Pound Forecast to Struggle Against Indian Rupee this Week

Pound Sterling remains under pressure against the Indian Rupee (INR) with markets taking a liking to the decision to appoint Dr Urjit Patel as the new governor of the Reserve Bank of India (RBI).

Patel is expected to continue the legacy of the previous governor Rajan, who put bringing inflation under control as a higher priority than stimulating growth.

In practical terms the new governor is expected, therefore, to keep base lending rates high, so as to encourage saving and control inflation, which has risen to 6.1%, which is well above the 5.0% upper target band set by the RBI.

High lending rates will keep Indian bond yields relatively high too, attracting more capital inflows with the side effect that this will increase demand for the rupee and therefore its value.

Indeed, according to advisory service Capital Economics, Indian bond yields are set to remain higher for some time into the future, leading to a longer-term positive outlook for the rupee:

“We think that the RBI will continue to face difficulties in meeting the inflation target in 2017 and 2018, as commodity prices recover further and growth picks up. As such, we think that the repo rate will remain on hold for an extended period," said Capital’s Alex Holmes.

This combined with an equally negative outlook for UK bond yields, creates the sort of divergence currency traders can only dream of.

“The prospect of a further prolonged period of ultra-loose monetary policy suggests that government bond yields are set to remain markedly low for a long time yet,” remarked Capital Economics in a briefing to clients on the matter.

As such, purely from a yield differential perspective the pressure for the GBP/INR is likely to lie to the downside.

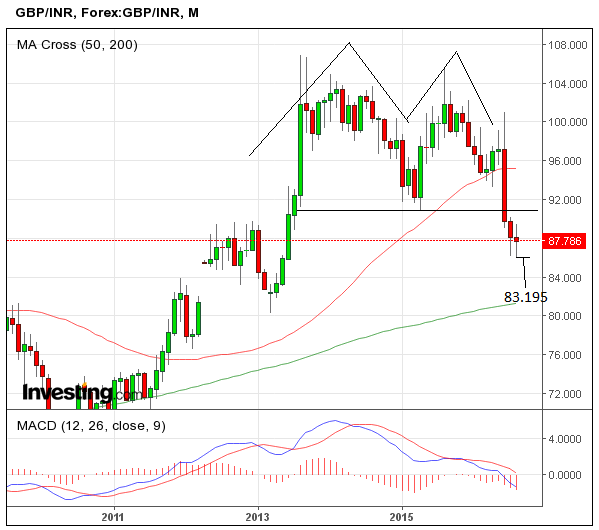

This forecast falls neatly in line with the outlook for the rupee on longer-term price charts such as the month chart below, which shows the currency moving down after having formed a large double top reversal pattern between 2013-16.

The first target for the move down following the break below the double-top’s neckline is at 83.195.

The daily chart tells a different story - but one that is familiar to those of most other sterling pairs in the aftermath of Brexit.

The pair has formed a rough but credible double-bottom pattern after basing after the referendum sell-off.

This would seem to indicate the possibility of a break higher evolving if the pair can break above the neckline at 89.140.

Such a breakout to the upside would probably then reach a target at 91.000.

Nevertheless, the last three day’s activity has been bearish, which suggests the possibility of lower prices to come, and brings into question the validity of the double-bottom.

As such, another possibility which should be considered, given the strong fundamental dynamics favouring more selling, that a break below the 87.420 swing lows would probably signal a deeper move down to the 86.030 lows – or just above at 86.100.