New Zealand Dollar Tipped to Rebound in Wake of RBNZ Rate Decision

- RBNZ tipped to boost quantitative easing mid-week

- But NZ Dollar could rally says RBC Capital

- ANZ see NZ Dollar weakness potential against GBP and EUR

Above: File image of RBNZ Governor Orr. Image © Pound Sterling Live, Still Courtesy of RBNZ

- GBP/NZD spot rate at time of writing: 1.9825

- Bank transfer rates (indicative guide): 1.9130-1.9270

- FX specialist providers (indicative guide): 1.9218-1.9640

- More on market beating exchange rates here

The New Zealand Dollar could be due a relief bounce in the wake of Wednesday's highly anticipated meeting of the Reserve Bank of New Zealand (RBNZ), with one analyst saying the hurdle is high for the statement to be taken as sufficiently dovish to prompt further downside.

The RBNZ will meet to discuss where to take interest rates and quantitative easing in order to support the economy which has suffered the effects of a global economic slowdown prompted by the covid-19 crisis, with markets expecting interest rates to be slashed to below 0% at some point before the middle of next year.

The markets are therefore expecting a 'dovish' central bank (one that is inclined to err on the side of further rate cuts), and the rule of thumb is that a dovish central bank is a negative for the currency it issues. However, as is often the case with such events, the foreign exchange market can engage in a "sell the rumour, by the fact" behaviour which could well see the NZ Dollar react by going higher in response to what the RBNZ says or does.

"With forward rates already pricing in negative policy rates around the middle of next year, the hurdle is high for the statement to be taken as dovish. Since the last meeting in late-June, activity data have been better than expected and most COVID-19 constraints on activity have now been removed. We position for a reversal of NZD’s underperformance," says Adam Cole, Chief Currency Strategist at RBC Capital markets, who adds that this weakness is most likely to come against other 'commodity' currencies.

Ahead of the RBNZ decision, the Pound-to-New Zealand Dollar exchange rate hit a fresh two-month high on the eve of the meeting having gone to 1.9866, the New Zealand Dollar-U.S. Dollar exchange rate meanwhile looks to be settling in the 0.66 region following the sizeable 1.40% decline witnessed last Friday. * If you are looking to take advantage of current or future NZD rates our partners at Global Reach can deliver both expert guidance and market-beating rates.

Above: Daily GBP/NZD chart

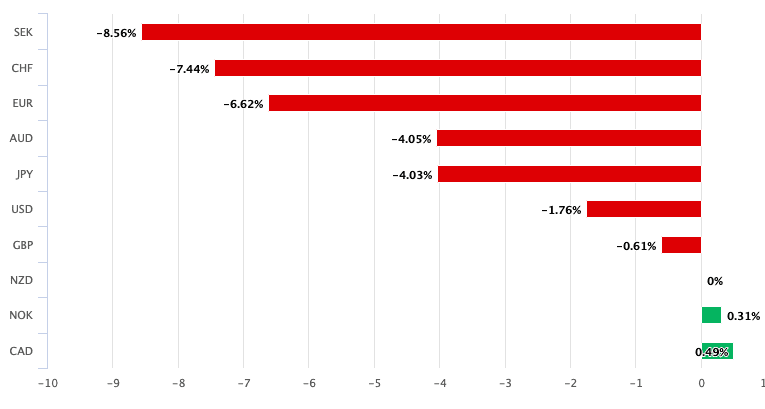

Persistent concerns that the RBNZ is considering cutting interest rates to 0% or below are the primary reason why the New Zealand Dollar has been one of the laggards in global FX over various time frames; not just over the course of the past week but over the course of the past month and in 2020 as a whole.

Over the course of the past week we have witnessed further New Zealand Dollar underperformance, with the currency going lower against all its major peers apart from the risk-off Japanese Yen. Over the course of the past month that underperformance is reflected in that the currency has fallen against all peers apart from the Yen and U.S. Dollar.

And for 2020 as a whole the New Zealand Dollar is holding a threadbare gain against the Canadian Dollar and the Norwegian Krone.

Above: NZD performance in 2020

Economists at ANZ Bank say the RBNZ will likely increase its quantitative easing programme and weigh up other tools to support the economy when they meet this week.

"The case for further significant monetary easing is clear with inflation set to plummet and unemployment heading towards double-digits. Expanding the Large-Scale Asset (LSAP) Programme (QE) remains the first choice to deploy more stimulus at the August MPS, but we also expect much more clarity on the “menu” of policy options, detailing the criteria for when each tool might be considered, and stressing that choices will depend on circumstances," says Sharon Zollner, Chief Economist at ANZ.

ANZ expect the RBNZ to increase quantitative easing to $90BN from $60BN while extending the time within which to carry out the programme to 18 months.

However, the RBNZ could announce other shifts to how it conducts quantitative easing, while it will likely maintain guidance that it is willing to cut interest rates further and into negative territory.

According to ANZ foreign exchange strategist David Croy, the RBNZ event is likely to on balance result in weakness in the New Zealand Dollar against the likes of the Euro and Pound, but not necessarily the U.S. Dollar owing to the Greenback's ongoing run of depreciation.

"The focus isn’t just on policy delivered next week – arguably NZD direction depends more on the menu of unconventional policy options that are left on the table. We expect the RBNZ to keep its options open and we’d be very surprised if they backed off signalling that they are open to negative rates. And the market seems to have discounted the prospect of foreign asset purchases, risking a negative NZD reaction if it remains on the table as we expect. Against the backdrop of broad-based USD weakness, that is likely to mean that NZD/USD holds up better than crosses like NZD/EUR and NZD/GBP," says Croy.