Pound Surges against Polish Zloty on Central Bank Mistake, More Volatility Expected

- Written by: Gary Howes

Above: NBP governor Adam Glapinski gives a press conference following the unexpected 75bp interest rate cut. Image courtesy of the NBP.

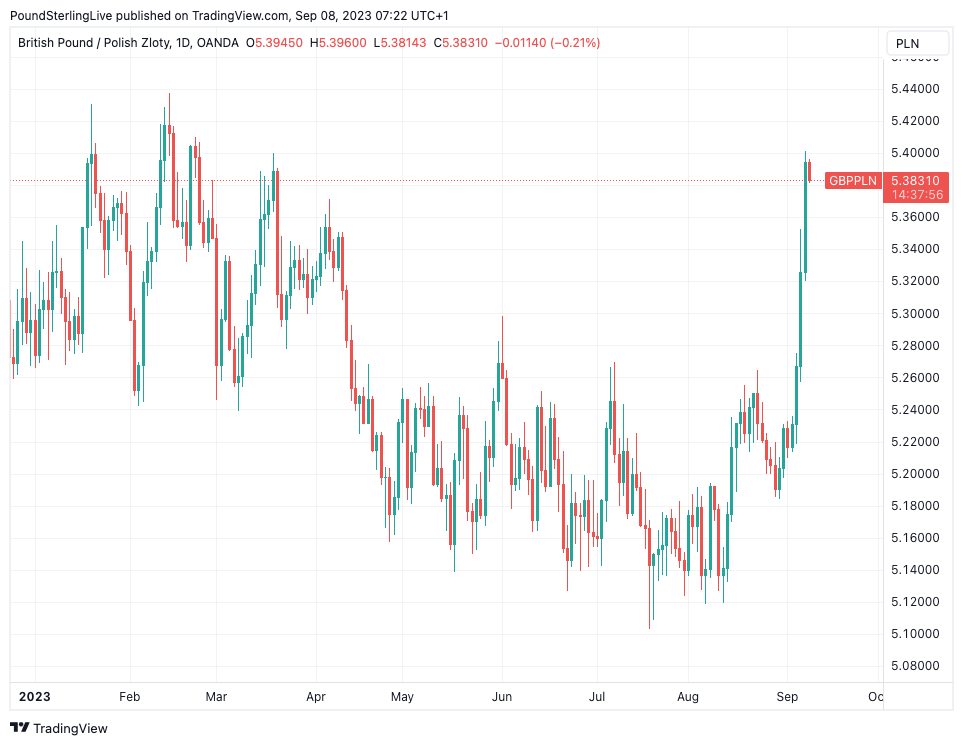

The Pound to Zloty exchange rate (GBPPLN) has surged in dramatic fashion to its highest level since March following what analysts are labelling as the first policy mistake made by a major central bank as we move into the next phase of the economic cycle.

Further Zloty volatility is expected after the Narodowy Bank Polski (NBP) unexpectedly slashed interest rates by 75 basis points midweek and followed the move with some unconvincing guidance from NBP governor Adam Glapinski.

"The Polish zloty had another mighty fall yesterday after NBP governor Adam Glapinski spoke at his monthly press conference to clarify on the central bank's latest monetary policy changes," says Tatha Ghose, FX Analyst at Commerzbank.

Glapinski reiterated that the rate cut had nothing to do with politics - 15 October is general elections - but investors appear unconvinced given the close proximity of elections.

"In the absence of a balanced debate which the FX market could process for policy signals, the currency declined sharply," says Ghose.

The net result is the Zloty lost 3.0% in value to the British Pound as the GBPPLN has surged to 5.38, having been as low as 5.2167 at the start of the week.

Against the Euro, the Zloty has lost 3.28% (4.6136) and against the Dollar, losses stretch to 3.90% (4.3033).

Above: GBPPLN shown at daily intervals.

The NBP surprised the market with a 75 basis point cut this week when a 25bp or unchanged decision was expected, taking the policy rate to 6% from 6.75%.

This is at a time when nominal and core inflation rates are both above 10% (headline is at 10.8%), raising questions as to why a central bank is cutting interest rates at a time when such moves are clearly not warranted.

"The real driver might just be political with a general election on the horizon next month," says W. Brad Bechtel, Global Head of FX at Jefferies LLC.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Bechtel explains in a daily research note that Poland's central bank looks to have committed the first major policy mistake of the next phase in the economic cycle, one where growth is falling down but inflation remains stubbornly high.

"The chance for policy mistakes in this environment is very high, and we may have just seen our first one in NBP," says Bechtel. "The currency is the outlet valve when policy mistakes happen and the PLN is cratering."

BNP governor Glapinski defended the move in a press appearance Thursday by consulting the Erdogan textbook and saying the fall in the currency was because economists were only serving the interests of the banks and the move would be welcomed by most ordinary Poles.

The outsized cut comes as other central banks are seen holding interest rates at current levels, and in some cases raising them, in recognition of inflation's stubbornness.

This leaves the Polish Zloty particularly exposed on a relative basis.

"The market’s perception of NBP could be swinging in the same direction as the Turkish central bank, or the initial period after governor Ales Michl was nominated to head the Czech National Bank. We should be prepared for similar volatility – the period of rock-solid performance by the zloty seems to be over," says Ghose.

The Zloty was one of the better-performing of the world's major currencies until the NBP's unexpected move but it now looks set for some significant volatility as central bank credibility falls out the window.

Glapinski justified the cut by citing flat inflation on a month-on-month basis, for several months, as a sign that the inflation problem had disappeared.

Yet the BNP's projection shows inflation will still record a near-7% by the end of the year and could take until 2025 to decelerate to 3.5% upper limit of the target range.

"The fallout from this is likely to continue," warns Bechtel at Jefferies.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes