Pound is Vulnerable to Euro and Dollar, Despite Strong Data, as Charts Point to Short-term Weakness

Sterling may have gained a small respite from stronger UK economic data but this probably won't be enough to overcome an increasingly ugly chart.

The Pound has made a temporary recovery after better-than-expected public accounts data showed the UK government did not need to borrow as much as analysts had expected in November.

This was partly due to stronger than expected tax revenue, which is a positive sign for the economy, but it was also as a result of changes to the way some debt is categorised.

The reclassification of housing association debt for example, from public to private, saved the exchequer 0.3bn.

Furthermore, a one-off increase in revenue due to changes in the way taxes on are collected helped lower public borrowing in the first quarter last year but will not be repeated in 2018.

Yet despite these one-off influences, the data is indicative of positive continued resilience of the economy according to Ruth Gregory, a UK economist at Capital Economics.

"If we are right in thinking that the OBR is too gloomy about the prospects for GDP growth, then borrowing should come down at a faster rate than it expects further ahead," she says in response to the data.

The slight pick-up in the Pound as a consequence marks a recovery from its recent fairly steep slide, even if this is only temporary.

Against the Euro, the recovery has coincided with what technical analysts call a "throwback" move (see below). This is a temporary relief rally following a break below a key chart level.

On GBP/EUR, the throwback occurred just after the pair broke down through the key 1.1270-80 level (labelled "neckline") and penetrated to a new December low of 1.1249.

The throwback recovery has lifted the exchange rate back up to 1.1290 but this short-term move is not expected to last.

Above: Chart showing Pound-to-Euro at four-hourly intervals.

Moreover, on the four hour chart of GBP/EUR (above), there is a bearish topping pattern forming, called a head and shoulders (H&S), which is composed of three peaks, the centre one of which (the head) is taller than the two adjacent peaks (the shoulders).

H&S patterns are reliable harbingers of downside so the occurrence of such a pattern on GBP/EUR suggests a propensity for further weakness.

The confirmatory signal for a H&S is a break below the level of the lows between the three peaks, called the "neckline". As can be seen on the diagram of the chart of GBP/EUR, this confirmatory signal has already been given.

A move below the 1.1249 low would confirm a continuation down to a target generated by the H&S, which is based on its current height extrapolated lower.

This suggests downside penetration to around 1.1140, where a major trendline is situated. Thus, we think the downtrend should resume again with a similar vigour as it did before.

The Bigger Picture

Looking at the daily chart we can see that, despite the bearish H&S pattern on the four-hour chart, the bigger picture shows a sideways moving market that is stuck between a ceiling at 1.1450 and a floor at roughly 1.1100.

Above: Pound-to-Euro shown at Daily intervals.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Sideways patterns like the one forming on GBP/EUR are usually composed of a minimum of five constituent waves (oscillations), which we have labelled a-e.

It appears a potentially terminal wave ‘e’ is currently forming, as the exchange rate breaks lower in line with the H&S on the four-hour chart. After 'e' completes, however, what then?

We see a greater probability of an eventual break higher from the current range. This is partly because the trend prior to its formation of the range was bullish and this predisposes the pattern to a continuation however, the look-and-feel of the chart also seems to suggest more upside.

Ultimately, we would wish to see a break above the top of the range at 1.1450 for confirmation.

