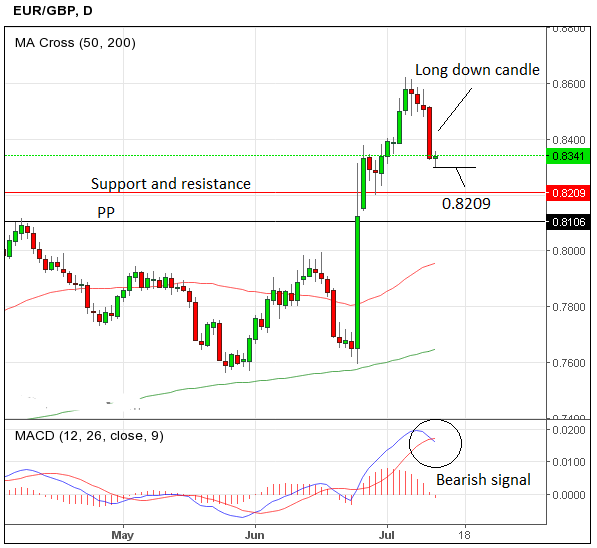

Euro in Correction Against Pound; Expected to Continue Higher Eventually; Support in 0.82s

The current pull-back in EUR/GBP is merely a correction, an Elliot Wave 4 in technical terms, and it will soon recover and continue higher, says a leading technical analyst

The EUR/GBP pair is in a broad up-trend, which is likely to reach a target at 0.8815, and then possibly 0.9250, according to analysis from Commerzbank's Karen Jones.

The market technician sees the current pull-back from the 0.8630 highs as running out of steam, either at support at 0.8320, or at 0.8220.

The pair is currently trading at 0.8418.

"Please note that we have various Elliott wave counts that suggest that the move will extend towards the 0.9250 area. Dips lower will find initial support at 0.8320/0.8228, the 38.2% retracement ahead of .8116 the April 2016 high."

Elliot Waves are a form of cycle observed in markets composed of 5 up waves and 3 down waves in a repeating template.

The are fractal, so small waves fit into bigger waves, which fit into even larger waves - well theoretically.

The current correction appears to be a wave 4, which when it ends will rotate and resume going higher in a wave 5.

Growing Signs of Weakness

According to our own analysis we feel there is more risk of downside - in the short-term anyway, although this does not necessarily contradict Jone's view that the pair is in a wave 4 correction which will eventually go higher in a wave 5.

For us, the large down-day on Monday, which saw the pair fall almost two cents from 0.8517 to 0.8328, was a strong bearish sign, and further evidence that the pair may have topped, and more downside is on the cards.

The MACD has also crossed its signal line, providing a mild bearish signal.

However, there is a possibility that this downside could be limited and capped.

It's also worth noting in this regard that the BOE did strongly hint at cutting rates in August and possibly also including some QE in the mix - a move which, if it happens is almsot certain to trigger a move higher for the pair, possibly in that wave 5 Karen Jones refers to.

Lloyd’s commercial banking’s Robin Wilkins sees the pair “supported” in the 0.8235-50 zone:

“The pair should now be well supported by the 0.8250/35 area, with key trend support below at 0.8150-0.7950. Resistance on the day may be met at 0.8390-0.8405, ahead of 0.8490-0.8550 and range highs at 0.8625/30.”

A further sign that the trend - in the short-term – at the very least (defined as 3-6 weeks) - may be changing is the triangle topping pattern which has formed at the EUR/GBP’s highs on the four hour chart (see below).

Patterns at market highs often precede a more pronounced decline, rather than a mere pull-back, which adds further technical weight to the argument that the pair is likely to fall lower.

On the four-hour chart, the MACD momentum indicator in the bottom pane has just moved below the zero-line, signalling it is now in a down-trend on the four-hour time-frame - the zero-line distinguishes whether then pair is in an up-trend or a down-trend.