Demand for Pound Sterling Might be Peaking Suggests Citi Client Data

Data from the world's largest foreign exchange dealer suggests investor demand for the British Pound might be nearing a peak.

Data from Citi shows demand for the British Pound amongst traders and corporates might be about to peak.

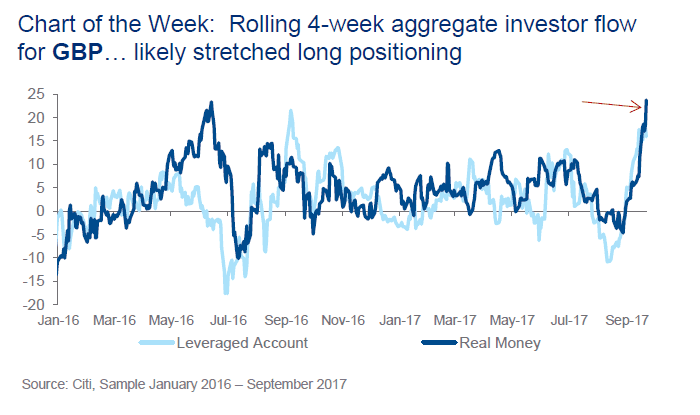

Following a brief period of selling in August, Citi's flows show that investors have bought Sterling at their strongest pace since last year as sentiment towards the UK currency improves following signs the Bank of England is to raise interest rates in November.

The data from the world's largest foreign exchange dealer echoes the findings of the most widely-watched data on trader sentiment; that provided by the US Commodity Futures Trading Commission.

The most recent data from the CFTC shows traders have recently turned the most positive (or least negative) on Sterling since 2015.

However, Citi believe a turning point in demand for Sterling might be nearing.

"While investors have been net GBP buyers in most periods this year, the recent spike does question how much more buying there can be from these clients in the near-term," says Scott Dingman, Quantitative analyst at Citi.

The data comes from Citi's client's order flows, which on the basis of a four-week rolling aggregate shows both real-money and leveraged clients' buying interest in the Pound recently rising at an extremely steep pace:

Clients on Citi's managed-account access platform have actually already responded to the Pound as if it were overbought and "switched to bearish GBP," according to Dingman.

Positioning data is hard to translate into predictions for future moves in a currency, but generally when positioning reaches stretched levels, the trend tends to fade and potentially reverse.

"While investors have been net GBP buyers in most periods this year, the recent spike does question how much more buying there can be from these clients in the near-term. This regardless of any Brexit developments and the Carney speeches later this week," says Dingman.

Indeed, FX managers on Citi’s Managed-Account Access platform have already switched to bearish GBP.

As of last Thursday, they are short GBP at double the exposure that would typically be expected with the majority of the recent selling coming from systematic funds.

We can't say why this is the case, but we can shed light on what those 'in the know' are doing.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.