DAX Forecast: Eurozone Inflation Surprise Spells Test of Lower Levels says City Index's Razaqzada

- Written by: Fawad Razaqzada, Analyst at City Index

Image © Adobe Stock

DAX Forecast: Hotter than expected Eurozone CPI inflation is bad news for stock markets says City Index's Fawad Razaqzada and his latest analysis of the DAX's charts leads him to spy a potential test of 15k.

Following the release of hotter-than-expected inflation figures from Germany and Spain earlier this week, the market had already revised its expectations higher about the Eurozone CPI as a whole, which explains why the major Eurozone indices had already been struggling this week.

Lo and behold, Eurozone CPI came in hotter than expected this morning, but as expectations were already boosted by those CPI figures from Germany and Spain, the euro hardly reacted.

Stock market investors found no reason to cheer the data by bidding up the indices, which meant that the likes of the DAX showed an immediate negative reaction to the numbers, before bouncing off their lows by the mid-morning session.

Sentiment was actually already downbeat before the CPI data was released with the major European stock indices falling sharply at the open.

The DAX was already down over 1% shortly after the bell and similar losses were seen for other eurozone indices, and for US index futures.

It was a weak handover from Asia where Chinese equities gave back a chunk of their impressive gains made the day before on the back of strong PMI data.

Eurozone CPI: For stock markets, This is Bad News

Well, the headline inflation figure actually decreased to 8.5% from 8.6% year-over-year rate in the previous month. Even so, this was not as big a drop as 8.3% expected.

More to the point, core inflation rose to a fresh record high of 5.6%, in a surprise move.

The latter was expected to have risen to 5.3%, from last month’s 5.2% reading, which was also revised up to 5.3%, as it turned out.

This should mean that the European Central Bank has no reason to stop hiking.

For stock markets, this is bad news, as higher interest rates for longer, in theory anyway, should weigh on economic activity.

There’s still some hope that inflation will weaken more aggressively moving forward, though. Above all, due to base effects. Indeed, the March CPI should be much weaker as the big jump from March 2022 falls out of the year-on-year comparison.

But this doesn't mean inflation will quickly return to target as food and services inflation remain rather sticky.

Bulls Have Even More Reason to be Cautious

Today’s stronger CPI data from the Eurozone is certainly not good news for those hoping that inflation would drop quickly.

Outside of Europe, we also had signs of sticky inflation in the US last week, with the Fed’s favourite measure of inflation – the Core PCE Price Index – coming in higher than anticipated.

That – as well as some other above-forecast economic indicators – helped to raise market expectations about US interest rates. As a result, US 10-year Treasury yields crossed 4.00% on Wednesday for the first time since November. They have gone a bit further higher today.

Rising bond yields have come back to haunt investors on Wall Street.

Having outperformed Wall Street, Europe’s top indices were always going to stop rising at some point without the participation of US markets. But now, the bulls have even more reason (hot Eurozone CPI) to be cautious.

DAX Index at Risk of Going Lower

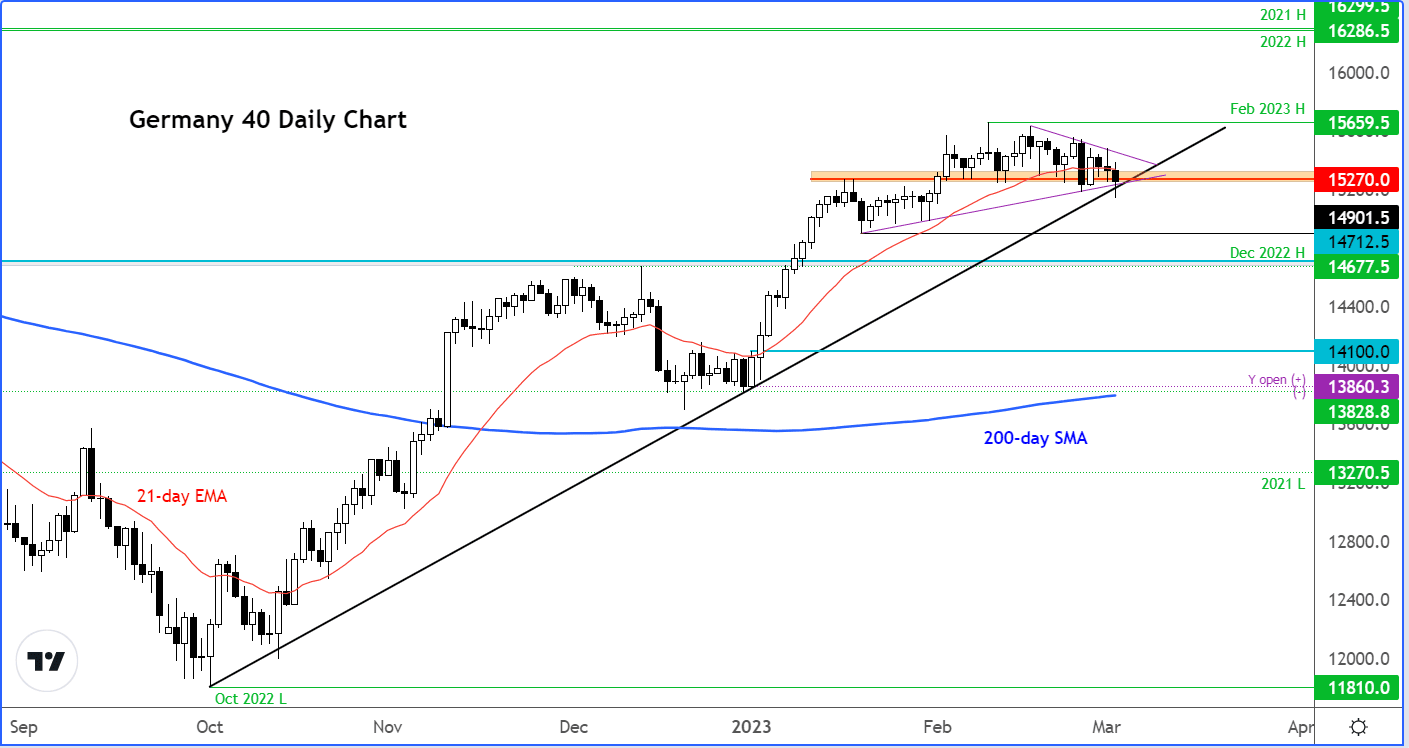

Following the CPI release, the DAX peaked below the bullish trend line that has been in place since the market bottomed in October (black line on the chart), before bouncing off the lows.

The German index had also fallen below the support trend of its triangle pattern (purple line), and below support at 15270.

Image courtesy of City Index.

Given that there has not been an immediate follow-through to the downside, it may be best to wait how the market performs later when US investors come to the fray.

So, it is all about whether the index will now hold below those levels on a closing basis, with 15270 being key. If it does, then it would confirm the bearish reversal.

Should that happen, the DAX could drop towards 15K next, possibly much lower in the days ahead.

However, if the bulls step back in and reclaim the above-mentioned levels on a closing basis, then this would keep the bull trend intact – at least for a little longer.

All told, the risks appear to be skewed to the downside for the DAX, both from a technical point of view and because of macro reasons.

Fawad Razaqzada is an analyst at City Index.