Pound-to-New Zealand Dollar Forecast: 'Dagger-Fall’ Steep Downtrend Likely to Extend

Image © Pavel Ignatov, Adobe Stock

- GBP/NZD is falling steeply and likely to continue

- A bounce from oversold is likely to be short-lived

- Brexit headlines to drive Sterling, NZD moved by US-China trade relations

The Pound is looking firmer against the NZ Dollar at the start of the new month with a 0.70% rebound ensuring 1 GBP now buys 1.18824 NZD.

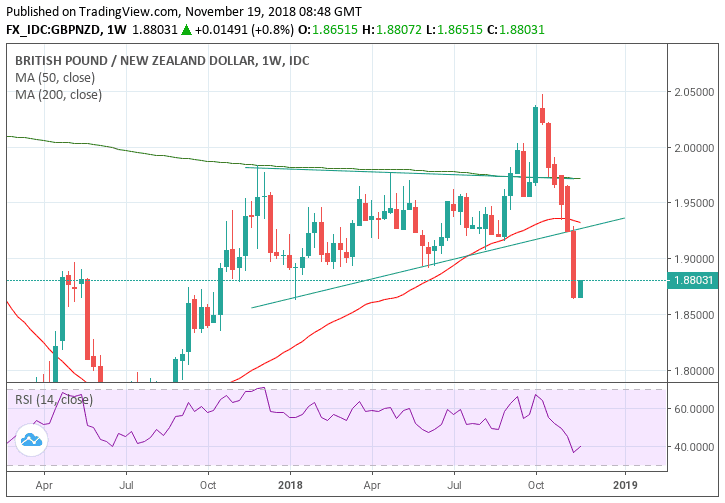

This is small change; GBP/NZD has fallen by nearly 9.0% in only 5 weeks after touching a peak of 2.04 in October and then falling precipitously to last week's 1.86 lows; now it is consolidating in the 1.87s but the tone is very much bearish and we expect further declines to follow.

The pair has broken cleanly through the last major bullish defence at about 1.94 composed of the 200-day moving average (MA) and the lower border of the large triangle pattern. With these two formidable floors now broken the way has been opened to further downside. The pair has already followed through lower and we expect the trend to continue.

Although the weekly chart does not show any signs the pair is oversold the daily chart does, with the RSI, a momentum indicator, now well into the oversold region.

This suggests an increased possibility the pair could bounce or undergo a relief rally. We do not expect an ‘all out’ reversal, however, and whilst there is likely to be a bounce it is unlikely to last long. The previous bear-trend since the October highs was so steep that the odds favour a continuation, and the trend is unlikely to reversal sharply from such a strong downtrend to a new uptrend.

Nevertheless, we would ideally like to witness some confirmation before entering shorts due to the oversold nature if the market, and it would take a break below the 1.8630 lows to green-light an extension lower, with the next target to the downside at the 1.8325 October 2017 lows.

Advertisement

Bank-beating GBP/NZD exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The New Zealand Dollar: What to Watch

The main driver of the New Zealand Dollar's recent ‘purple patch’ has been increased confidence in China, New Zealand's largest trading partner. Easing trade tensions between the US and China have created a more benign backdrop for trade and the Kiwi.

Indeed, expectations for improved confidence in China in 2019 make the NZD a buy candidate with global investment banking giant Goldman Sachs, details of the call can be read here.

Whether or not the improved tone around trade relations is set to continue or worsen over coming days is however difficult to tell, as previously held optimism took a hit over the weekend at the Asia Pacific Economic Cooperation (APEC) summit where the two superpowers found little common ground.

Recent reports from Washington appear to show advisors and influencers endorsing a more conciliatory approach to economic foreign policy which suggests US-China tensions are more likely to subside and we see little to be gained by the US ratcheting up a trade war with the Chinese. Federal Reserve's Clarida said the US needed to consider it's monetary policy within a global context and a similar sentiment was echoed by the Wall Street Journal which published an editorial entitled “The US is not an Island”.

Thus overall the Kiwi appears biased to extending its upside as global trade tensions are more likely to diffuse than not, but that is not the only positive backdraught for the currency.

Further upside could also come from a growing trend for improving economic data. The main recent surprise release was NZ unemployment which fell 4 whole basis points in Q3 from 4.3% to 3.9%. But there are other plusses which promise to support the currency going forward such as sold 1.0% quarterly growth registered in Q2, rising inflation and a falling public debt pile.

As far as hard data in the week ahead goes, the main standout release is the Global Dairy Trade Index (GDT) out on Tuesday at 14.30 GMT. The GDT provides a price fix for a basket of dairy goods at a global auction every fortnight.

Dairy products are NZ's key export so a rise in their prices tends to be supportive of the Kiwi over the long-run. This is especially true for Dried Whole Milk which is a major export for NZ.

The GDT has described a rather bearish profile in 2018 after falling over 10% so far so the bias is for further losses. This is more an underlying factor impacting on the Kiwi, however, and fortnightly changes in the Index are unlikely to impact much on the currency immediately on release, unless well beyond the standard range.

The Pound: What to Watch

All eyes will be on prime minister Theresa May and whether she can hold onto power.

Importantly, there is confirmation that the U.K. can get further concessions from the E.U. - this is exactly what is required to allow the DUP and Conservative party opponents back on side.

In a Sky News interview May says the key to the outlook would be the next seven days, when her negotiators would be going back to E.U. officials and hammering out the "future relationship".

She will also be visiting Brussels, she added, and will talk to E.U. Commission president Jean-Claude Juncker as part of the week's discussions.

May needs further concessions and the E.U. can quite clearly see the plan they have brokered requires some help. This news is a Pound -positive development.

Conservative rebels seeking May's ouster might this week eventually muster enough votes - 48 are needed - to force a vote of no confidence in the Prime Minister. This would be a Pound-negative development.

If May loses the vote she is out, if she survives she is immune to another challenge for a year.

"To unseat PM May successfully would require a majority and it is much less clear

that this number would be reached," says MUFG's Loew. "If PM May was surprisingly defeated in a leadership challenge, we would expect the Pound to fall by a further 3% to 5%. It would heighten concerns over a 'No Deal' outcome."

May winning a vote would be Pound-positive as it does suggest the room for manoeuvre by 'hard brexiteer' opponents is fast running out.

There were expectations that May would be subject to a no confidence vote on Friday, November 16, but the threshold has yet to be met, suggesting the rebellion might in fact be stalling. As of the time of writing there still appears to be too few letters to trigger a vote of no confidence.

If it does stall, we see it as a positive trigger for a potential, partial, recovery in the currency.

A key event in the week ahead for the Pound is probably the Bank of England Inflation Report hearings conducted by members of the House of Commons Treasury Select Committee, a parliamentary body charged with oversight of the public finances.

The comments from the Bank of England at this hearing, especially in relation to the trajectory of the economy and the effect of Brexit, could impact the Pound.

Recent economic data including CPI and retail sales were lower-than-expected, while growth data suggests a slowdown in activity into year-end.

The hearings are on Monday at 11.00 GMT.

The other key release is the CBI industrial trends survey out at 00.00 on Monday, November 19. Although unlikely to move markets on their own, CBI surveys are usually good leading indicators of future economic activity and, therefore, contribute to formulating the overall economic backdrop in which to access the Pound.

Public sector net borrowing is out on Wednesday at 10.30. Borrowing came out at -3.26bn on October. Overall government borrowing has fallen over recent years.

Advertisement

Bank-beating GBP/NZD exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here