Calls for British Pound Rebound Against Euro and Dollar Premature say Lloyds

- Written by: Gary Howes

European currencies topped the global exchange rate leader board in the week gone by, but can they repeat their strong performance in the coming week?

- Pound to Euro exchange rate: 1.1551

- Pound to Dollar exchange rate: 1.3077

- Euro to Dollar exchange rate: 1.1325

- Pound to Australian Dollar exchange rate: 1.7148

The Pound’s effective exchange rate edged up by around 1.4% over the past week – from what was the weakest effective rate since the financial crisis.

Following the strong showing in the UK retail sales data many financial commentators have reflected that the referendum result has not had the negative impact on the economy that many had been assuming.

Indeed, the theme we have been covering over recent days has been one of calling the bottom in the GBP's decline.

Analysis from a number of big-name institutions have suggested that while there is no big recovery likely on the horizon, we can be more confident in calling the bottom of the declines.

"This optimism seems rather premature," counter Lloyds Bank in an economic brief to clients.

"Until additional ‘hard’ data allow the prospective growth deceleration to be gauged, the outlook remains highly uncertain, not least judging by the unusually wide dispersion of economists’ forecasts for UK growth," say Lloyds.

Lloyds are forecasting the Pound to Dollar exchange rate to fall to 1.28 by the end of 2016, while the Pound to Euro exchange rate is forecast to trade at 1.19 by year-end.

It will only be in September when we get the next set of economic statistics that can help determine whether Lloyds’ view is correct.

The only notable data on the calendar for GBP in the week ahead is the second estimate of UK GDP for the second quarter.

This is not likely to be a market mover as 1) it is essentially old news and 2) it covers the pre-referendum period.

British Pound has a Better Week

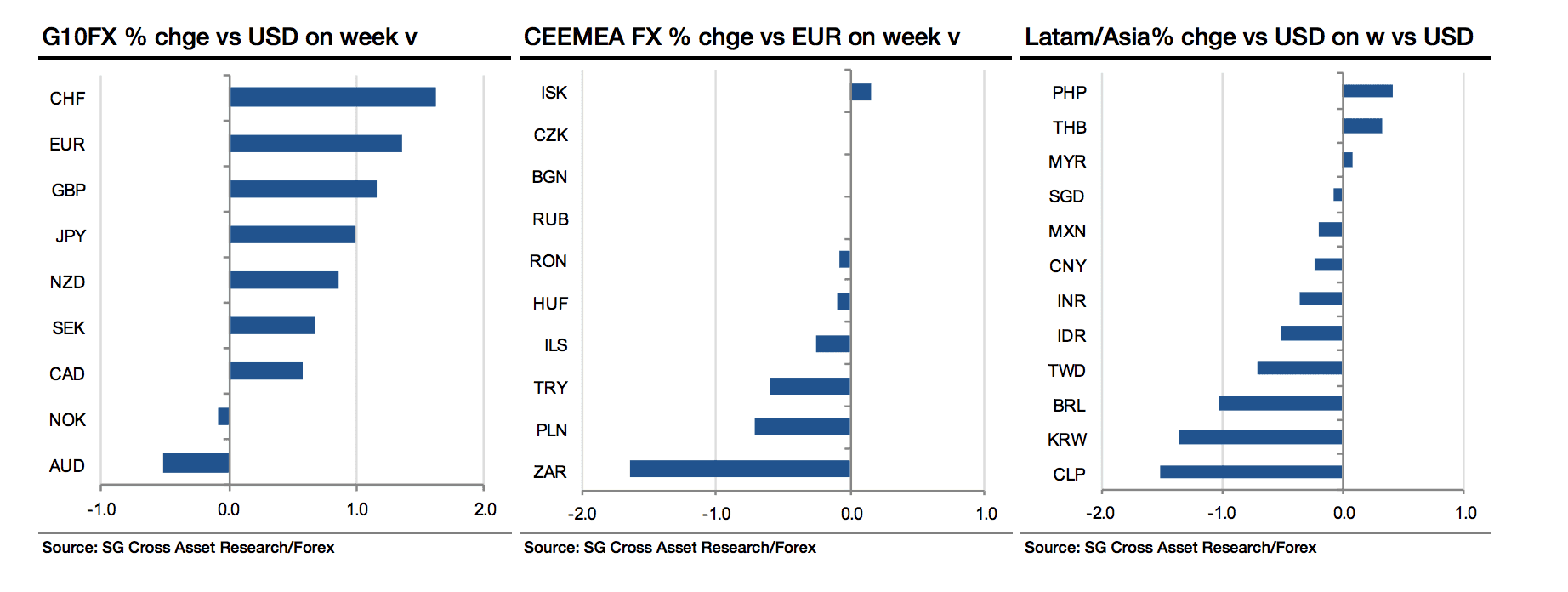

It was the Swiss Franc that topped the board as the G10’s best performer in the week ending 19th August.

The Franc was followed by the Euro and then the British Pound.

At the bottom of the piles was the Australian Dollar. It would seem that Moody’s warning that it may cut Australian banks’ credit rating spooked investors.

The Norwegian Krone recorded a small decline against the US Dollar.

The Dollar struggled as 10-year Treasury yields rose just 1bp this week, all of which happened on Friday the 19th, “so that they are ending at the top of a very narrow weekly range. That lack of yield support for the dollar drove cash into emerging market bonds,” says Kit Juckes, a strategist with Societe Generale in London.

The Dollar was undermined by a mixed bag of US economic data and FOMC minutes that continue to suggest a glacial pace of Fed tightening.

Even hints from San Francisco's John Williams and New York's William Dudley that we shouldn't be completely ruling out a September hike were unable to fire the Dollar’s engine.

Pound Sterling was helped by stronger than expected employment and retail sales data, triggering short-covering.

The data has seen many analysts have to consider the negative forecasts they laid out for the UK economy following the Brexit result as a result of the strong run.

If the Bank of England follows suit and see less downside risks to the economy then they could well call time on quantitative easing once the current round is complete.

This would be a GBP-supportive occurrence that could well stimulate a broader period of recovery.

Dollar Week Ahead: Yellen’s Jackson Hole Speech

A perception that the US Federal Reserve is in no great hurry to tighten monetary policy, on the market’s reading of the minutes of the July FOMC meeting, saw the dollar soften to its weakest, and the euro to its strongest, since the announcement of the ECB’s QE programme in January 2015.

For FX markets, and the Dollar in particular, the main focus will be Janet Yellen's speech at the Economic Symposium in Jackson Hole on Friday.

“The selling pressure in the dollar is strong and for sentiment to change, we need Yellen to say that a rate hike is coming and we need to another unambiguously strong non-farm payrolls report,” says Kathy Lien, an analyst with BK Asset Management.

Markets currently place little chance of an interest rate rise occurring before December as it is at this Fed meeting when the latest economic projections are delivered and Yellen delivers a press conference.

“If they were to raise rates this year, it would happen then, days before Christmas when Americans are well into their holiday shopping,” says Lien.

Euro Week Ahead: Big Data

The Eurozone is where the lion’s share of economic statistics are released over coming days.

Of note are August PMIs, the German IFO report and revisions to second quarter GDP.

“So far data from the Eurozone has been relatively healthy and regional officials have expressed their optimistic view that the impact of Brexit will be limited,” says Lien.

Considering that U.K. PMIs took a nosedive recently, investors will be watching the Eurozone PMIs carefully.

“EUR/USD enjoyed a very strong rally this past and there's no major resistance until the pre-Brexit high of 1.1425. However should the currency pair find itself back below 1.13, a deeper correction to 1.12 is likely,” says Lien.