Pound-to-New Zealand Dollar 5-Day Forecast: Support Level Protects Sterling Against Significant Losses

© Rafael Ben-Ari, Adobe Stock

- GBP/NZD rises from support but too early to call a new trend

- Pair is neutral on a technical basis

- Brexit headlines out over weekend on balance Sterling-positive

- GBP eyes GDP, inflation data; NZD by central bank meeting

The GBP/NZD exchange rate is trading at 1.9148 at the start of the new week just over a percentage point lower than the week before. A weakening New Zealand Dollar was the main catalyst, for the advance following the release of disappointing employment data. The Pound trod water as the Brexit impasse continued.

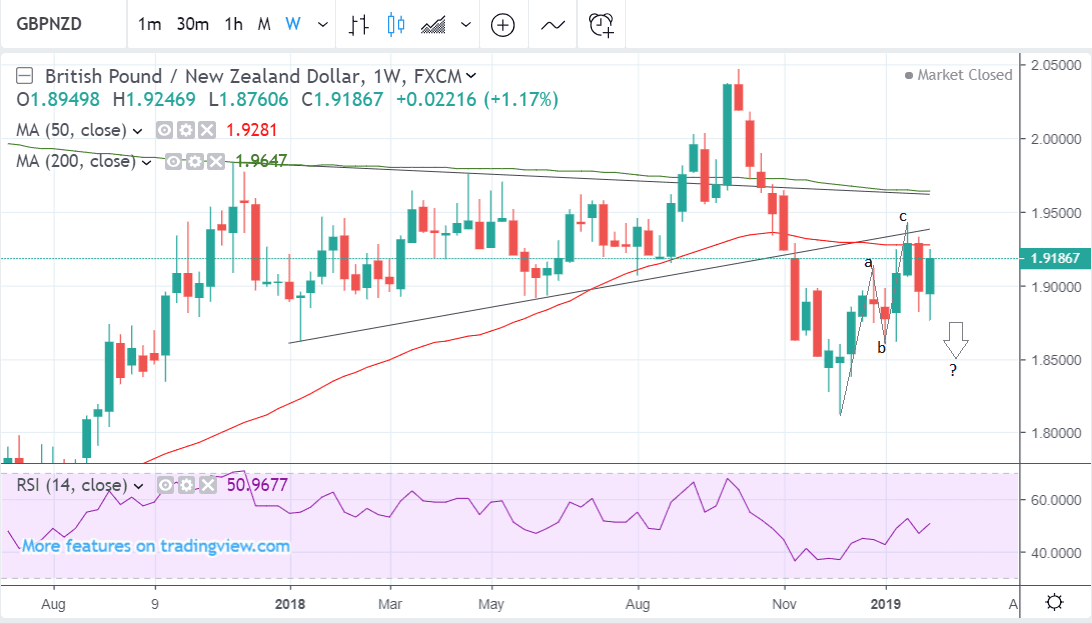

The technical outlook for the pair is neutral we find; it was previously bearish but the strong rebound from the trendline changed that.

The strong surge after the pair found support suggests an uptrend could be developing, although, a break above the 1.9426 highs would be required for confirmation and to suggest a continuation to the next upside target at 1.9600.

There is a roughly equal chance of a move lower, however, and a break below the Feb 6 lows and the 50-day MA would provide the necessary confirmation. A clear move below 1.8700 would provide the green-light to unlock a downside target of 1.8600.

The four hour chart provides added clarity on why the trend is so ambiguous. It shows how the pair was in a fairly strong short-term downtrend after peaking and rolling over at the January 25 highs, but that this suddenly evaporated as the pair rotated and struck higher after finding support at the Feb 6 lows.

The move higher remains difficult to class - is it the start of a new uptrend, or just a strong correction of the previous downmove? It is still too early to say for sure.

It is a very strong upthrust which suggests it has further to extend, but as yet is still only composed of one set of higher highs (HH) and higher lows (HL), which is insufficient to class it as a new uptrend.

The weekly chart adds a further layer of complexity to the outlook by suggesting a bearish bias. The pair has declined after peaking at the October highs. It then based at 1.81 in December and since then has risen in what looks like a corrective three-wave 'abc' pattern higher.

The 'abc' now looks complete given waves a and c are of about the same length and it has that familiar zig-zag look. This suggests there is an increased risk that the more dominant overarching downtrend will resume its extension lower.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The New Zealand Dollar: What to Watch this Week

Then main release for the New Zealand Dollar (Kiwi) is the policy meeting of the Reserve Bank of New Zealand, on Wednesday at 1.00 GMT.

Despite recent poor employment data which showed the unemployment rate jumping to 4.3% in Q4 from 4.0% in Q3 previously, the RBNZ is not expected to change the official cash rate from its current 1.75% level.

A change in the interest rate would have a profound effect on the Kiwi. Higher rates are positive and vice versa for lower rates. This is because higher rates attract and keep greater inflows of foreign capital drawn by the promise of higher returns.

The statement which accompanies the decision and the press conference with the governor at 2.00 could still cause some volatility for NZD, however, even if the bank does not change interest rates.

Most expect a pessimistic tone - or dovish in central bank parlance - to dominate, putting downwards pressure on NZD (upwards on GBP/NZD pair).

Apart from the RBNZ meeting probably the most important release for the Kiwi is Chinese trade data for January, out on Thursday at 3.00 GMT.

A continued decline in Chinese trade figures is likely to increase concern about the outlook for the Chinese economy in general and the whole region, including New Zealand .

“China will likely post another worrying set of trade figures on Thursday as trade tensions with the US continue to dampen demand for Chinese goods,” says Raffi Boyadjian, a currency analyst at XM.com.

China’s trade surplus is expected to fall to $33.5bn in January from $57.0bn in December. Exports are likely to fall by -3.3% from -4.4% previously. Imports are expected to slow to -9.0% from -7.7% previously.

Such a slowdown in imports could weigh on the Kiwi, given China is New Zealand’s biggest trade partner.

The Pound: What to Watch this week

Brexit remains the key driver for Sterling with the currency being a function of the markets expectation for a 'deal'or 'no deal' Brexit.

Markets are currently confident a deal, of some sort, will be achieved, hence the Pound's outperformance during 2019.

Weekend news is constructive in this manner amidst news the government has sought to buy Prime Minister Theresa May more time to put together a workable Brexit deal by promising MPs another say by the end of the month, as business leaders said the process was now in the “emergency zone”.

Communities secretary James Brokenshire has said that if no finalised deal were put to the Commons by 27 February, MPs would again be given an amendable motion to consider. This would give them the chance to block a 'no deal' departure or make other interventions.

Markets will likely focus on the prospect of parliament being given another shot at blocking 'no deal', we believe this should prove supportive to Sterling.

May will make a statement to parliament on February 13 updating lawmakers on her progress so far in seeking changes to her deal. The debate on February 14 will be on a motion — a proposal put forward for debate - about Brexit more generally. However, because May is clearly engaged in negotiations with the EU, parliament is expected to give the PM more space and votes of significance will only likely be expected later in the month, in line with Brokenshire's guidance.

The main data release for Sterling is Q4 and December GDP data out at 9.30 GMT on Monday, February 11.

The data will provide investors with further hard evidence of how Brexit uncertainty, as well as the global slowdown, is affecting the UK economy.

“So far, we have seen only mixed signals from the economy, although the more up-to-date PMI data suggests businesses and individuals are delaying their purchasing plans as the Brexit debate enters crucial stage with the March 29 exit date fast approaching,” says Fawad Razaqzada, a market analyst at Forex.com.

Current market expectations are for GDP to slow to 1.4% compared to a year ago (from 1.5% in Q3) and to rise 0.2% compared to the previous month of November. A deeper slowdown might have a temporary short-term negative effect on Sterling but it could also focus minds on avoiding a hard-Brexit and, therefore, ultimately have a positive impact on the Pound, if it reduces the chances of ‘no-deal’.

“On top of this, Brexit will remain in focus as a desperate UK Prime Minister Theresa May struggles to renegotiate the withdrawal agreement with the EU leaders,” adds Razaqzada.

Also released at 9.30 on Monday morning are Manufacturing Production data, with the headline expected to show a rise by 0.2% in December, Industrial Production, which is forecast to rise 0.2% and Business Investment, which is expected to rise by 0.2% quarter-on-quarter in Q4.

Inflation data out on Wednesday at 9.30 will be of interest. Usually, it is important for the Pound but this time it may be overshadowed as Theresa May could be making another major Brexit updating speech on that day.

“UK CPI will also be released on Wednesday. Although important, in the grand scheme of things, not many people will pay much attention to it because of Brexit, as mentioned above. Anyway, headline CPI is expected to have eased to +1.9% from +2.1% previously while core CPI is expected to have remained unchanged at +1.9%,” says Forex.com’s Razaqzada.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement