Turkish Lira Looks to Stabilise with USD/TRY Under 14.00

- Written by: James Skinner

- TRY stabilising in middle of holiday range

- USD/TRY attempts to level off near 14.00

- After TRY deposit scheme elicits rebound

- But FX market still bearish on TRY outlook

- Analysts say deposit scheme no panacea

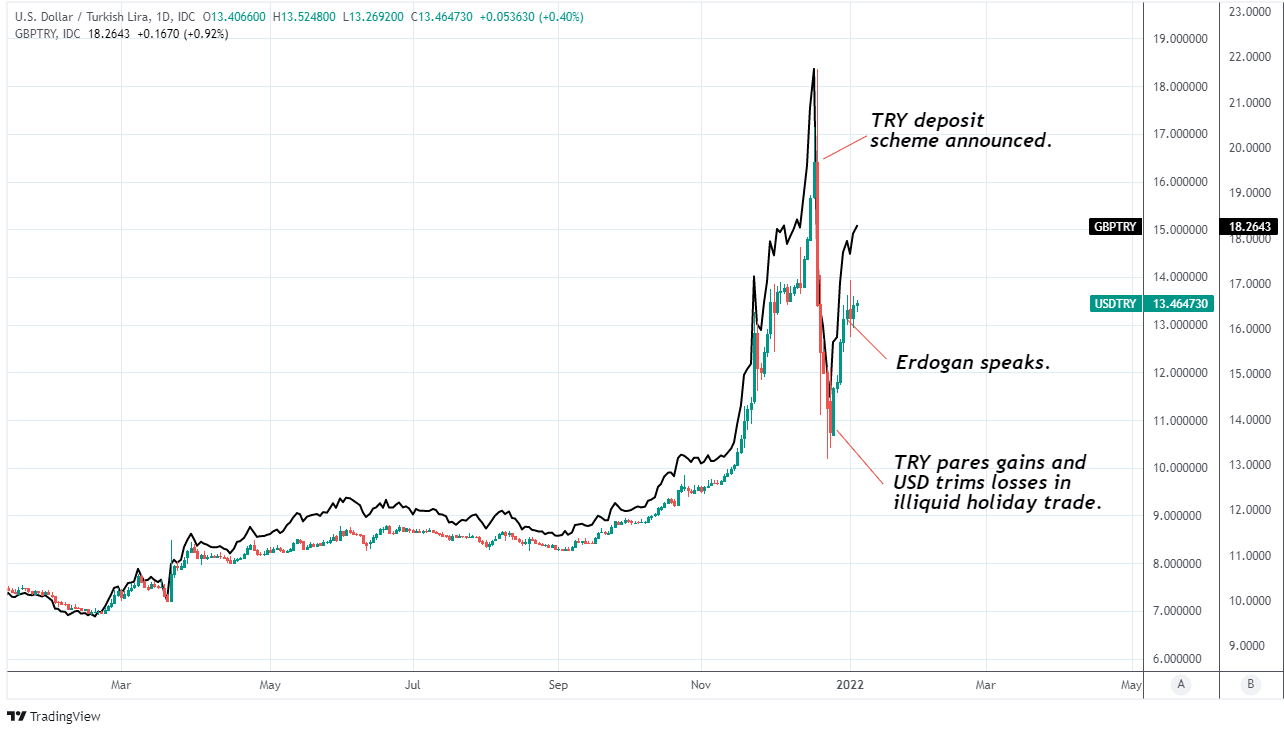

The Turkish Lira appeared to be stabilising in the opening week of January with USD/TRY holding in a narrow range below the 14.00 level, which could potentially mark a short-term top for the exchange rate if recent remarks from President Recep Tayyip Erdogan are anything to go by.

Turkey’s Lira was holding onto much of its late December gains by the midway milestone in the opening week of the new year and may have been aided by further actions from the government and central bank aimed at reversing a late 2021 collapse in Turkish exchange rates.

Most recently a Bloomberg News report suggested that local exporters will now be required to sell a quarter of their U.S. Dollar, Euro and Pound Sterling foriegn exchange revenues to the Central Bank of the Republic of Turkey (CBRT), potentially providing ongoing support to the Lira.

This followed the late December launch of a new savings deposit scheme intended to curtail household demand for foreign currencies, which has previously exacerbated the Lira’s depreciation in a process known as ‘dollarisation.’

“From the day we announced this package, there has been a serious return from foreign currency to our own money in deposits. As of the beginning of the year, we see the signs that both our companies and our citizens will accelerate the return to our own money,” President Erdogan told the ASKON General Assembly on December 31.

Above: USD/TRY shown at daily intervals alongside GBP/TRY.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The savings scheme prompted an almost record setting rally by the Lira, which held onto much of its gains as market conditions normalised this week.

“It is a temporary situation that the exchange rate has started to fluctuate again these days due to the closing of accounts at the end of the year. We think that the exchange rate will stabilize at a reasonable level as it was at the beginning of this week. We will also use the means at our disposal to achieve this,” President Erdogan also said, according to an official readout of the address.

Meanwhile, President Erdogan has urged companies to abandon the use of foreign currencies and to only do business using Lira wherever possible, while also imploring citizens who own gold “to include this value in our financial system.”

His address came at the tailend of a torrid quarter over which the Lira halved in value against the Dollar and other currencies as speculators besieged it in an apparent response to the four interest rate cuts that were announced by the CBRT between early September and late December.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“We have taken and are taking measures to prevent it. We do all these without deviating from the rules of free market economy and without harming our country's strong ties with the global economic system,” President Erdogan said in reference to speculation against the Lira.

