New Zealand Dollar no Longer Undervalued say BNZ

- Written by: James Skinner

© Adobe Stock

- NZD overvalued once more says BNZ.

- Milk price fall and recent gains see NZD trade above "fair value".

- "Tread carefully" says BNZ as market could easily correct lower.

The New Zealand Dollar is the G10 currency universe's best performer for November but the Antipodean unit is now overvalued, according to analysts at Bank of New Zealand (BNZ), who say to tread carefully over coming weeks because the currency could easily hand back all of its recent gains.

BNZ's caution comes after the New Zealand Dollar topped the G10 league table consistently for a month-long period, thanks to a combination of domestic and international developments.

A recent run of improved economic data has lessened the risk of a Reserve Bank of New Zealand (RBNZ) interest rate cut being delivered in the New Year. And markets have grown ever more hopeful that next weekend's G20 summit will yield a detente in the so-called trade war between the world's two largest economies.

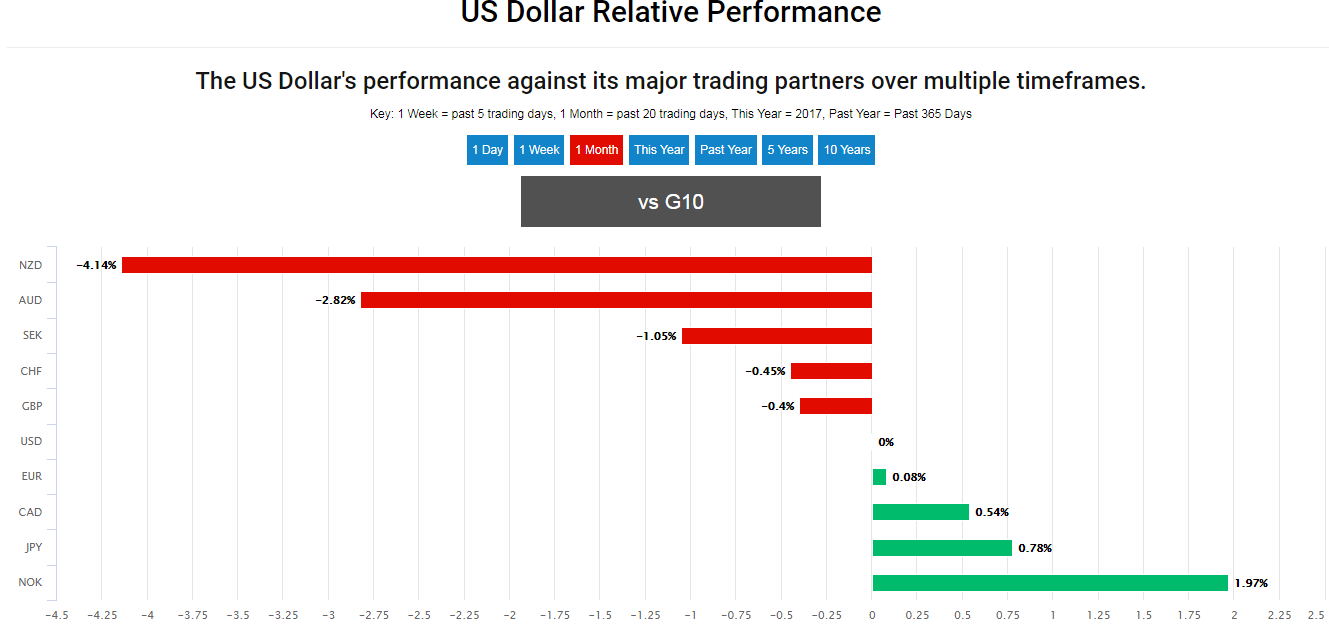

Above: One-month performance of G10 currencies relative to the U.S. Dollar.

