British Pound Mixed at Head of New Week

The British pound was the best performing currency in the G10 space last week confirming the unit could benefit from positive momentum over coming days; but we think this is as good as it gets for now.

After an impressive run in the previous week, pound sterling was left looking overbought.

We warned a correction lower would be required to balance the market having witnessed pairs like the GBP/AUD flashing extremely overbought RSI readings.

It appears that this correction is underway, so those watching the market can expect some weakness over the near-term ahead of a potential recovery.

There is also the chance that sterling has gone as far as it can go in the circumstances - there is little fundamental reason to chase the pound higher ahead of the EU referendum on June 23rd while UK economic data has tended to disappoint to the downside over recent weeks.

With momentum stalling we could be about to see GBP settle into a consolidative phase.

"Intra-day momentum suggests the upside is becoming limited and Vlieghe’s comments (read below) may also bring home reality around the economic state at the moment. Polls we feel are likely to have less and less impact," say Lloyds Bank in a foreign exchange briefing to clients.

Recent sterling gains have contrasted with the recent weakness in the UK economic surprise index (ESI).

The unexpected resilience in April retail sales, released last week, have helped support GBP and reverse the downtrend in the ESI.

"While there are a number of seasonal distortions around Easter we would be wary of extrapolating the uptrend in monthly sales reported by the ONS. While sales volumes may have increased by 1.5%, looking at the 3m on 3m trend, which is more reflective of long term trends is rather less robust, on that basis the series moderated to 0.7% from 1.1%," says Jeremy Stretch at CIBC.

Despite the reversal in the ESI and unexpected consumer resilience, which contrasts with the anecdotal data expect overhead resistance at 1.4670 to contain GBP topside against the USD.

"We would regard recent GBP gains as looking increasingly overdone," says Stretch.

GBP/USD Not Done

As already noted, GBP/USD momentum could yet deliver an exchange rate towards 1.47.

"Key support from the "neckline" to the base, 55-day average and 50% retracement of the February/May rally remains intact at 1.4332/1.4299, and while above here our bias is to stay bullish," says a note from Credit Suisse.

Analysts argue the move above near-term price resistance at 1.4513/42 reinforces a basing story for a move back to 1.4771/4807 – the recent high and 200-day average.

"Beyond here should see strength extend to 1.4883, ahead of a cluster of more important price and retracement levels at 1.5118/30. Below 1.4193 is needed to suggest thoughts of a base can be abandoned for a move back to 1.4006, ahead of the 1.3836 low from late February," say Credit Suisse.

GBP/EUR Picture Still 'Supportive' but Profit-Taking Due

Regarding the GBP to EUR conversion, technical analysts also continue to favour advances.

Sterling/Euro (€1.2918) – the latest opinion polls are giving the ‘remain’ campaign a meaningful lead (55%-45%, according to the Times) and this has clearly been beneficial for sterling, which rose by a hefty 1.7% against the euro last week.

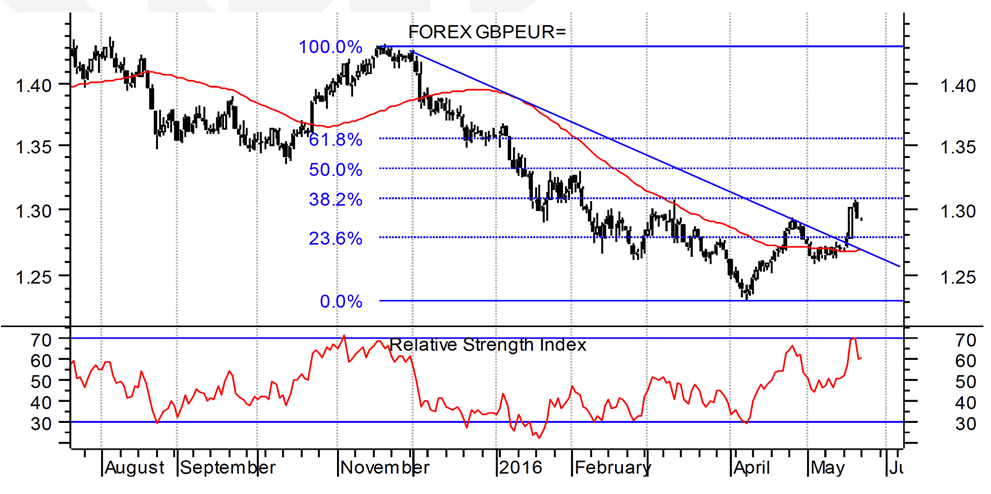

Concerning the outlook, Bill McNamara at Charles Stanley argues:

"As the daily candlestick chart demonstrates, this lifted it to its highest value since early February and, in the process, achieved a 38.2% retracement of the decline that began last November and if there is a caveat to the bull case for the UK currency it is that it close well below the week’s highs, at 1.307 (which suggests that a degree of profit-taking set in following its recent strong run).

"That said, the broader technical picture remains supportive and further upside looks possible if the polls remain the way they are."

Vlieghe Warns of Interest Rate Cuts, Undermines the Advance

While we believe that the decline is related to the underlying overbought nature of GBP, and is therefore technical in nature, others have laid blame for GBP's stall at the door of Gertjan Vlieghe, a member of the Bank of England’s Monetary Policy Committee.

In a speech, Vlieghe warned the Bank of England may need to restart its monetary stimulus if the recent slowdown in growth is not primarily due to jitters about the referendum.

An interest rate cut would undermine GBP in a significant manner as it would reduced the yield offered to international investors on UK assets even further. Sterling's value is highly dependent on foreign inflows of investor capital.

Heading into the May MPC meeting there were suggestions that Vlieghe may vote for an interest rate cut; something that would be taken as a negative for sterling as it signals a shift in thinking at the Bank.

In the event, Vlieghe joined his colleagues in voting to keep rates at current levels.

We don't see the prospect of the next move as being an interest rate cut, particularly with inflation expected to pick up speed over coming months.