British Pound Downgraded 3-4.5% vs Euro but Upgraded vs US Dollar, Brexit Risks Seen Receding: J.P. Morgan

- Forecasts for Sterling-Euro cut by J.P. Morgan

- Warnings of a fall to parity are overblown

- Sterling-Dollar forecast raised amidst broad-based USD underperformance

- Brexit-related risks to the Pound seen diminishing.

We can report that analysts at the world’s largest investment bank have downgraded their forecasts for the Pound to Euro exchange rate in the region of 3-4.5% across various timeframes.

However, in their latest monthly currency update, J.P. Morgan say the Pound's outlook against the US Dollar is more constructive with the GBP/USD's year-end forecasts being nudged higher amidst a broader downgrade to the Dollar profile.

The Euro, which remains one of 2017’s best-performing major currency, has seen its profile raised against both the Pound and US Dollar.

Pound-Euro Pointed Lower Still

A soggy Pound, contrasted with a Euro reaping the rewards of a vastly improved economic performance will conspire to send GBP/EUR lower than J.P. Morgan had previously anticipated.

What matters for the Pound’s outlook remains a combination of economic performance and sentiment regarding Brexit with the two drivers being interchangeable in terms of importance. Whichever bears the most bad news, trumps in importance.

This is a peculiar theme we have reported on before; Sterling is subject to a negative bias at present and is in need of a game-changer to shift sentiment from poor to constructive.

“The news flow was not universally negative – the government has moved to acknowledge the need for a lengthy Brexit transition that defers any economic adjustment for a number of years beyond the formal exit in 2019 – but weak cyclical developments are taking precedence,” says Paul Meggyesi, an analyst with J.P. Morgan in London.

“In other words, the reality of a soft economy matters more for the near-term direction of the exchange rate than the expectation of a softer Brexit,” adds the analyst.

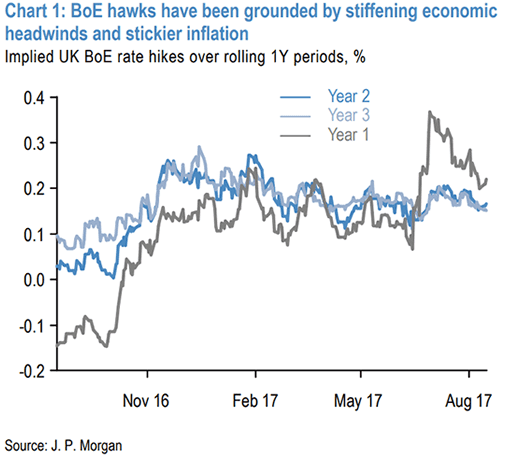

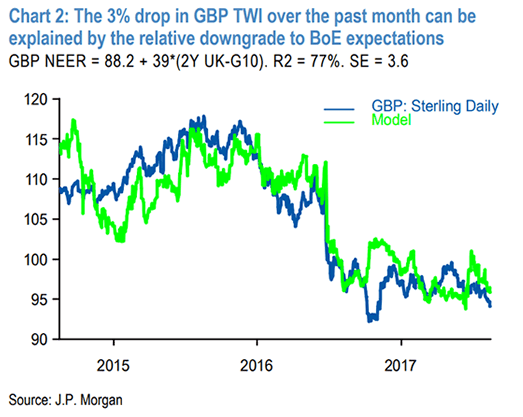

GBP is the worst performing major currency this past month as the Bank of England switched from being a central bank inclined to raise rates soon to one that has yet again kicked such a move into the distance.

And further downside is likely.

“We are downgrading the GBP forecast to reflect less favourable cyclicals (the weakest growth in G10, the reduced probability of a near-term rate hike) and also to accommodate the upward revisions to the EUR/USD forecast,” says Meggyesi.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

But, Brexit Risks Receding

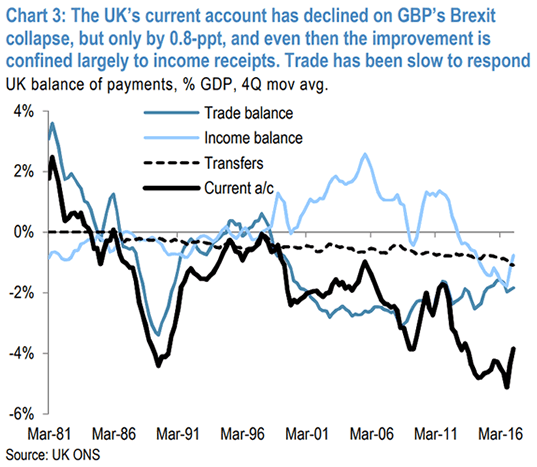

While a softer economy is liable to weigh on Sterling, the longer-term picture remains more constructive as the risks of a disruptive Brexit process are seen easing.

“The long-term risk to GBP from a disruptive Brexit has diminished as most players in the government now accept the need for a transitional deal that will ensure very little changes on the ground for a handful of years after 2019,” says Meggyesi.

