Strong January Sets Pound Sterling up for a Year of Gains Against the Dollar and Euro

Above: Mark Carney reminds us that what the Bank of England does to interest rates in 2018 will be key to Sterling direction. (C) Bank of England.

The British Pound enjoyed a strong January, and this is significant in that history tells us that it bodes well for the remainder of the year.

Analysts at Investec - the global investment bank - have advised they are now minded to raise forecasts for Sterling noting - amongst a number of reasons - that January is typically a good precursor to subsequent moves in the Pound over the remainder of the year.

If we look at January performances we see Sterling has indeed had a good January having risen against all of the world's top 20 currencies.

Above: Sterling advances against the G10 (C) Pound Sterling Live.

Included is a near 5% jump against the US Dollar, 3% jump against the Canadian Dollar, 2.5% gain again the Australian Dollar and a 1.84% gain against the Euro.

"Do January moves in the Pound tend to presage trends over the rest of the year? The answer is yes," say Investec.

The trend noted in the above graphic appears to be more applicable to the GBP/USD exchange rate but we note a rising GBP/USD typically drags along other Sterling exchange rates.

There is however a warning that politics could stifle this trend and 2018 will likely have more politically-based risks to navigate than has been the case in the past:

"But while we agree that sterling’s level still prices in generous Brexit related downside risks, we are still wary of possible hitches in UK/EU talks. Also the Tories’ problems are not over and we expect investors to consider carefully the implications of a possible Corbyn-led government. Sterling is not a one way bet."

Nevertheless, forecast targets for Sterling are likely to be raised.

"At $1.41 and 88p vs the Euro, Sterling has either already crashed through or come very close to our end-2018 targets. Our medium-term currency forecasts are now under review," say Investec in a monthly FX forecast update, referencing their year-end targets for GBP/USD and EUR/GBP respectively.

(0.88p in EUR/GBP gives us 1.1363 in GBP/EUR).

Momentum Rests with the Pound

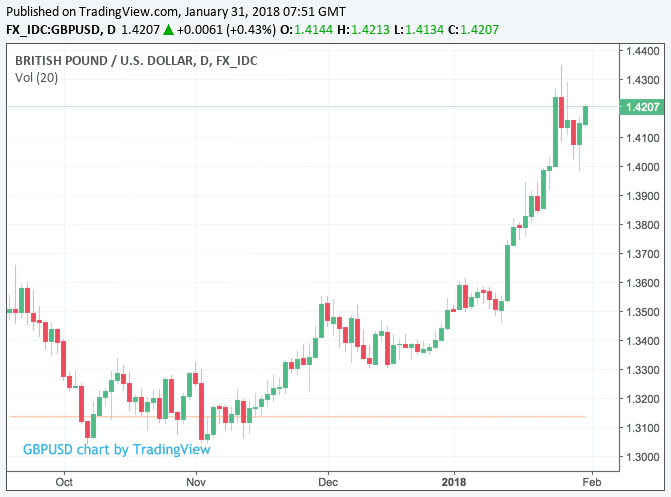

The gains for Sterling in January have however faded at the start of the new month with the currency falling back from its recent highs against both the Dollar and Euro, there were growing concerns at the start of the week - amongst those hoping for a stronger Pound - that perhaps the uptrend had run its course.

However, Sterling currently enjoys solid momentum against the Dollar and the multi-week outlook for GBP/USD remains constructive:

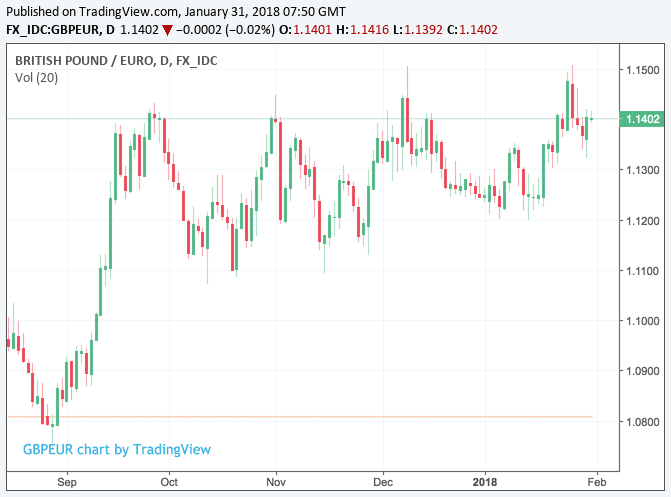

Against the Euro, the trend higher is less aggressive, but we are seeing a gentle rise starting to establish, despite the existence of solid resistance in the 1.1510 area:

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Bank of England Could be a Supportive Influence Behind the Pound this Year

Pound Sterling was supported heading into the end of January, thanks largely to strong trend momentum and a little help from the Bank of England's Mark Carney.

