Swedish Krona Weathers Rough Global Markets after Inflation Incites Riksbank

- Written by: James Skinner

"The Riksbank does not want to change its signalling for the upcoming meeting but is following incoming data and the development of the banking situation" - SEB.

Image © Adobe Stock

The Swedish Krona rose against a falling Euro and some other major counterparts in a resilient midweek performance after inflation rose further for the month of February, placing the Sveriges Riksbank under a spotlight ahead of its April interest rate decision.

Sweden's Krona was the top performer among Scandinavian currencies on Wednesday while it also notched up gains over the Swiss Franc, Mexican Peso and South African Rand despite heavy losses for stock indices across the globe and a renewed investor focus on banking sector stability.

"Inflation soared in Sweden in February and the Riksbank suffered yet another blow to its forecasting credentials. Barring a financial crisis the Riksbank will have to hike aggressively to defend its credibility," says Pär Magnusson, a senior rates strategist at Swedbank.

"50bp in April and 50bp in June is our base case, but 75bp is not out of the question," he adds in Wednesday commentary.

Wednesday's performance came after Statistics Sweden said annual inflation rose from 11.7% to 12% in February and that core inflation edged higher from 9.2% to 9.4%, making for stronger-than-expected outcomes in both cases.

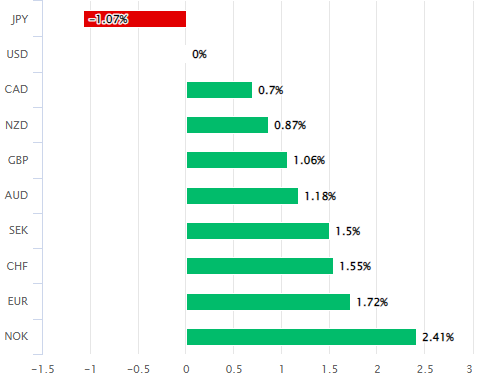

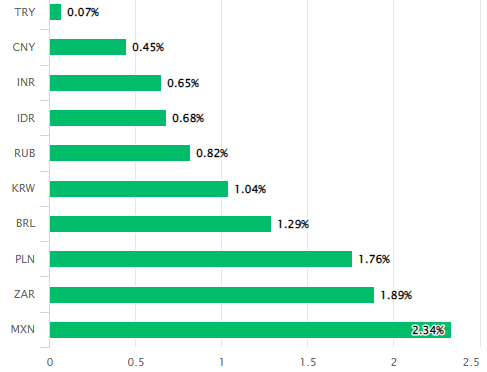

Above: U.S. Dollar performance relative to G10 and G20 currencies including Swedish Krona on Wednesday. Source: Pound Sterling Live. To optimise the timing of international payments you could consider setting a free FX rate alert here.

"SEK outperformed with hawkish Riksbank rhetoric ahead of the Swedish CPI out this morning," says John Hardy, head of FX strategy at Saxo Bank.

"Governor Thedeen reiterated that inflation is still far too high and monetary policy needs to act to bring it back to 2% within a reasonable timeframe, adding that guidance for a 25bps or 50bps hike in April remains valid and data dependent." Hardy writes in Wednesday market commentary.

Wednesday's data is likely to be disappointing for the Riksbank but comes some six weeks out from an April monetary policy decision in which many economists are looking to see the Repo Rate raised from 3% to 3.5%.

It's not yet clear whether the data does or doesn't introduce the risk of an even larger interest rate move next month.

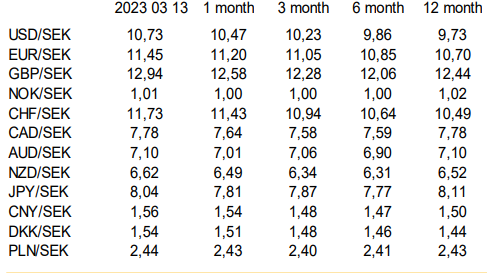

Above: Swedbank forecasts for Swedish Krona pairs. Click image for closer inspection. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

"The open hearing of the Riksbank in the finance committee yesterday showed that the Riksbank does not currently see major risks to financial instability and that it wants to see a more broad-based decline in inflation before ceasing rate hikes," says Jussi Hiljanen, chief strategist for USD and EUR rates at SEB.

"The Riksbank does not want to change its signalling for the upcoming meeting but is following incoming data and the development of the banking situation in the US closely. By the 26 April meeting, the Riksbank should have more information on how the current crisis has evolved," Hiljanen adds.

The Swedish Krona sustained heavy losses against the Euro and U.S. Dollar on Wednesday but outperformed others even as European banking sector shares came under significant pressure amid potentially, if not entirely misguided speculation about the viability of Swiss lender Credit Suisse.

"The Swedish banking system is one of the more dependent on wholesale funding markets and also has sizable exposure to the Swedish residential and in particular commercial property sector," says Chris Turner, global head of markets and regional head of research for UK & CEE at ING.

"Ever higher rates in Sweden only stand to heap more pressure on the property sector, on the banks, and on the SEK," Turner also warned on Wednesday.

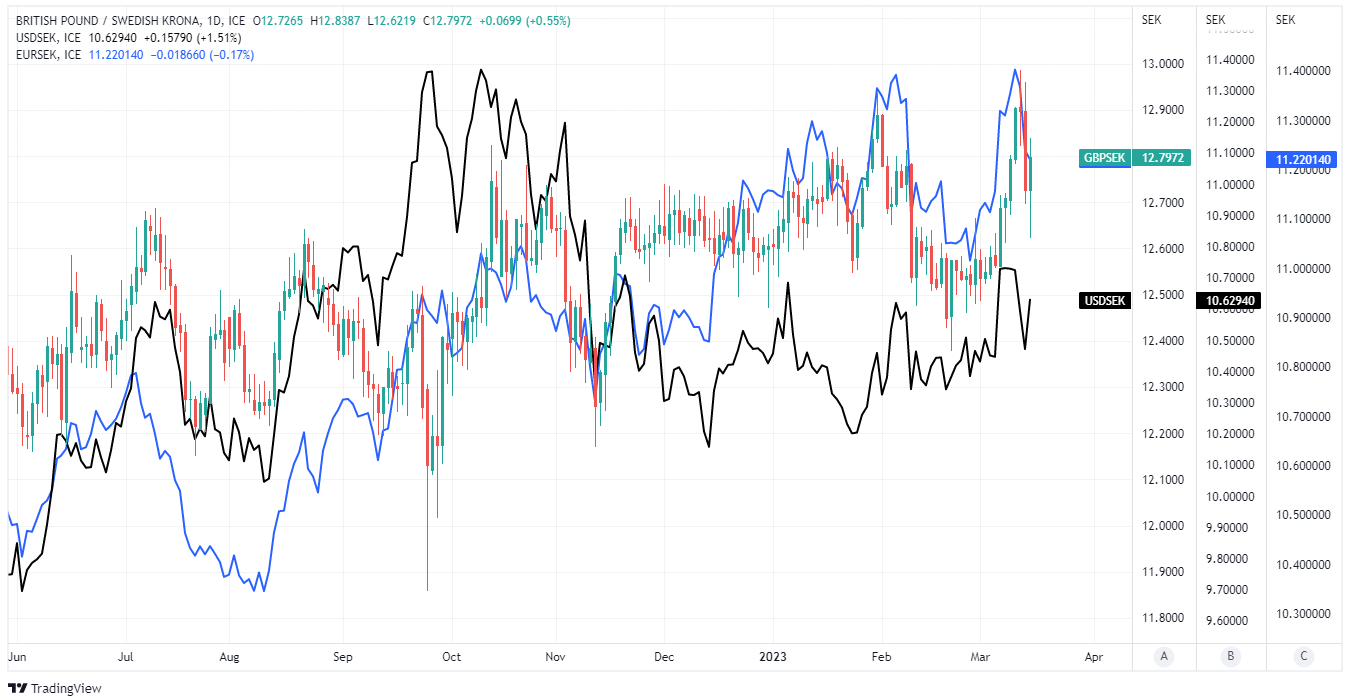

Above: Pound to Krona rate shown at daily intervals alongside USD/SEK and EUR/SEK. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.