“Likewise, we invite our citizens who prefer gold as a savings method to include this value in our financial system. The more gold we can bring to our economy, the stronger our country and nation will be. The faster we carry out the process of horizontalizing the exchange rate and bringing gold into the system, the stronger our hand will be in our struggle to control inflation and exorbitant price increases that often exceed it,” Erdogan also said.

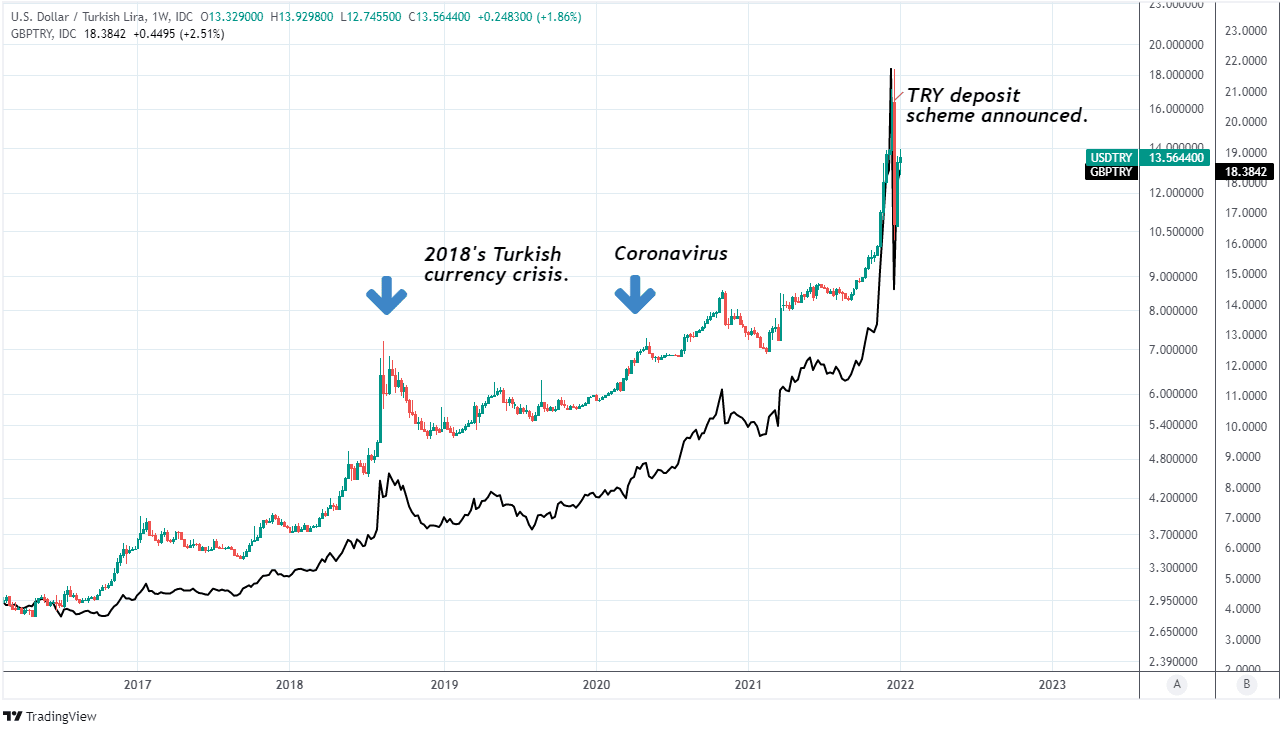

While much of the Lira’s late 2021 losses have since been reversed, many analysts are sceptical that any of the new schemes announced will succeed in turning the tide for the Lira.

The Lira has depreciated significantly each year on average ever since at least the turn of the millennium in price action that is often attributed by analysts to the government and central bank’s unorthodox approach to interest rates and inflation.

Above: USD/TRY and GBP/TRY shown at weekly intervals.

“The central bank signaled last month that it does not intend to cut the policy rate further while the bar for switching to a hawkish tone remains elevated. This environment seems to us consistent with scope for still sizable moves in USDTRY in the weeks ahead as the government experiments with unconventional measures,” says Nimrod Mevorach, a strategist at Credit Suisse.

Typically central banks tend to increase their interest rates in order to combat high and rising rates of inflation and vice versa.

However, CBRT policy has increasingly come to reflect President Erdogan’s unorthodox view that “interest is the cause, inflation is the result,” with the central bank reducing its cash rate from 19% to 14% last quarter as inflation rose from 19.6% to 36.1% between September and year-end 2021.

The CBRT indicated in its December monetary policy decision that it would be unlikely to cut interest rates further in the short-term, although statements from President Erdogan and Finance Minister Nureddin Nebati also made clear in December that the unorthodox approach to interest rates and inflation is an integral part of the government’s new economic strategy.

That seeks to use low interest rates in order to help the economy grow through “investment, employment, production, exports and current account surplus,” although the strategy has done little to assuage analysts’ and economists’ bearish views on the outlook for the Lira.

“We cannot forecast levels for USDTRY with a high degree of confidence at this point but at current levels of around 13.40 we think USDTRY risk remains weighted towards the upside,” Credit Suisse’s Merovach and colleagues wrote in a Tuesday market commentary.