Buy American Banking Stocks and Sell European Govt. Bonds Says TS Lombard

- Written by: James Skinner

"EU banks ≠ US banks, euro bank funding measures are far from crisis levels and dovish pricing is by far an overreaction. European core inflation remains persistent with little sign of disinflation and the ECB is maintaining its overtightening bias" - TS Lombard.

Image © Adobe Images

Many European share markets were higher ahead of the North American open on Thursday including those in Switzerland, France and Germany, in a potentially favourable outcome for TS Lombard strategists who've tipped large U.S. bank stocks as a buy and European government bonds as a sell.

Swiss share markets led the rebound in European stocks on Thursday after the harried and seemingly hunted lender Credit Suisse said it would make use of a Swiss National Bank (SNB) it would swap regulatory capital assets for short-term liquidity at the Swiss National Bank (SNB).

The roughly $3 billion set of transactions follows an announcement from the SNB late on Wednesday notifying the market that it would support Credit Suisse and others with liquidity in the event of any circumstances where it's necessary following a speculative rout in the European bank stocks.

"EUR/CHF itself is back above 0.9850 now after making lows just shy of 0.9700 yesterday and on Monday. I suspect SNB is helping that pair a bit at the lows," says Brad Bechtel, global head of FX at Jefferies.

"There is still a huge disconnect in the market between what the Fed thinks and the market thinks, but we haven't heard a peep from the Fed since the SVB crisis began and the volatility that ensued this week," Bechtel adds.

Above: GBP/CHF shown at hourly intervals alongside EUR/CHF. Click any image for closer inspection.

Above: GBP/CHF shown at hourly intervals alongside EUR/CHF. Click any image for closer inspection.

Compare GBP to CHF Exchange Rates

Find out how much you could save on your pound to Swiss franc transfer

Potential saving vs high street banks:

CHF 2,825.00

Free • No obligation • Takes 2 minutes

Wednesday's rout in stock markets originated from the European banking sector but was ultimately a spillover effect of the funding pressures that snowballed into the failures of Silicon Valley Bank (SVB) and others at the weekend.

That culminated in a federal intervention on Sunday that has since circumvented the prospect of panic spreading among depositors of other firms, leading TS Lombard strategists to say recent price action was an overreaction.

"We knew that after a decade of perma low rates and QE, built-up stress would expose vulnerabilities that feed into the real economy and markets. SVB is the latest victim of rising rates," writes Skylar Montgomery Koning, a macro strategist at TS Lombard, in a Wednesday research briefing.

"Our base case has been recession on the grounds that accumulated [Federal Reserve] tightening would constrict the economy – and that is exactly what we are getting; the SVB crisis raises our conviction in this call. However, the market reaction in the short term looks to be overdone," she adds.

Koning said late on Wendesday that "there is no systemic crisis" and that actions taken by supervisory authorities are enough for the problems at hand.

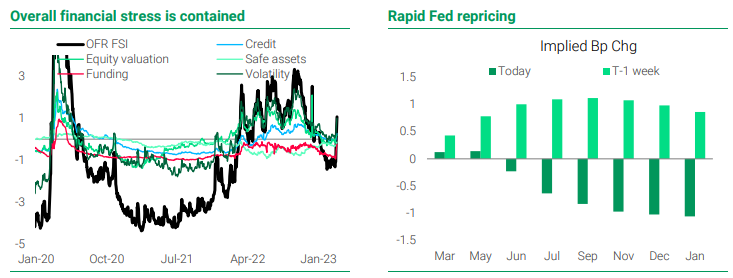

Source: TS Lombard. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Source: TS Lombard. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

She also argued that clients "tactically buy US large cap banks," citing a supervisory response that "is enough to prevent contagion" or further 'bank run' type behaviour and so leaves the shares of larger banking firms appearing somewhat discounted.

"We re-engage short Euro Schatz. Last week we put a trailing stop on our short EUR Schatz position at +0.5%, which has swiftly been hit. With fixed income gaining downside momentum in recent trading, we re-engage," Koning says.

"Germany is our preferred front-end fixed income short; since the ECB is a policy laggard, this cycle means it has more room to hike, especially as economic surprises have been coming in on the positive side. Moreover, the German 2y looks expensive with a yield of 2.6%," she adds.

All of this is after press reports and other anecdotes suggested there were worries among investors and others that companies and households engaging in 'bank run' behaviour could force banking firms to liquidate capital reserve assets in order to meet demand for deposits.

Fears were that this would lead banks themselves to realise large and financially crippling losses by selling government bonds at much lower market prices than when they were acquired due mainly to the effect that central bank monetary policies have had on bond prices everywhere.

