ECB March Event: Decisions, Analysis and Reactions of the Euro

The European Central Bank dropped some key wording regarding the future of monetary policy and in doing so sent the Euro higher. But, gains were ultimately forfeited as inflation forecasts for 2019 were revised lower.

© European Central Bank, reproduced under CC licensing

Watch the press conference here:

Market Rates at Time of Most Recent Update:

Pound-to-Euro exchange rate: 1 GBP = 1.1221 EUR

Euro-to-Pound exchange rate: 1 EUR = 0.8912 GBP

Euro-to-Dollar exchange rate: 1 EUR = 1.2316 USD

Monetary Policy Decision Outcome

The Euro rose against the majority of its competitors after the release of the decision of the March policy decision document in which a language change saw the ECB drop notice of its willingness to extend its quanitative easing programme if needed.

"This is one-step forward towards the end of asset purchases. Normalisation on track is supportive for EUR," says analyst Viraj Patel with ING Bank N.V. in London.

This outcome goes against expectations as our pre-ECB coverage noted strategists to be expecting the Euro to slip as the ECB opted to maintain previous language in light of recent events in Italy and emerging global trade tensions.

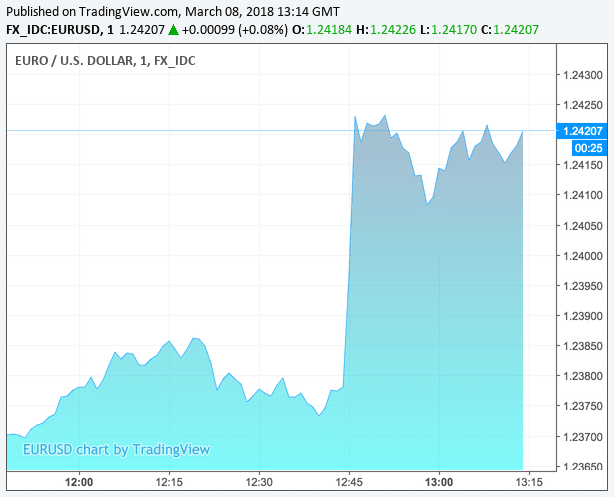

"With only about 1/3 of analysts looking for a change in language today, this was taken as a hawkish surprise. EURUSD popped about half a cent higher, and is currently trading around 1.2420," says Jacqui Douglas, Chief European Macro Strategist with TD Securities.

Above: The Euro pops higher against the Dollar in the wake of the release

Specifically, this is the phrase that has gone missing:

"If outlook becomes less favourable, or financial conditions become inconsistent with further progress towards sustained adjustment in path of inflation, the Governing Council stands ready to increase the asset purchases in terms of size and/or duration."

"The dropping of the QE bias is a surprise to us, but we do not judge that it has major implications for the speed of the ECB’s exit compared to our current base line scenario. In June, we think the ECB will set out a clear roadmap for the end of its asset purchase programme," says Nick Kounis, an economist with ABN Amro.

"This is, in our view, an important first step towards the exit of unconventional policies, and increases the probability that the asset purchases will be finalised in September," says Kjersti Haugland at DNB Bank ASA.

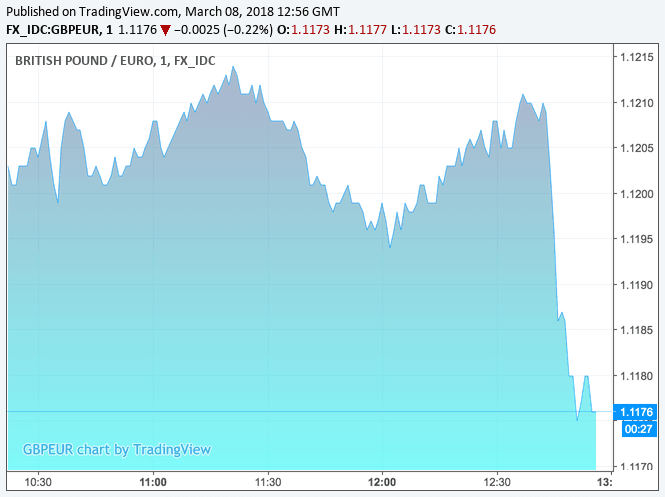

Above: Sterling slipped against the Euro in the wake of the release of the ECB's policy decision.

The Statement and Press Conference

The ECB gave the Euro further impetus when appearing before journalists and delivering more details on the ECB's thinking and latest growth and inflation expectations.

Of note, the ECB sees 2018 GDP growth up at 2.4%, this is an upgrade from a previous forecast for 2.3%. "Growth in the euro area is projected to expand in the near term at a faster pace than expected," says Draghi.

2019 growth is still forecast at 1.9%.

Draghi says strong momentum could lead to positive growth surprises, but downside risks relate to global factors and FX markets.

Further exuberance was contained by the view that underlying inflation remains subdued and has yet to show convincing signs of a sustained upward trend.

The ECB kept its inflation forecasts for 2018 at 1.4% but revised down its projection for inflation in 2019 slightly to 1.4% from 1.5% previously. Inflation is still forecast at 1.7% in 2020.

This is probably the most bearish element of the event for the Euro.

"It is not surprising then that the Governing Council is retaining the option to extend the current EUR30bn per month asset purchase program beyond September 2018 until 'a sustained adjustment in the path of inflation consistent with its inflation aim' is seen. To reinforce this point, President Draghi emphasised bluntly in the Q&A that policy setting would remain reactive not forward looking," says Elliot Clark with Westpac.

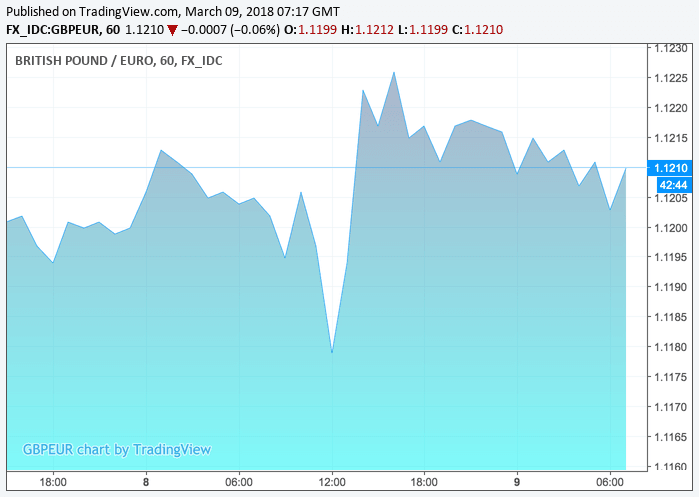

Above: The hourly chart shows the Pound made a solid comeback against the Euro ahead of the weekend on the inflation forecast downgrade.

"Given the appreciation of the Euro over the past year or so, which has taken the effective exchange rate almost back to where it was in 2014, policymakers may feel that changes in tone and policy should be gradual so as not to spark much further appreciation," says Andrew Grantham at CIBC.

CIBC see the Euro only slightly stronger than current levels by the end of this year, before moving back into the low 1.30's against the US$ in 2019 as the ECB finally joins other developed economies in raising interest rates.

Speaking on the risks to the outlook, remaining downside risks were said to relate to "global factors, including rising protectionism and developments in foreign exchange and other financial markets".

On the new risk of "rising protectionism", President Draghi went further in the Q&A, opining "If you put tariffs against what are your allies, one wonders who the enemies are"; that the Council "are convinced that disputes should be discussed and resolved in a multilateral framework"; "and [that] unilateral decisions are dangerous".

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Analyst views ahead of the event:

"Most scenarios favour moderate downside risks for EURUSD. Those should remain contained, however, and dip buyers should emerge. A particularly hawkish Draghi could send spot to new highs for this cycle above 1.2555." - Jacqui Douglas, Chief European Macro Strategist at TD Securities.

"At today’s ECB meeting the most important signal we will be watching is that the overall path towards policy normalisation remain intact. So long as this is the case, we would remain buyers of EUR/USD on dips. The flow “normalisation” story has more to run." - George Saravelos, Strategist at Deutsche Bank.

"In the face of rising trade tensions, we think it is more likely the ECB will defer any major changes to its communication and will instead continue to preach ‘patience’." - Robin Wilkin, Global Cross Asset Strategy at Lloyds Bank.

"The euro and European financial markets have hardly been impacted by the heightened political instability in Italy. The ECB is conscious that the euro has become more sensitive to potential changes in their forward guidance. It should leave the ECB very cautious over making changes to their forward guidance at today’s policy meeting... If they decide to tweak their forward guidance today, it would increase the risk of EUR/USD breaking above the 1.2500-level, which has held as a line in the sand since their last policy meeting." - Lee Hardman, Currency Analyst at MUFG.

"If we get radio silence and the straightest of straight bats from Mr Draghi today, will that disappoint euro bulls looking for a more hawkish tone? EUR/USD faces resistance at 1.2440 and support at 1.2290 and that might be today's range. If we're still here after NFP tomorrow, I think we'll have built the foundations for a push through 1.2550 and the next leg up in the weeks ahead. As was the case in Q4, the correction has been shallower than expected." - Kit Juckes at Société Générale.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.