Norwegian Krone Surges on 50bp Hike at Norges Bank

- Written by: Gary Howes

Above: File image of Norges Bank Governor Ida Wolden Bache. Photo credit: Nils S. Aasheim/Norges Bank.

Norges Bank surprised markets with a 'hawkish' policy decision Thursday, prompting a rally in the value of the Norwegian Krone.

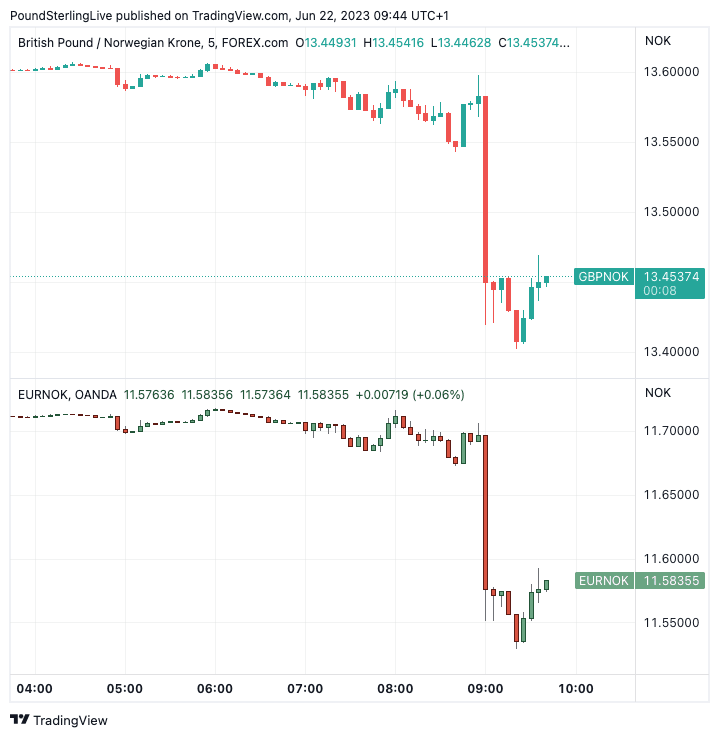

The Pound to Krone exchange rate (GBPNOK) slid by over a per cent to 13.43 in the minutes following the decision to raise the base rate by 50 basis points to 3.75%, which was a more determined move than the 25bp expected by the market.

Against the Dollar, the Norwegian currency was higher by a per cent as USDNOK retreated to 10.52. The Euro-Krone exchange rate (EURNOK) was lower by a similar margin at 11.57.

Core inflation rose to 6.7% year-on-year in May prompting the Bank to say in a statement: "inflation is markedly above the target. Wage growth is set to be higher than in 2022. Activity remains high amid continued tightness in the labour market, but pressures in the Norwegian economy are easing."

The promise of further rate hikes was made with a message, "the policy rate will most likely be raised further in August."

Above: GBPNOK and EURNOK at five-minute intervals showing the impact of the rate decision.

This was enough to prompt a bid in the Krone, one of 2023's biggest underperformers in the G10 currency space, partly owing to a belief amongst markets the Norges Bank has been too timid in dealing with inflation via higher rates.

"The Committee judges that a higher policy rate than previously signalled is needed to bring inflation down to target," said Norges Bank in a statement.

Governor Ida Wolden Bache said failure to raise interest rates could mean prices and wages could continue to rise rapidly and inflation becomes entrenched.

"It may then become more costly to bring inflation down again," she warned.

The policy rate forecast from the central bank was revised higher from the projection issued in March and indicates a rise in the policy rate to 4.25% in autumn.

This suggests at least two more hikes are committed by the Norges Bank, markets will likely raise bets for more based on the 'hawkish' signals in the guidance, suggesting further support for the Norwegian Krone.

"The more marked policy tightening could also contribute to a stronger NOK and thus lower inflation, but could come with a cost. Monetary policy works with a lag on the economy, and there are some signals that households are struggling with elevated rates and high inflation," says Kyrre Aamdal, an economist at DNB Bank ASA.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes