Pound-to-New Zealand Dollar Rate 5-Day Outlook: Downtrend Accelerates

Image © Rafael Ben-Ari, Adobe Images

- GBP/NZD falling rapidly as Kiwi appreciates

- Surprisingly strong NZ employment data an aid

- Brexit news to dominate GBP whilst trade news to move NZD

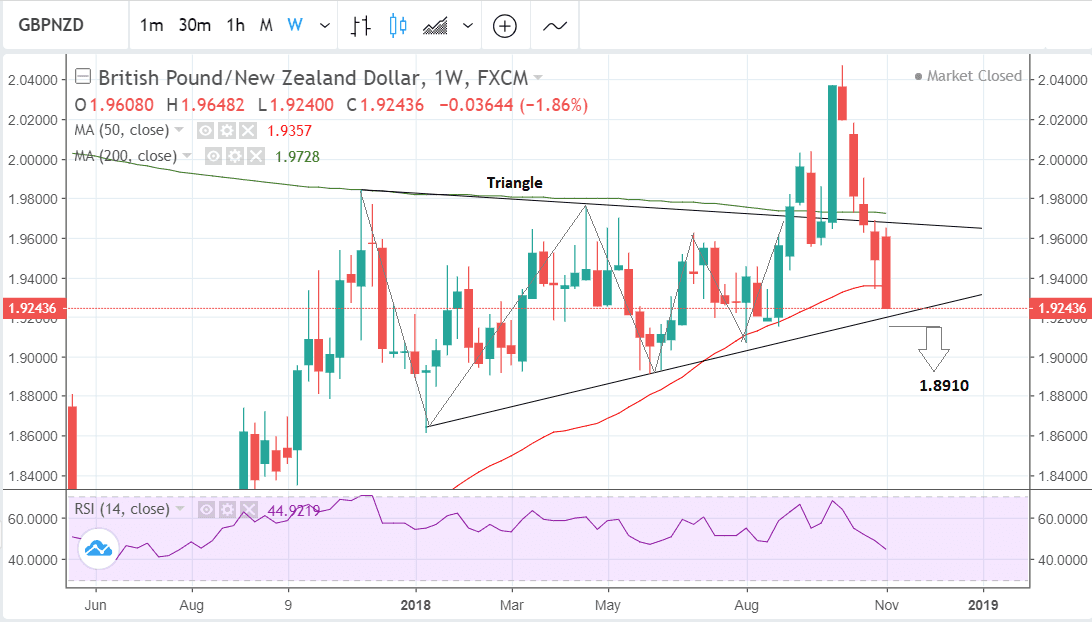

The Pound-to-New Zealand Dollar exchange rate is in an established short-term downtrend which our technical studies suggest is more likely to extend than not.

Backing the call is last week's massive hemorrhaging which saw the exchange rate fall from an open of 1.9608 to a close of 1.9244, a decline which constituted the fifth negative week in a row.

The one major impediment to further downside is the lower border of an old triangle pattern not far below the current market level, which formed in the first half of the year at roughly 1.9215. This is likely to present a fairly formidable obstacle to bears trying to push the exchange rate lower in the week ahead and presents a material risk of a stall or even a bounce.

To continue to expect more downside, therefore, we would ideally like to see the rate break clearly below the lower border, confirmed by a move below the 1.9140 level. Such a move would then be expected to fall all the way down to a target at 1.8910, although the 1.9000 level provides a more conservative target.

Momentum, as measured by RSI in the bottom pane of the chart, looks particularly bearish.

The last time it was as low as it is now was in July when the exchange rate was in the 1.75s, suggesting more downside is appropriate for this level of momentum.

Advertisement

Bank-beating GBP/NZD exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The New Zealand Dollar: What to Watch

The most important fundamental driver of the New Zealand Dollar (Kiwi) in the week ahead is probably general global risk sentiment, especially sentiment driven by the outlook for trade between China and the US.

A deterioration in trade relations between the two superpowers is likely to impact negatively on the Kiwi.

New Zealand is highly dependent on China as a trading neighbour so anything which weakens the Chinese economy also impacts negatively on New Zealand. On the flip side, an improvement in relations is likely to support the Kiwi.

Overall we see risks as more benign since Trump's more conciliatory rhetoric post the mid-terms. This may be driven by a desire to appease the electorate in areas worst hit by China's tariffs.