But it is too early for J.P. Morgan to justify an outright recovery in GBP from depressed historic levels (the REER is 17% below its 20 Year average) owing to a lack of clarity about the long-term trading arrangements that will apply after the transition.

“The government’s position papers on this were long on aspiration and short on detail and until sufficient progress is made on settling the terms of divorce, the EU will not move on to discussing a future trade deal,” says Meggyesi.

Nevertheless, J.P. Morgan have cut the probability of a hard-Brexit defined by defaulting to WTO rules from 25% to 15%.

Forecast Changes

The net result is a lowering of Pound to Euro rate forecasts, but not as far as some of J.P. Morgan’s competitors have done recently.

“There is naturally some focus on whether EUR/GBP could reach parity but we regard that as being much too aggressive in the absence either of an outright UK recession or the failure of Brexit negotiations that heightens the risk of a disruptive Brexit in 2019,” says Meggyesi.

The bank’s end-2017 forecast for EUR/GBP is lifted from 0.89 to 0.9250 while the peak forecast is now 0.9350 vs 0.90.

(The forecast assumes a beta between EUR/GBP and EUR/USD close to the long-term average near 0.5% - the 1Y forecast for GBP/USD is 1.34).

Flipping the targets from EUR/GBP to GBP/EUR, the end-2017 forecast is cut from 1.12 to 1.08 while the lowest forecast is now 1.07 vs 1.11 previously.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

What Could go Wrong for the Euro?

So the outlook for the Euro is positive but there are of course risks to the view.

JPM’s John Normand warns the ECB could prove quite sensitive to the Euro’s trade-weighted strength, “so either delay a tapering announcement, extend the wind-down process or telegraph a very long pause between the end of QE and the first rate hike.”

A warning shot was fired by the ECB’s July policy meeting minutes which suggested some members of the governing council were concerned by the currency’s strength.

The fall in the single-currency in response suggests investor nerves; this could be a feature of the market going forward.

“Investors may anticipate such the macroeconomic effects of a strong Euro and reallocate,” says Normand.

The analyst notes equity investors already appear unnerved by currency strength, judging from how quickly cross-border flows by US accounts into Euro area stocks have collapsed.

Pound-Dollar Forecasts Lifted

But also subject to a downgrade is the US Dollar, owing to a tepid rate of inflation in the US which allows J.P. Morgan’s forecasts for the Pound to Dollar exchange rate to be raised.

“This helps push GBP targets higher to year-end 1.30 (1.29) with the 3Q18 target 1.35,” says analyst Daniel P Hui.

Reasons for downgrading the Dollar include:

1) US inflation continues to surprise to the downside – “five consecutive months, which has only occurred once previously in the past 20 years – leading to one of the flattest US money market curves so far in this Fed cycle... if US inflation might be slow to normalise and US political risk increase, an overshooting Euro can extend into year-end.” says J.P. Morgan.

2) President Trump’s approval rating has fallen further due to a variety of policy missteps, “which in turn preserve the risk of a complicated debt ceiling debate once Congress returns from summer recess in September.”

Above: A shift to extreme short positioning in the dollar has coincided with a fall in President Trump’s approval rating to record lows. President Trump’s net approval rating (percent approval minus percent disapproval) versus net long positions in the US dollar on the IMM).

3) Analyst Hui argues the next two months bring further vulnerability to the Dollar, as multiple issues come to a head:

“Congress, after returning on Sept 5th faces numerous necessary fiscal tasks. This includes raising the debt ceiling by mid-October, funding the government beyond end September, and passing a FY18 budget. Only after clearing these, can Republicans properly turn towards the task of crafting tax reform.”

US Dollar Boosted by Reports of Trump Progress on Tax

The US Dollar is however in the driving seat and dictating play on global currency markets at the time of writing as traders prepare for an upcoming meeting of central bankers in Wyoming and US President Donald Trump finally makes some progress on tax reform.

US markets and the Dollar rose with, "fresh hope of moves on US tax reform apparently providing the catalyst for gains. Warm words from Senate leader McConnell on the debt ceiling are also helping to boost confidence,” says Chris Beauchamp, an analyst with IG.

Politico reports Trump’s top aides and congressional leaders have made significant strides in shaping a tax overhaul, “moving far beyond the six-paragraph framework pushed out in July that stoked fears about their ability to deliver on one of the GOP’s top priorities.”

“There is broad consensus, according to five sources familiar with the behind-the-scenes talks, on some of the best ways to pay for cutting both the individual and corporate tax rates,” adds the report.

This will be music to the ears of Dollar-bulls.

“We are seeing a bit of a correction in the Dollar on the back of two things,” says Brent Donnelly, a spot FX trader with HSBC:

1) “Some position adjustment into Jackson Hole.”

2) “A pretty weak article on Politico. With nothing priced for tax reform I guess any

hope is better than nothing.”