Berenberg Raises DKNG Share Price Target

- Written by: Sam Coventry

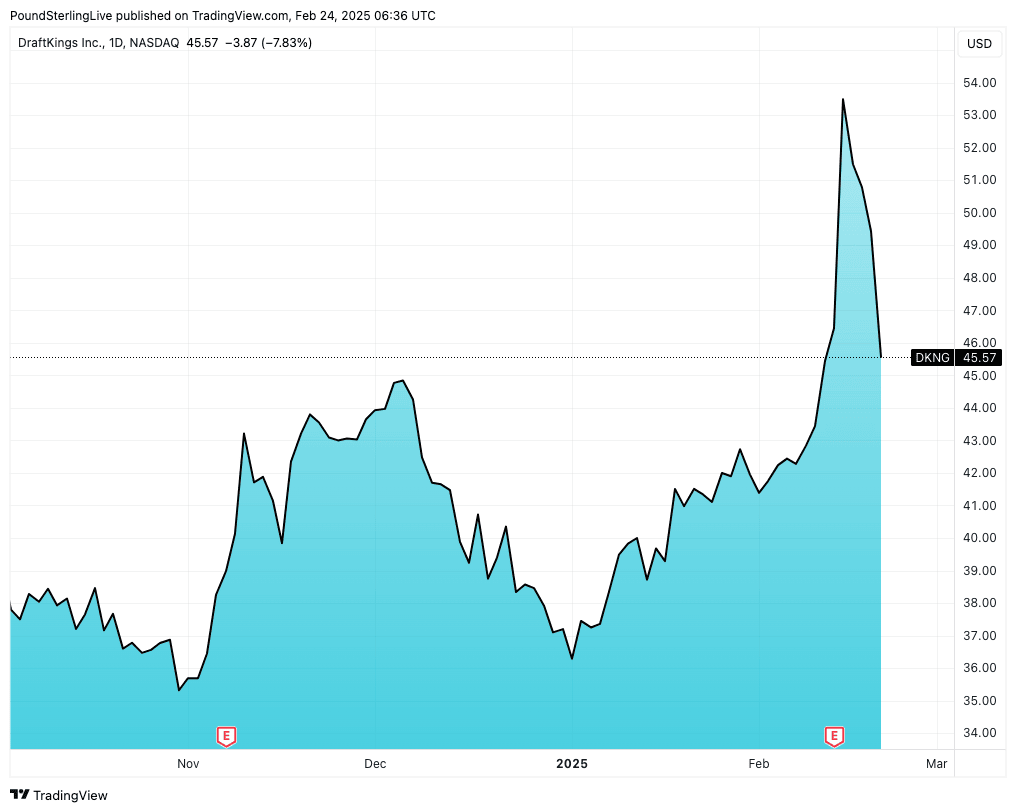

Above: DKNG share price at daily intervals.

Equity market analysts at Berenberg raise their target for DraftKings Inc (NASDQAQ: DKNG) following the release of results that suggest "a more resilient performance in the business."

DraftKings' shares jumped 15% after the fourth-quarter FY24 results on February 14, which showed a solid finish to the year and a strong start to FY25. While Berenberg maintained its "Hold" rating, it highlighted better-than-expected profitability and improved mid-term outlook as key drivers for the revised target.

Despite facing some headwinds, including unfavourable sports outcomes in FY24, DraftKings reported Q4 revenue of $1.39 billion, aligning with consensus expectations. The company delivered 30% year-over-year revenue growth to $4.77 billion for the full year, with adjusted EBITDA of $181 million, surpassing Berenberg’s prior estimate of $121 million.

Berenberg noted that FY25 guidance was reaffirmed, with EBITDA expected to be between $900 million and $1 billion. However, the bank highlighted that current trading trends suggest upside potential, particularly with positive quarter-to-date sports outcomes and stronger live betting revenue.

"Sports betting continues to grow in the US as more and more states legalise it. DraftKings is at the forefront of that, and one of the most trusted sportsbooks out there. These results are no surprise to anybody in the industry," says James Swann-Philips, Editor-in-Chief of sports betting expert site FIRST.com.

The analysts also pointed to enhanced disclosures from DraftKings, which suggest further long-term gains. They identified two key drivers for their FY26 and FY27 estimate revisions:

Expanding sportsbook hold rates as promotional spending declines and ongoing momentum in iGaming revenue.

Despite the improved outlook, Berenberg maintains a cautious stance, emphasising that while DraftKings has shown improved profitability and free cash flow, risks such as regulatory uncertainty and market saturation remain.

DraftKings' new price target of $53 is now in line with the stock’s current levels, implying a limited immediate upside. As a result, Berenberg reiterated its "Hold" rating, reflecting a balanced risk-reward profile.

The market response has been positive, with investors welcoming the company’s ability to sustain profitability despite external pressures. However, analysts will closely watch the company’s performance in the coming quarters, particularly as it navigates state-level expansion efforts, including the upcoming launch in Missouri.