The US may also increasingly come to rely on foreign loans now the government will be limited in its ability to make cuts to public spending since the Democrats control the lower house. This is likely to lead to a widening deficit and the US more dependent on foreign loans to cover its deficits, which will require a less abrasive foreign policy from its head.

On the hard data front, it is a fairly light week for the Kiwi. The main releases of any note are electronic card sales which are forecast to show a 0.6% rise in October when released on Sunday evening at 21.45 GMT and Business NZ PMI out at 21.30 on Thursday, November 15.

New Zealand labour market data showed a surprise improvement in Q3, with the unemployment rate falling from 4.4% to 3.9% but the participation rate rising at the same time, suggesting the fall could not be explained by an exodus of jobseekers out of the market.

This suggests at least the possibility that other economic data metrics may also surprise to the upside, which would increase gains for the Kiwi, as it would suggest the possibility the central bank might have to tighten policy sooner than previously thought.

The Pound: What to Watch

The main driver of the Pound in the week ahead is likely to be Brexit news and the British Pound could be in for a soft start to the new week thanks to headlines suggesting the E.U. are rejecting proposals by U.K. Prime Minister to break the deadlock in Brexit negotiations centred over the Irish backstop.

"Theresa May’s Brexit deal crashes as E.U. ‘turns off life support’" reports the Sunday Times; a headline that will surely see markets pare exposure to the U.K. currency in the near-term

"This weekend senior EU officials sent shockwaves through No 10 by rejecting May’s plan, sparking fears that negotiations have broken down days before “no-deal” preparations costing billions need to be implemented," says Caroline Wheeler, Deputy Political Editor at the Sunday Times.

The headlines from the Sunday Times are indeed worrying: if true then it might be the case that Theresa May will have to walk away from negotiations as she simply won't be able to muster parliamentary support for a wildly unpopular deal in the shape of currency proposals that risk the U.K. being subjugated to E.U. law indefinitely.

Yet, we always knew these negotiations would go down to the wire and with December being the final deadline we are not surprised by these negative headlines.

Markets could be accused of becoming far too optimistic on the state of Brexit negotiations of late. The E.U. always negotiates until the very end; and we are seeing just this.

That is also possible gains on any deal may be short-lived as even if the government announces a deal it will still have to get approval from Parliament, and this could be an arduous process, presenting a risk to Sterling.

The conservative government only has a small majority and is reliant on support from the DUP and every single one of it MPs, so there is a risk that if either the DUP or Brexit rebels vote against the deal Theresa May may find she does not have the majority to push it through, and this could weigh on the Pound.

On the hard data front, one of the most significant releases in the week ahead is likely to be inflation data for October, which, according to the market consensus, is forecast to show a 0.2% rise on a month-on-month (mom) basis and 2.5% rise on a year-on-year (yoy) basis (for headline inflation) when it is released on Wednesday at 9.30 GMT.

A result in line with expectations would probably be bullish for Sterling as higher inflation puts pressure on the central bank to raise interest rates which appreciates the currency.

This is because higher interest rates tend to attract more inflows of foreign capital drawn by the promise of higher returns.

There is a chance, however, that inflation will disappoint because of the waning influence of the cheap Pound which has appreciated on Brexit hopes. Headline CPI has already fallen from a peak of 3.0% in January due to the bounce in the Pound, so more losses are possible - although if comments from the Bank of England (BOE) are anything to go by unlikely.

"In its most recent meeting, the Bank of England (BoE) noted that it does not expect inflation to fall much further, with price growth instead holding fairly steady near the 2% target," say Wells Fargo in a note to clients.

Another major release for the Pound is labour market data out on Tuesday at 9.30. Probably of most significance to Sterling is the average earnings component because of its influence on inflation. The current expectation is for a rise of 3.0% in Earnings (including bonuses) and for a rise of 3.1% in earnings excluding bonuses. A result in line with expectations could be positive for the Pound as it will reflect an even stronger rise in real earnings since the fall in inflation from its January peak.

Other results of note within the labour report are unemployment, which is forecast to remain at 3.0% and employment change which is forecast to rise by 34k.

The final major release for the Pound is retail sales on Thursday, which is forecast to show a 0.2% rebound in October, from a rather weak -0.8% previously, and a 2.8% rise yoy from 3.0% previously, when it released at 9.30 GMT.

Advertisement

Bank-beating GBP/NZD exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here