Traders Most Bullish on Pound Sterling Since 2015 but Euro Still the Darling of the Bulls

Data revealing how the world’s currency traders are positioned on various currencies shows sentiment towards Pound Sterling continues to improve.

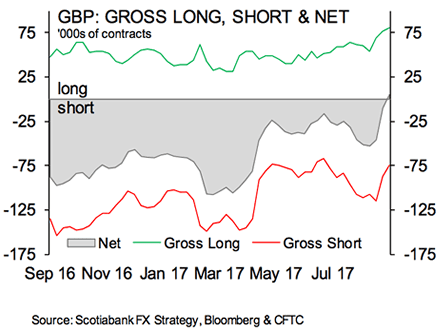

In fact, the latest data from the US Commodity Futures Trading Commission shows the Pound now enjoys a ‘net long’ position for the first time since 2015.

A ‘net long’ means there now exist more contracts that are betting on further gains than there are contracts betting on declines.

GBP positioning has pushed into bullish territory ($0.4bn net long) for the first time since late 2015 following this week’s $1.3bn swing according to the data which is the most expansive set of sentiment and positioning data available.

“The improvement in sentiment was driven by a combination of short covering and building longs. Gross longs are at their highest level since late 2014. Gross shorts are dropping toward the lower end of their multi-year range,” says Shaun Osborne, a foreign exchange analyst with Scotiabank.

Improved sentiment was expressed on currency markets with September seeing the Pound make its largest gain since 2015 amidst stable sentiment regarding Brexit and signs the Bank of England are looking to raise interest rates as soon as November.

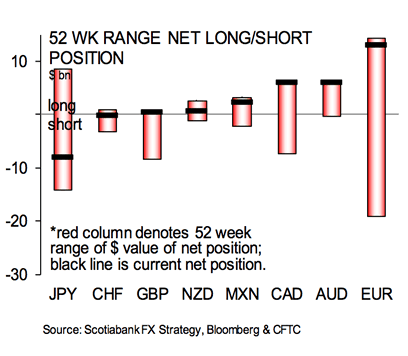

However, the Euro remains favoured by investors with the net long Euro position seen recovering a good portion of the prior two weeks’ decline on the back of a sizeable ($5.0bn) liquidation of gross shorts.

The $13.0bn net long is just shy of the $14.3bn record from early September.

The Pound-to-Euro exchange rate had been in the ascendency with an advance from sub-1.08 to a high just north of 1.14 being recorded in September.

The pair has however capped out and we reckon this coincides with traders starting to rebuild positions that anticipate further Euro strength. It also reminds us that Sterling will struggle to find meaningful headway against the Euro in such an environment.

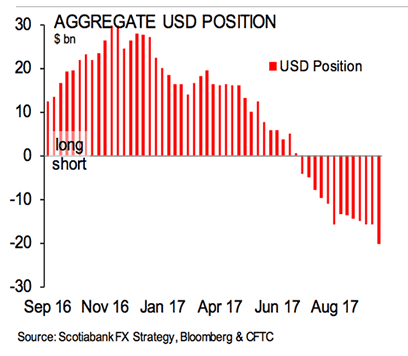

What we find of particular interest is that the US Dollar has actually seen a deterioration in positioning with the USD short bet widening to a fresh multi-year low of

$20.3bn — its widest since October 2012.

The data is a little delayed so we would expect the next tranche of figures from the CFTC to reflect an improvement in sentiment that reflects the Dollar’s recent recovery against the Pound and Euro.

That the Dollar is held net short - at record levels - could in itself explains the Dollar’s recent recovery.

Often when positioning reaches extremes the prospect of a sudden and sharp reversal grows as 1) there are no longer the volumes of new entrants available to the market to push the trend and 2) any reversals can trigger elevated numbers of stop-loss orders ensuring profits are booked and Dollars are purchased to close out trades.

With positioning at extended levels the move could well extend over coming days and even weeks so this recent turnaround in the Dollar's fortunes could have further to run.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.