New Zealand Dollar: Pound Hits Fresh Four-Month High against Staggering Kiwi

- NZD hit by souring investor sentiment

- GBP/NZD pushes fresh four-month highs

- Expect further gains if market sentiment deteriorates further

The Pound-to-New Zealand Dollar exchange rate has rallied to a new four-month high at 2.0451 ahead of the weekend, largely on the back of broad-based New Zealand Dollar underperformance.

The New Zealand Dollar's woes come in sympathy with a downshift in investor sentiment: if we look at the world's major stock markets we can see they are all in the red today. The FTSE 100 is down 0.45%, Wall Street futures are down 0.6% and Germany's DAX is down 0.66%.

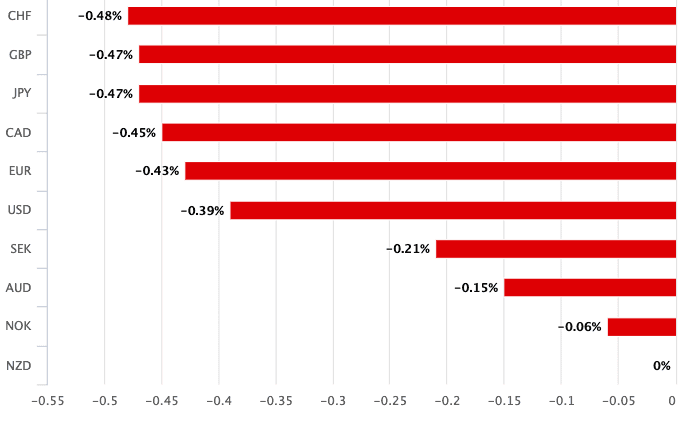

The New Zealand Dollar is meanwhile half a percent lower against the Pound and 0.40% lower against the Dollar. In fact, if we look at the New Zealand Dollar's relative performance, it is the day's worst performing major currency:

The link between stock market performance and the New Zealand Dollar is clear. The New Zealand Dollar tends to benefit when global investors are in a 'risk on' mood, i.e. they are buying assets that offer yield. The New Zealand Dollar is considered a 'high yielder' currency, hence it tends to respond to the sentiment of global markets.

"The mood in equity markets soured as coronavirus fatalities outside China rose and company earnings reflected the pandemic’s impact. The S&P500 is down 0.7%, and bond yields and the AUD and NZD are lower," says Imre Speizer, Head of NZ Strategy at Westpac.

Considering the New Zealand Dollar's current bout of underperformance therefore becomes an exercise in studying the reasons behind the current decline in sentiment in the global investor community; if this deterioration in sentiment persists then the New Zealand Dollar could suffer further declines.

"Toward the end of the European trading session, the market grew a bit more anxious after a number of new COVID-19 cases reported at a Beijing hospital led to fears that the virus may spread in China’s capital – which could further hit the economy as well as company results," says Bas van Geffen, Quantitative Analyst at Rabobank.

The Australian Dollar is also under pressure, and we find that often the NZ Dollar moves in sympathy with its trans-Tasman neighbour.

"AUD/USD remains heavy and briefly fell below 0.6600 in the Asia session. Comments from China’s Ministry of Finance and Commerce that they expect Chinese trade growth to slow sharply in the January‑February period weighed on AUD," says Kim Mundy, a foreign exchange strategist with Commonwealth Bank of Australia.

While the cases of new Coronavirus cases appears to be fading as a concern to markets, what is apparently starting to resonate is the actual economic impact the lengthy shutdown to the Chinese economy might have. We are starting to see the numbers come through, just look at the reaction to Apple's warning last week that it will miss sales targets owing to production disruptions in China.

China is New Zealand's premier export destination and signs that the Chinese economy is struggling under the weight of the outbreak will therefore impact on sentiment towards the New Zealand economy and its currency.

We would therefore expect the GBP/NZD exchange rate to maintain its uptrend as long as global markets are fretting over China.

- Spot rates at time of writing: GBP/EUR: 1.0808, -1.75% | GBP/USD: 1.1852, -2.15%

- Bank transfer rates (indicative): GBP/EUR: 1.0520-1.0596 | GBP/USD: 1.1537-1.1620

- Specialist money transfer rates (indicative): GBP/EUR 1.0650-1.0701 | GBP/USD: 1.1650-1.1745 >> More details