Morgan Stanley Looking to Sell Pound Sterling vs the Euro

- Written by: James Skinner

This is as good as it gets for the British Pound say strategists at Morgan Stanley as they look to buy dips in the EUR/GBP exchange rate.

Strategists at American investment bank Morgan Stanley have added the Pound to their “sell list” and are watching for opportunities to go long the EUR/GBP pair.

The trading strategy rests on the view held by researchers that the Pound's recent run higher against the Euro is at risk of stalling and reversing.

The Pound has rallied as markets prepare for the Bank of England to hike rates for the first time in ten years in November and amid tentative signs of progress in Brexit negotiations between the UK and the European Union.

Analysts at Morgan Stanley believe there is a strong relationship between expectations for future interest rate policy at the Bank of England and the value of the Pound - as expectations for future rate rises increase, so the value of the Pound increases.

But, this area of support for Sterling appears to have peaked.

"The AUD and GBP rate curves appear to be overpriced for next year or have reached limits, without a significant pick-up in economic data," says Morgan Stanley strategist Hans Rediker. "Both these currencies are added to our sell list."

Redeker says bond markets have already priced in two full rate hikes from the Bank of England between November and the end of 2018, which means further BoE-related upside for the Pound could be limited over the coming months. Meanwhile, risks are building.

“We think the risk/reward of being long GBP is not attractive and prefer selling into rallies,” Redeker adds in a note dated September 29. “The Conservative Party Conference in the coming week (begins at weekend) also poses a risk event, where signs of a split within the Tory Party may weigh on GBP as it raises concerns about PM May's leadership.”

At a joint press conference Thursday, UK Brexit secretary David Davis and EU negotiator Michel Barnier claimed to have made progress toward agreeing some of the key issues on the table in the so called divorce talks, although more work is needed.

The positioning of foreign exchange traders also suggests to Morgan Stanley that the Pound's rally higher might be reaching a limit.

“CFTC data shows that GBP speculative short positioning is now the smallest since November 2015, with leveraged funds having covered almost all their shorts,” says Redeker.

This suggests that were markets to turn negative on Sterling once more there will be no more constraints to such a move as the market has the capacity to entertain a big move by the trading community into selling Sterling.

Of course - there are also no constraints for traders to buy the Pound, but Redeker clearly believes the risks are biased to the former.

If the UK government gives enough ground to EU negotiators in Brussels then it is possible that talks will progress on to the subject of the future trading relationship between the UK and the EU, which would be positive for Sterling.

However, the UK is set to leave the EU in March 2019 and the clock is ticking so, in the absence of further progress in imminent future, those speculators referenced by Redeker could soon begin to rebuild their short positions against the Pound.

“As the market volatility in US yields and EURUSD settles down, we will be looking for opportunities to buy EUR/GBP again,” says Redeker.

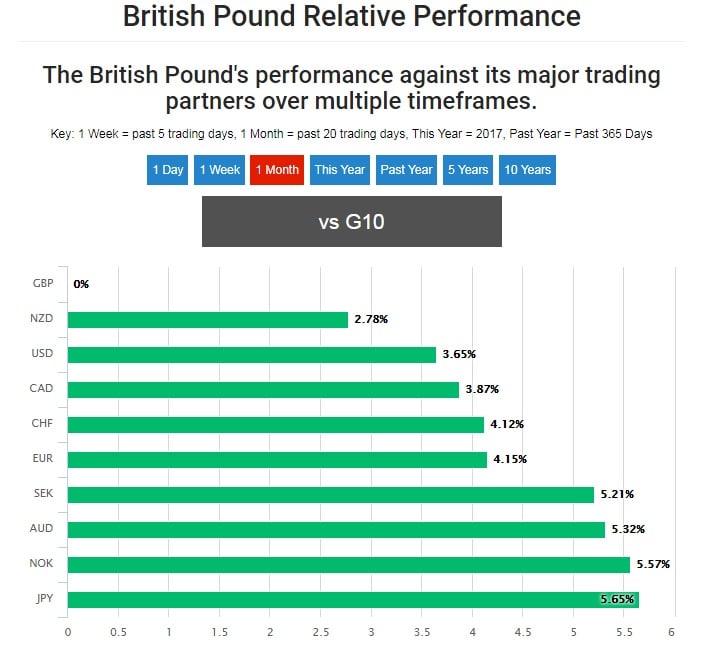

The Pound-to-Euro exchange rate rate is quoted at 1.1333 around noon in London Friday, down 0.58% on the day, although it has risen by 4.98% during September.

This move have largely reversed the near-7% year to date loss that was previously carried by the currency pair.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.