New Zealand Dollar a "Buy on Dips"

- NZD outlook "more positive"

- Analyst sees potential for 250 pips of gains

- "Tide seams to be turning now"

Image © Adobe Images

- GBP/NZD rate at time of writing: 1.9745

- Bank transfer rates (indicative guide): 1.9054-1.9192

- FX specialist rates (indicative guide): 1.9567

- More information on specialist rates, here

The New Zealand Dollar's outlook has improved notably according to new technical analysis which says any weakness is likely to be considered an opportunity to buy.

"We are gradually turning more positive on the Kiwi once more. Throughout August, the Kiwi had a real struggle on a relative basis against major forex, but the tide seems to be turning now," says Richard Perry, an analyst at Hantec Markets.

The call by Perry comes following a solid recovery for the New Zealand Dollar, which at one point in August was the worst performing major currency of 2020.

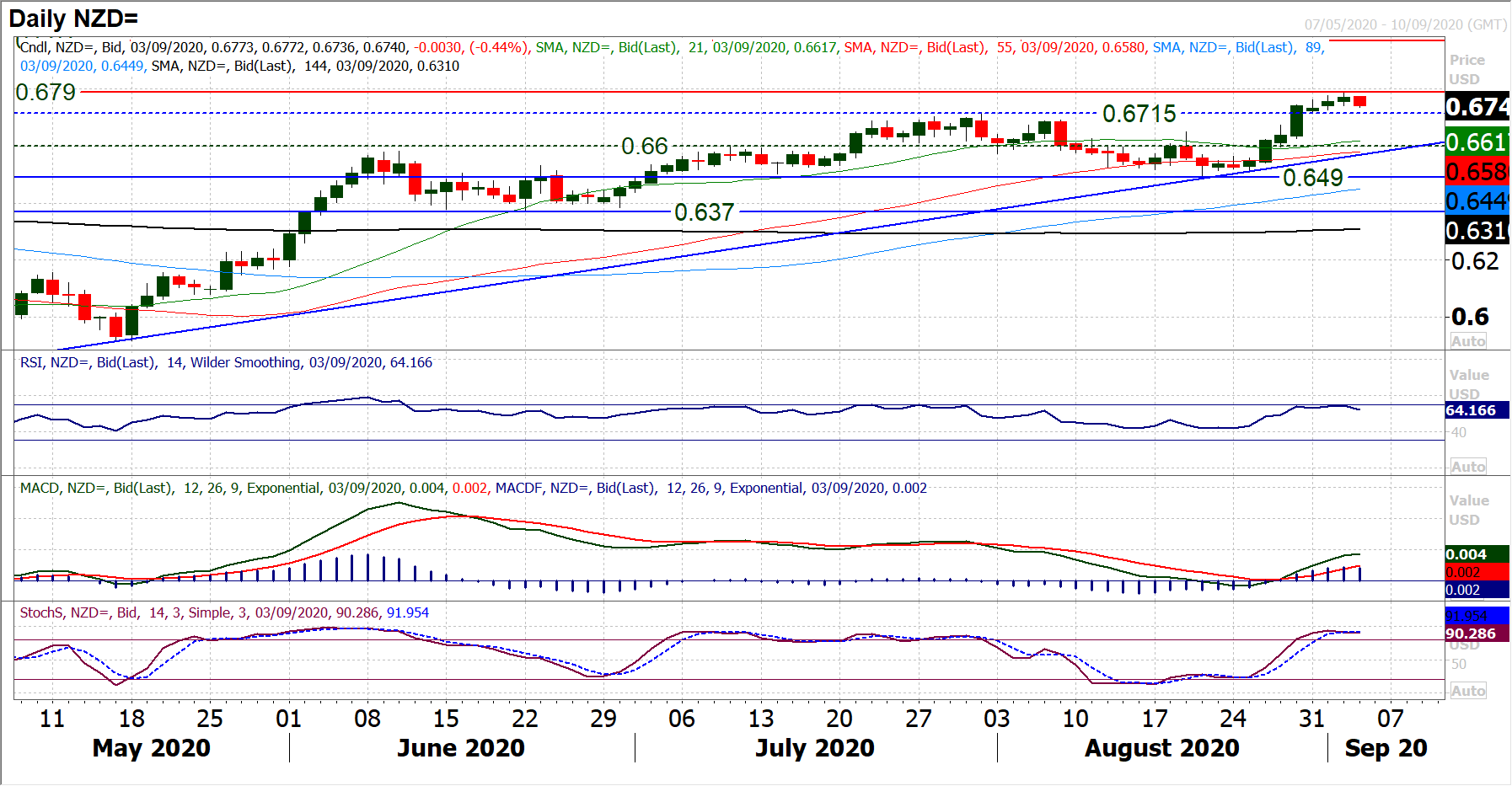

"After a series of strong bull candles, the breakout back above 0.6715 has signalled a decisive shift in sentiment," says Perry of the NZD/USD exchange rate.

Where the NZD/USD leads it is often the case that other New Zealand Dollar exchange rates follow, therefore this could be a bullish reading for the currency in broader terms. Indeed, the Kiwi's turn of strength has meant the Pound-to-New Zealand exchange rate has fallen back notably over recent weeks and is now quoted at 1.9748, down from an August 21 high at 2.0271.

The New Zealand Dollar has however succumbed to the U.S. Dollar's show of strength over the course of the past 24 hours, which might lead some readers to consider if calls for further New Zealand Dollar gains are premature.

The New Zealand Dollar-to-U.S. Dollar exchange rate has fallen back from its recent multi-week highs and is now quoted at 0.6716, having been as high as 0.6978 on Wednesday.

But the charts are telling Perry that for now any weakness in the currency should be considered an opportunity to buy in anticipation of the Kiwi's broader uptrend resuming.

"It effectively completes a two month range breakout and implies around +225 pips of upside now. The near term USD rebound is weighing on the outlook and a drag back towards the 0.6715 breakout (old resistance becomes new support) would represent a buying opportunity," says Perry.

"Throughout July and August a mid-range pivot formed around 0.6600 and any supported weakness into 0.6600/0.6715 which is now a near term buy zone, should be considered an opportunity," says Perry. (If you would like to lock in current rates for future international payments, or automatically book better rates, please learn more here).

The New Zealand Dollar outperformed mid-week - advancing even against a resurgent U.S. Dollar - after Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr was interpreted as having given investors a green light to bid the Kiwi currency higher.

Orr set out in an address to an audience at Victoria University Wellington School of Management how the RBNZ is using a range of tools to achieve familiar policy objectives in unprecedented circumstances, however there was no attempt to 'jawbone' the NZ Dollar lower.

"NZD gained support on-the-day with RBNZ Governor Orr expressing no concern with the level of the currency," says Bipan Rai, North America Head of FX Strategy at CIBC Capital Markets.

He reiterated a now well understood warning that the bank is actively preparing a package of unconventional policy measures to support the economic recovery "in the near future" including a negative cash rate and foriegn asset purchases that would see large amounts of Kiwi Dollars sold on the market.