Bank of England policy was in focus late Tuesday when the Governor of the Bank of England Mark Carney told lawmakers in the UK's upper house that the Bank stood ready to fight stubbornly high inflation over the course of the next year.

“The important thing with policy now ... is that as ... slack in the economy has been taken out, we move into a more conventional area for monetary policy, where the focus is increasingly on returning inflation sustainably to target over an appropriate horizon,” said Carney.

The subtext is that this challenge to inflation would come in the form of more interest rate rises; and rising interest rates are typically associated with a stronger Pound.

"The BoE sees reduced risks of monetary tightening derailing the economic expansion and therefore a decision to raise rates is more easily made if there is any further evidence of an inflation slippage from target," says Derek Halpenny at MUFG. "So his comments were pretty clear to us – the risks are piling up that the BoE will be much more active than implied by current market pricing."

The Governor saw inflation staying above the Bank's 2.0% remit, in part due to rising wages.

“The labour market has continued to tighten. We see it in a gradual firming of wages,” said Carney.

The Pound-to-Euro exchange rate has since recovered back above 1.14 while the Pound-to-Dollar exchange rate is trading up at 1.42 having been sub-1.40 in the previous 24 hours.

"Constructive comments by BoE Governor Carney underpinned GBP and UK interest rate futures. Carney noted that a 'disorderly Brexit looks less likely than before'. Carney added the firming of UK labour market and pick‑up in wages over the next few years appears to be on track," says Elias Haddad with global investment bank, CBA.

"Our house view is for the next rate hike in Aug 2018. There is now some risks that BoE could potentially move earlier than our expectations, which is already considered hawkish amongst consensus," says Winson Phoon with Maybank. Maybank maintain they like buying the Pound on any dips against the US Dollar as a strategy.

However, there is a word of caution that politics might impact on Sterling, and those with an interest in the currency should be prepared for volatility, particularly as Brexit negotiations are set to commence once more.

"While we are bullish on the outlook of GBP, we had cautioned that the impressive rally so far faces a reality check - lack of agreement or clarity on transition agreement may dampen markets’ enthusiasm on soft Brexit and renewed fears of disorderly Brexit will pose downside risks to GBP," says Saktiandi Supaat, Phoon's colleague at Maybank.

Sterling's Uptrend Intact as Manufacturing PMI show UK Exports Strengthen the Most in Four Years

Pound Sterling appeared to shrug off a surprise fall in the IHS Markit manufacturing PMI data on Thursday, when it clung to earlier gains over the Dollar, Euro and broader G10 basket.

January’s IHS Markit survey showed the manufacturing index slipping to 55.3, down from 56.2 in December and below the consensus expectation of economists for an increase to 56.5.

However, Sterling's reaction confirms the obvious - the manufacturing sector continues to expand at a solid pace and will continue to provide support to the economy.

Nevertheless, the result marks the second consecutive month of decline for the index, taking it back to a level last seen in June 2017, although it still remains substantially above its long term average of 51.7.

"The detail of the report showed that most of the decline in the headline PMI resulted from a moderation in the pace of current output and new orders. Still, with the flow of new orders continuing to come through at a healthy rate, firms registered an improvement in prospects for future activity. Accordingly, manufacturing firms continued to hire additional workers – the pace of which picked up over the month," says Nikesh Sawjani, UK Economist with Lloyds Bank's Commercial Banking unit.

The IHS Markit PMI is a survey that measures changes in business conditions in the manufacturing industry from month to month. It asks respondents to rate current conditions across a range of areas including employment, production, new orders, prices, supplier deliveries and inventories.

“Manufacturing output continued to rise at a solid pace, although the rate of expansion eased to a six-month low...Sector data signalled solid increases in output and new orders across the consumer, intermediate and investment goods sectors,” IHS Markit say, on releasing their findings.

There is however undeniably good news to be found in findings that the recent trend of rising export orders gained further momentum during January, which is good news for the Pound, with foreign demand rising at its fastest pace for over four years.

Much of this increased demand came from North America, China, Europe and the Middle East.

"The fall in the UK manufacturing PMI in January suggests that growth has slowed a little at the start of the year. But the big picture is that the sector is still performing well by recent standards," says Ruth Gregory, an economist at Capital Economics.

The Pound was quoted broadly higher ahead of and after the release, with gains spanning the breadth of the G10 basket.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.