New Zealand Dollar on "Highway to Strength" says HSBC in New Forecast Update

- Written by: Gary Howes

- GBP/NZD forecast to end year lower

- NZD/USD forecast to end year higher

- Strong trade balance to aid NZD higher

Image © Adobe Stock

- GBP/NZD reference rates at publication:

- Spot: 1.9546

- Bank transfers (indicative guide): 1.8863-1.9000

- Money transfer specialist rates (indicative): 1.8936-1.7410

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The New Zealand Dollar is on a "highway to strength", say analysts at HSBC, the global investment bank and lender.

In a new research briefing to clients HSBC say they expect the New Zealand Dollar to outperform alongside the Australian Dollar, thanks in part to the strong trade accounts the two countries hold with the rest of the world.

Paul Mackel, Global Head of FX Research at HSBC says his team see a "green light for outperformance" in the two antipodean currencies, with ongoing outperformance driven by the healthy external balances of their economies.

"Additionally, the gains in the AUD and NZD have led to tighter monetary conditions, which reduce the need for the RBA and RBNZ to sound hawkish. The AUD and NZD seem almost impervious to dovish talk," says Mackel.

The Australian and New Zealand Dollars have outperformed peers courtesy of the strong global rebound in both stock and commodity markets that has been in place since the middle of 2020, courtesy of expectations for a post-covid rebound in activity.

The rebound holds as we move through the second quarter of 2021, although a strong rally in commodity prices does appear to have come off the boil over recent days.

However, a decline in commodity prices is unlikely to be deep enough to have a material impact on the strong trade positions that New Zealand and Australia are currently holding.

"In our view, the healthy external balance and improving terms of trade (rising commodity prices) will likely continue to be bullish features for both currencies. Additional “risk on” sentiment, driven by a global recovery, should also support the AUD and NZD," says Mackel.

"While monetary policy will likely remain accommodative, this should not hamper the currencies’ climb," he adds.

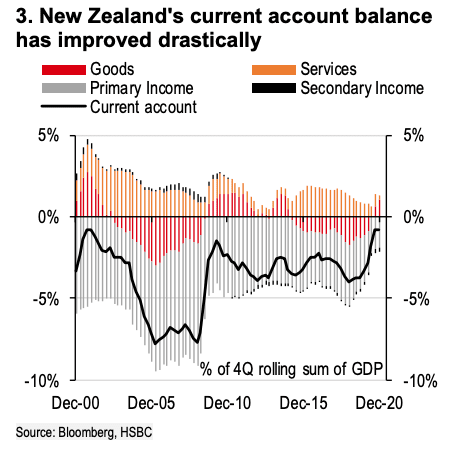

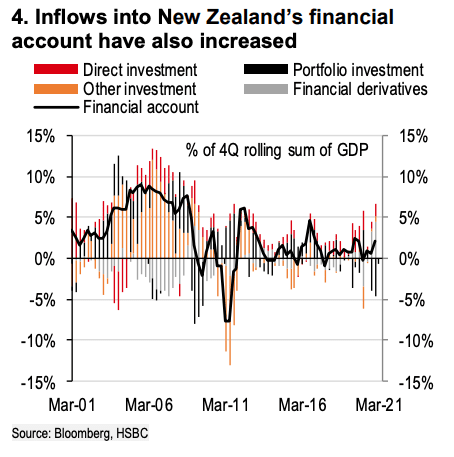

The New Zealand current account deficit has narrowed to its smallest level in two decades and the financial account surplus has also increased.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"The combination of a slowdown in current account outflows and a pickup in financial inflows has contributed to a stronger NZD," says Mackel.

However Mackel does caution that with financial flows now at the pre-pandemic level, the NZD would see less support from these flows and its pace of appreciation may slow compared to 2020.

"Meanwhile, New Zealand’s terms of trade have declined slightly recently, but this is likely to be temporary as the global cyclical upswing continues," he says.

HSBC says the recovery from the global pandemic should gather further steam, ensuring the demand for commodities is likely to remain firm, conferring support to New Zealand's trade and current account balances.

"A global recovery also bodes well for risk appetite, which will be positive for both currencies," says Mackel.

HSBC forecast the NZD/USD exchange rate to rise to 0.75 by year-end, the pair is quoted at 0.7213 at present.

Given the bank's forecast for GBP/USD to fall back to 1.37 by year-end, we can arrive at a Pound-to-New Zealand Dollar (GBP/NZD) cross exchange rate target at 1.8266.

GBP/NZD is presently seen at 1.9546.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}