Analysis of Euro-to-Pound

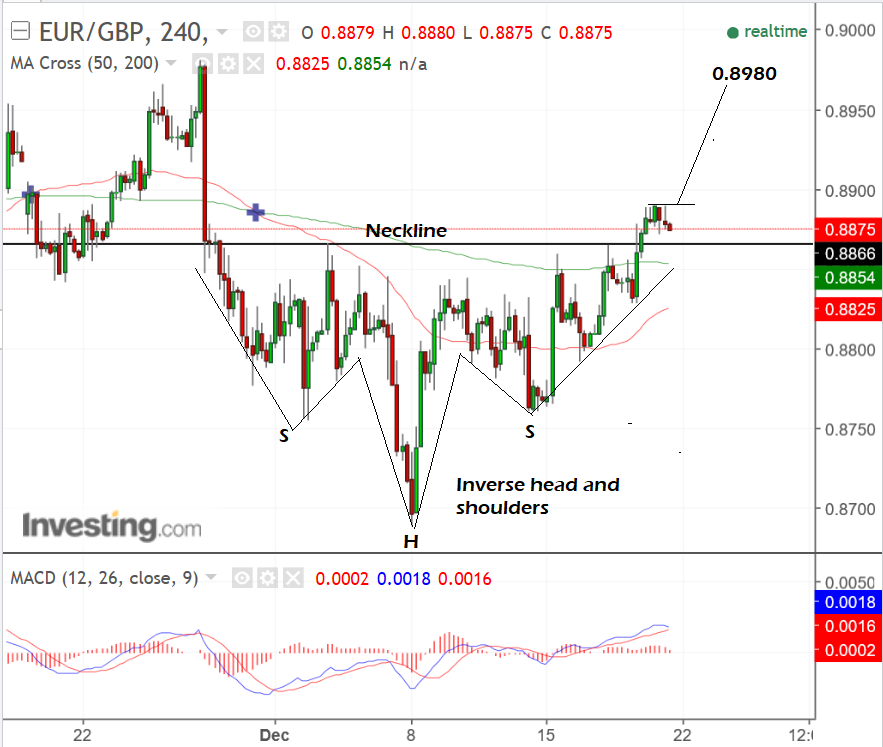

For the EUR/GBP charts, the same analysis holds except in reverse - thus instead of a H&S topping pattern we have an inverse H&S bottoming pattern forming at the lows of EUR/GBP.

Again, instead of the throwback in the midst of a downtrend, this has taken place in the midst of an uptrend, which is forecast to resume shortly. This should take the exchange rate back up to an eventual target of 0.8980.

Above: Chart showing EUR/GBP at four-hourly intervals.

Other analysts also see the Euro climbing higher versus the Pound.

Karen Jones, a technical analyst at Commerzbank, says Sterling is vulnerable in the short-term and notes how EUR/GBP is approaching a key level at 0.8898.

A break above "should be enough to trigger a move to the 0.9034 October high."

Above: Commerzbank Research chart showing EUR/GBP technical analysis.

Robin Wilkin, a cross-asset strategist at Lloyds Banking Group, says he has increased "conviction" of "a move towards the 0.8950-0.9025 range highs."

"Daily momentum is positive and has room to extend... It would take a decline back through 0.8850 and then 0.8750 to suggest we could see a re-test of lower supports around 0.8690."

Sterling to Drift Higher in 2018, Say Strategists

The longer-term fundamental analysis also supports the technical view that the Pound will eventually break higher from its sideways range between 1.1100 and 1.1450.

Recent forecasts from BMO Capital Markets highlight expectations there will be a drift higher in the Pound, as the Brexit game of chess reaches its inevitable endgame of a 'soft' Brexit.

This would avoid a “cliff-edge” that many have said would be a catastrophe and is only favoured in parliament by a minority of MPs.

GBP/USD should trade at 1.36 in 3 months time, 1.40 in 6 months time and 1.45 in 12 months, partly due to a weaker Dollar, according to Stephen Gallo, Bank of Montreal’s European Head of FX Strategy.

"In combination with a weak USD, we think 2018 will pave the way for the ‘softest’ of all possible Brexits and a 1-2-year transition due to 1) complications over the Irish border and 2) the pressing need for PM May’s minority government to avoid a snap election."

"We believe that the GBP will start to respond to a number of fundamentals in 2018 which suggest that the currency is still quite cheap."

"In EURGBP, our preference would be to sell rallies and we look for GBP rebound to the 0.8600 area in 9 months."

The reasonably strong performance of the economy in 2017 and the acceleration in global growth are factors in favour of a stronger Pound.

Gallo says the market is too negative about the possibility of the Bank of England (BOE) raising rates in mid-2018 and this could provide a tailwind for Sterling.

This view chimes with that of ING Group, which has forecast a modest recovery for the Pound, as possible based on an overly pessimistic assessment of Brexit and the economy.

If Brexit talks break new ground and investors see a more optimistic future, it could ease the restraints on the BOE, who might then be more likely to raise interest rates again.

Higher interest rates would be positive for Sterling as they would attract more foreign capital flows, drawn by the higher return on offer.

"We sniff an opportunity right now for a positive GBP re-rating were we to see further Brexit progress," says Viraj Patel, an FX strategist at ING.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.