week having better resisted pressure from an advancing U.S. Dollar throughout the period, despite the first in an anticipated series of RBNZ interest rate rises being delayed when New Zealand returned to ‘lockdown’ as a result of a fresh coronavirus outbreak.

Economic closures and other measures were extended on Friday to run until at least next Wednesday in an ominous sign the country could potentially be following in the footsteps of Australia, much of which was on course Friday for a full three months worth draconian imposition after containment measures were extended repeatedly since first being introduced in June.

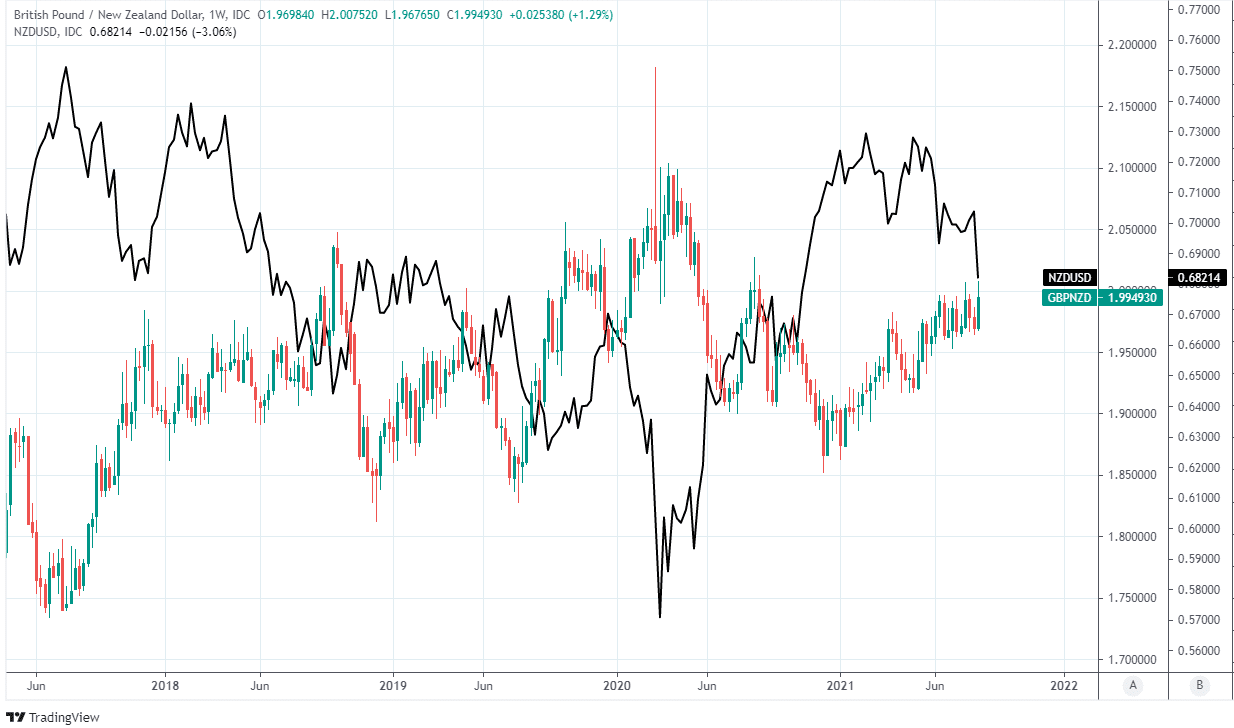

“The first reason for NZD’s limited losses is simply that, aside from timing, markets (rightly for now) assume little has really changed. The RBNZ may have handed the baton of first G10 hiker to Norges Bank, but beyond the timing of the first move, the forward profile for rates has changed little,” says Adam Cole, chief FX strategist at RBC Capital Markets.

Above: RBC Capital Markets graph shows change in market expectations for RBNZ cash rate since Monday.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Until Monday when Wellington announced it had detected an infection and that the country would go back into ‘lockdown’ the market had been unanimous in its anticipation that the RBNZ would lift its benchmark interest rate from 0.25% to 0.50% this Tuesday, after the bank itself had hinted as far back as May that it was beginning to err in the direction of steadily withdrawing earlier pandemic-inspired monetary support for the economy.

RBNZ guidance and prices in the certain financial markets had indicated strongly that Tuesday’s now-scuppered rate rise would be the first in a series that could eventually lift the cash rate back to levels not seen since a long time before the coronavirus ever cropped up on the global economic scene.

“Clearly, much depends on the current outbreak of infections and how quickly it is brought under control and when the economy can be released from lockdown,” says RBC’s Cole.

Expectations of an RBNZ rate rise built quickly, and perhaps too quickly for the currency market given the pricing-in of a higher cash rate in the derivative and bond markets did little to lift the Kiwi over recent months.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

This was after a stronger-than-expected recovery that enabled New Zealand’s economy to recover all of the GDP lost to the coronavirus in 2020 despite the economically-significant tourism sector remaining closed along with the national borders.

“We suspect the small and illiquid nature of the NZ’s government debt market leaves a much narrower range of international investors chasing moves in yields and this reduces the sensitivity of the exchange rate,” Cole says.

Recovery stoked rising wages in other parts of the economy and had the RBNZ concerned its 1%-to-3% inflation target would be overshot in the coming years, leading it to adopt a “least regrets policy” last quarter in which it began preparing the market for an interest rate lift-off that is now in jeopardy.

“On a central expectation that lockdowns work and cases peak in the 50-120 range that the Health Ministry’s models point to, forward rates pricing is reasonable, but it is hard to argue for much more independent NZD strength,” Cole warns. “In a worst case scenario where markets fully unpriced the tightening that has been priced in over the last two months, downside for NZD/USD could run to another 200pts or so.”

Above: NZD/USD shown at daily intervals alongside Pound-to-New Zealand Dollar rate.

With financial markets still pricing-in a full and complete cycle of rate rises from the RBNZ, Cole and the RBC team are doubtful the Kiwi will garner much support from any eventual decision to go ahead with the interest rate normalisation process but have warned of scope for further modest losses in New Zealand Dollar exchange rates in the event of the bank being forced to abandon that idea.

The latter is something that would require a significant setback for the Kiwi economy of the kind that has not yet been seen at all during the crisis and which may never actually materialise, although if things do go from bad to worse for the antipodean economy then the assumed losses for NZD/USD in that eventuality would have significant implications for the Pound-to-New Zealand Dollar rate also.

New Zealand’s outbreak is linked to a traveller from New South Wales, Australia, who was moved almost immediately to a quarantine facility after landing in New Zealand and officials have said several times in recent days that they’re confident the virus “hadn’t been widespread or out in the community for very long before it was detected,” which keeps alive the possibility of the outbreak being relatively short-lived.

But Cole and the RBC team’s projection of around 200 points worth of losses for NZD/USD in a worst case scenario would take that exchange rate down to almost 0.66 from Friday’s levels, which is a price move that would lift the Pound-New Zealand Dollar rate to 2.06 and close to 2020’s crisis highs iif the main Sterling exchange rate GBP/USD is assumed to hold around Friday’s 1.36.

The Pound-to-New Zealand Dollar rate always closely reflects relative price moves in NZD/USD and GBP/USD, for reasons relating to the underlying mechanics of the market.

Above: Pound-to-New Zealand Dollar rate shown at weekly intervals with NZD/USD.