Above: Credit Suisse shares shown at hourly intervals alongside Barclays, Deutsche Bank, Goldman Sachs and Bank of America shares. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: Credit Suisse shares shown at hourly intervals alongside Barclays, Deutsche Bank, Goldman Sachs and Bank of America shares. To optimise the timing of international payments you could consider setting a free FX rate alert here.

"EU banks ≠ US banks, euro bank funding measures are far from crisis levels and dovish pricing is by far an overreaction. European core inflation remains persistent with little sign of disinflation and the ECB is maintaining its overtightening bias," Koning and colleagues say.

Bond prices and values do fall when central bank interest rates and bond yields rise but losses below par value are merely an accounting technicality if and when the bonds in question are intended to be held until maturity, as is the case with banking sector capital reserve assets.

Hence why actions taken by the Federal Reserve and other federal agencies in the U.S. at the weekend, and in Switzerland on Wednesday evening, have been effective in nullifying any risk of the above scenario becoming reality.

As a result of the actions taken, there are facilities being provided by the relevant central banks to enable private participants in the banking sector to effectively swap their holdings for something closer to their redemption value for any necessary period of time.

Many share indices were higher ahead of the North American open on Thursday including those in Switzerland, France and Germany, although performances across the banking and finance sectors were chequered.

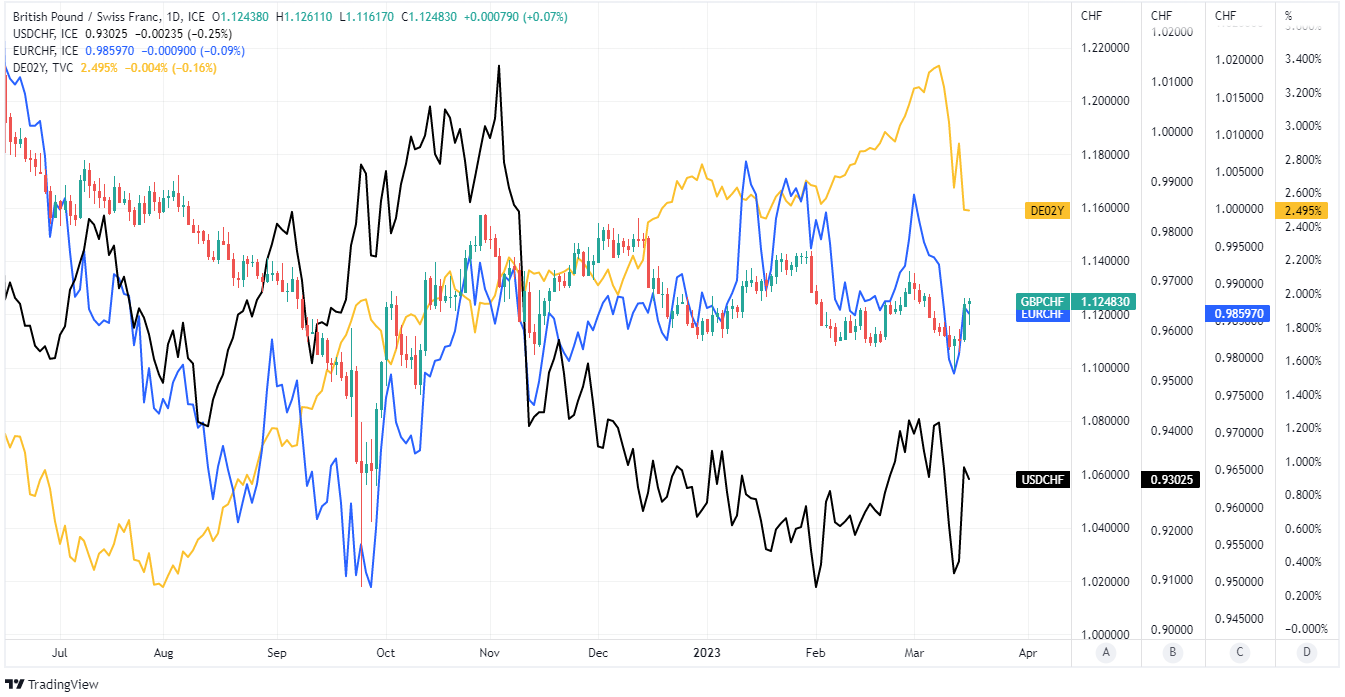

Above: GBP/CHF shown at daily intervals alongside USD/CHF, EUR/CHF and 02-year German government bond yield.

Above: GBP/CHF shown at daily intervals alongside USD/CHF, EUR/CHF and 02-year German government bond yield.

Compare GBP to CHF Exchange Rates

Find out how much you could save on your pound to Swiss franc transfer

Potential saving vs high street banks:

CHF 2,825.00

Free • No obligation • Takes 2 minutes