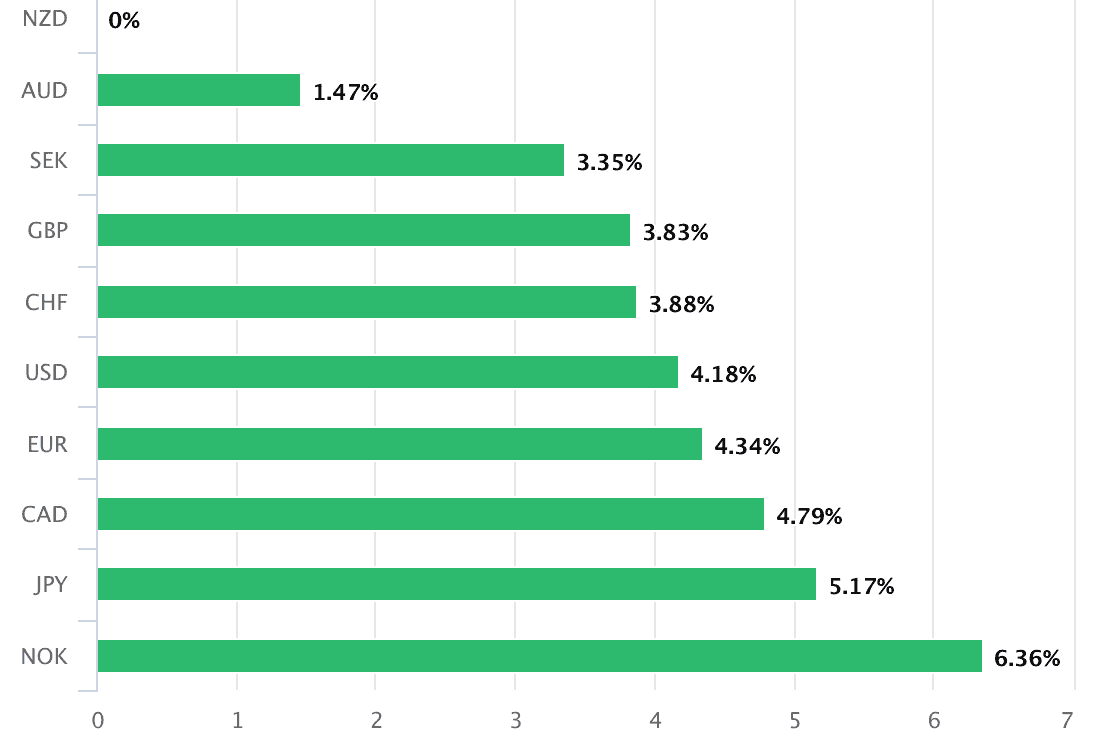

Above: NZD has risen against all major currencies over the past month.

However, the performance of the New Zealand Dollar over the last month is not the sole reason for why it is now overvalued. The equilibrium level for the Kiwi has also fallen in recent months, thanks to a decline in commodity prices.

Whole milk powder (WMP) prices fell by -1.8% at last Tuesday's auction when markets had been looking for a 2% increase, knocking the New Zealand Dollar off two-month highs shortly after.

The decline was the result of increasing levels of supply on global markets and is just the latest in a series of price falls that have added yet another headwind to the outlook for New Zealand's Dollar.

This dented the fundamental value of the Kiwi because it is, after all, substantially underwritten by New Zealand's agricultural commodity trade with other countries like China, Australia and the U.S.

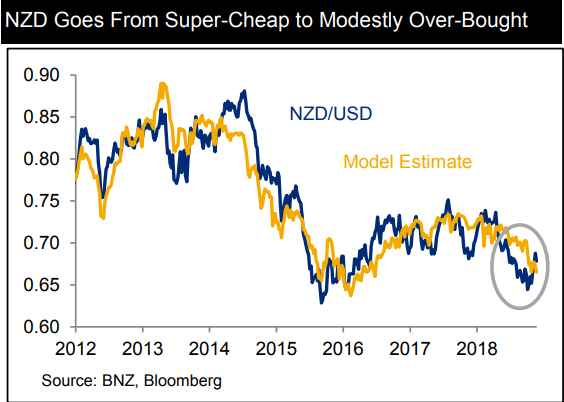

"Our short-term fair value model estimate has fallen to 0.6650, driven down by lower risk appetite and lower NZ commodity prices, taking the NZD from super-cheap to modestly over-bought. Despite a trade war ceasefire removing some potential nearterm downside risk to the NZD, our message would be to tread carefully," says Jason Wong, a strategist at BNZ.

Fair value is falling at a time when other headwinds are abating, making it difficult for analysts to get a clear sense of where the currency might head next.

Above: Bank of New Zealand graph showing NZD/USD rate and NZD/USD fair value.

"Our year-end and Q1’19 targets of 0.65 assumed a deteriorating US-China trade picture. There is obviously some upside risk to these targets if Trump has turned over a new leaf and wants a quick deal. A ceasefire might well last several months and would remove a key source of near-term downside risk to the NZD," says Wong.

President Trump has imposed tariffs on $250 billion of China's annual exports to the U.S., citing "unfair trading practices", and threatened to target another $267 billion if the nation's leadership does not change course.

The existing tariff rate of 10% will automatically increase to 25% on January 01, 2019 unless the White House decides otherwise, and markets have been hopeful the weekend's G20 summit will bring a deal that avoids this increase.

However, China's Commerce Ministry made several combative statements at the end of last week, which suggest an agreement to de-escalate the tariff conflict cannot be taken for granted.

The tariff conflict between the world's two largest economies matters for the Kiwi because China is New Zealand's largest trading partner so anything that hurts its economy could also have an impact in the Antipodean country.

"We’ll hold off any forecast changes until next month, by which we’ll have further details on US-China trade developments. In the meantime, tread carefully," Wong warns.

Above: U.S.-New Zealand bond yield differential with NZD/USD (orange) overlay.

Next month will bring clarity about not only the outlook for U.S. and Chinese trade relations, but also New Zealand interest rates too. Reserve Bank officials have said repeatedly this year that if growth does not pick up they will cut the Kiwi interest rate to a new record low once into 2019.

On that note, markets will scrutinise New Zealand's third-quarter GDP data closely when it is released in December, for signs of an eagerly awaited lift in growth. The second quarter data, released in September, was much better than the market had anticipated and gave hope to some that a rate cut can be avoided.

Growth matters for the Kiwi because of what it means for the inflation outlook and therefore, Reserve Bank of New Zealand interest rate policy. With the U.S. Federal Reserve and other central banks lifting their interest rates, the Kiwi has been shunned by the market in 2018 because the RBNZ is still sitting on its hands.

The above chart highlights the 2018 increase in the yield investors get for holding U.S. government bonds instead of New Zealand debt, which has been a key source of downward pressure on the currency that will not ease until there is a change in Kiwi monetary policy.

Kiwi central bankers want the inflation rate to move sustainably into the upper end of the 1% to 3% target band, which economists say is unlikely to happen without faster economic growth.

The NZD/USD rate was quoted 0.53% higher at 0.6802 Monday and has risen more than 4% in November, which has reduced the pair's 2018 loss to just -3.90%. The Pound-to-Kiwi rate was 0.19% higher at 1.8894 and is down -0.42% for 2018.

Advertisement

Bank-beating exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here