New Zealand Dollar: Near-term Pressure Expected as Aukland Lockdown Just Comes Days Ahead of Key RBNZ Meet

- GBP/NZD near multi-week highs

- NZD faces near-term test from RBNZ

- Aukland lockdown could impact tone of RBNZ

- HSBC see NZD strength over 2021

Above: File image of Prime Minister Ardern. Image © NATO, reproduced under CC licensing conditions, image cropped from original.

- Pound-to-New Zealand Dollar spot rate at publication: 1.9194

- Bank transfer rates (indicative guide): 1.8514-1.8649

- FX transfer specialist rates (indicative guide): 1.8585-1.9052

- More information on securing specialist NZD rates, here

The New Zealand Dollar is well poised to advance in 2021 say foreign exchange analysts at international lender and investment bank HSBC, however they join their peers in urging caution on the currency in the run-up to the February meeting of the Reserve Bank of New Zealand which will now have to take into acccount a new lockdown in the country's capital.

HSBC analysts tell clients in a recent foreign exchange research briefing that they forecast the New Zealand Dollar to rise against the U.S. Dollar in 2021, but that caution should be exercised ahead of the Feb. 24 RBNZ meeting.

"The main near-term uncertainty lies with the RBNZ, which meets for the first time in nearly four months on 24 February," says Paul Mackel, Global Head of FX Research at HSBC .

With the economy outperforming expectations and property prices rising rapidly, HSBC’s economists join other major lenders no longer expect negative rates this year.

However, given the government's decision at the weekend to put Auckland into a new lockdown, the RBNZ is likely to maintain a cautious tone with regards to the impact of the pandemic.

"NZD/USD opened marginally lower following Sunday’s announcement that Auckland, New Zealand’s largest city, will be placed in a three‑day lockdown," says Kim Mundy, a foreign exchange analyst at Commonwealth Bank of Australia.

Some 1.6 million Auckland residents now face bans on non-essential movement until Wednesday under strict new lockdown as Australia suspends travel bubble.

The length of the lockdown will depend on whether testing uncovers further cases; if this is indeed the case the government will likely extend the lockdown again.

"In NZ, they have just announced a snap 3 day lockdown of Auckland because of 3 cases found in the community, this is too short to worry about from a growth perspective but we need to keep an eye on the spread to see if it is a bigger problem," says a note from the JP Morgan spot trading desk in London.

"The number of locations of interest, close and casual plus contacts may change," said a statement from the country's health ministry. "The priority is for close contacts and casual plus contacts to be tested so we can understand any risk in the community."

Prime minister Jacinda Ardern said genomic testing had shown that the three community cases were the UK variant of Covid-19.

The lockdown is the second time Auckland has undergone the emergency measures since last year’s more stringent 51-day nationwide lockdown which helped New Zealand eliminate the virus.

The RBNZ has in the past indicated it is keeping an eye on the pandemic in the domestic economy and another extension would almost surely prompt Governor Adrian Orr and his team to sound a more dovish-than-previously-anticipated message.

This could weigh on the NZ Dollar.

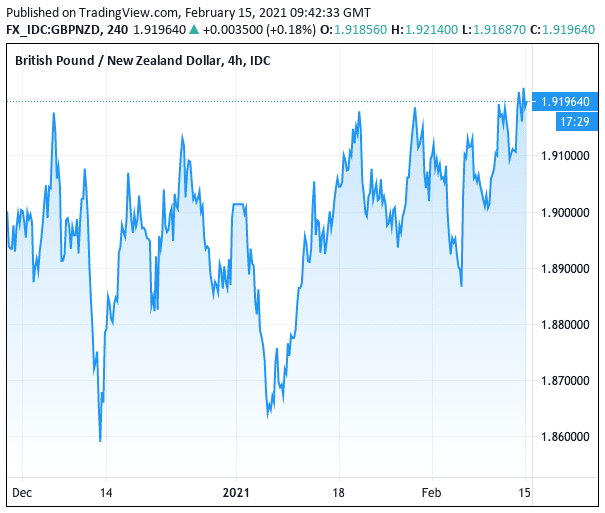

The weakness in the New Zealand Dollar at the start of the new week was also reflected in the Pound-to-New Zealand Dollar exchange rate (GBP/NZD) which rose to 1.9230, ensuring it was close to Friday's multi-week high at 1.9244.

Should the RBNZ strike a cautious tone then the GBP/NZD would likely break to fresh multi-week highs next week.

"One cannot ignore risks of a 'dovish' RBNZ, especially given market pricing and after the RBA extended bond purchases," says Juan Prada, an economist at Barclays.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

Beyond the pandemic, those watching the RBNZ should keep an eye on developments concerning the country's housing finance market as well as whether the central bank will consider debt-to-income rations when developing policy in the future.

But beyond the near-term risks HSBC see NZ Dollar strength reasserting.

"We continue to forecast NZD-USD to rise to 0.75 by end-2021," says Mackel. "While this view has been largely driven by the currency’s high beta sensitivity to a global recovery, signs of strong domestic growth outperformance also bode well for the NZD with 10-year yields rising over 30bp so far this year."

HSBC economists are impressed with the resilience of the New Zealand economy and note how the pandemic has only resulted in a blip in the country's economic growth.

"This cyclical strength versus the rest of the G10 space can be seen clearly in GDP, which not only returned to pre-pandemic levels in Q3 but is also now close to the previous cycle trend," says Mackel.

Meanwhile the unemployment rate has fallen to 4.9%, only 0.7ppt above where it was in the first quarter of 2020, which had coincided with pockets of upward wage pressure says the HSBC economist.