Forecasts For the Pound v Euro, US Dollar, Australian and New Zealand Dollars

With the British pound under sustained selling pressure we ask where the pain might end? Here are our forecasts for the UK currency against the dollar, euro, Australian, Candian and New Zealand dollars.

The pound remained under selling pressure at the start of the new week amid general ‘risk-off’ sentiment. GBP/USD fell to a 4-day low of just above 1.4350, while GBP/EUR declined below 1.29 which suggests a steeper decline to 1.25 is now possible.

However, negative market conditions have seen the expected decline in the commodity basket and we have therefore seen relief against the New Zealand, Canadian and Australian dollars.

Sentiment to sterling is poor In the aftermath of the Bank of England's ‘Super Thursday’ when the Bank revised down the outlook for inflation in the short- and medium-term. Essentially the GBP is not finding the support from those expectations for higher interest rates that drove it higher in 2015.

Further losses were then stoked by a new YouGov poll that shows the desire to exit the European Union is growing in popularity amongst the UK populace. The implications are notable, as Goldman Sachs warn there could be losses in the region of 20% for sterling should the UK exit.

Pound Exchange Rates Today, What You Will Pay

The pound to euro exchange rate made a bearish close below the all-important 1.30 support zone on Friday which has subsequently been confirmed on Monday. This suggests further declines are likely. Banks are quoting international transfers on this pair as low as 1.2600 while independents are quoting a great deal higher at 1.2748.

The pound to dollar exchange rate is at 1.4430 with banks quoting just above the 1.40 threshold. Independent currency payments are being offered around 1.42-1.4250.

The pound to Australian dollar exchange rate is at 2.0466, banks are making payments below 2.0 while independents are quoting higher with some offering above the key 2.0 marker.

The pound to New Zealand dollar exchange rate is at 2.1830 on Tuesday. Bank transfers are in the region of 2.1220 and independents are offering in the 2.15 region.

GBP to EUR Forecast

The persistent down-trend has resumed and we have witnessed the UK currency fail at 1.29-1.30. The pound will have hoped that there was enough speculative interest to form a rebound at these levels. Unfortunately, now that stop-losses have been triggered at this level we see little buying interest until at least 1.27.

“The recent 1.2900 cycle lows are vulnerable to attack again over coming sessions. If breached 1.2750 if not 1.2550 zones will then become readable next,” notes strategist Lucy Lillicrap at foreign exchange brokers AFEX.

I also expect the exchange rate to go continue lower.

A view of the weekly chart makes it clear why – there is a large head and shoulders along the top, which has breached its neckline.

Last week’s recovery moved was a throw-back to the neckline, before an air-kiss goodbye and move lower again.

This is a classic move signalling a continuation of the down-trend.

Furthermore, MACD is very bearish on the weekly chart, and supports further downside.

The minimum expectation is the 61.8% Fibonacci extension of the height of the H&S at 1.2630, which is also the level of the 200-week MA.

However, the S1 Monthly Pivot at 1.2809 is another strong support level standing in the way, and constitutes the first target to the down-side.

For confirmation of a move to 1.2809, I would wish to see a break below the 1.2893 lows.

Further, a move below the 1.2750 level would probably signal a further move to the eventual target at 1.2630.

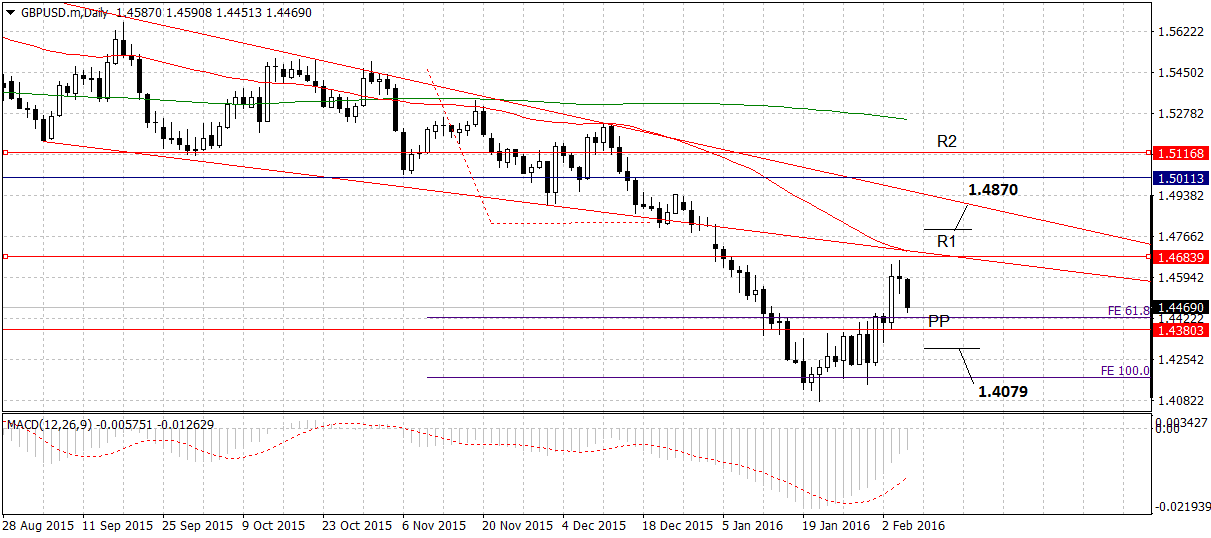

GBP to USD Forecast

Sterling's recovery against the dollar appears to have failed.

"We are viewing last weeks high of 1.4665 as the end of the correction higher. We note the Elliott wave count on the daily chart is indicating that this was the end of an ‘a-b-c’ correction. The market will have to move sub 1.4349 however to alleviate upside pressure and retarget 1.4151," says Karen Jones, a technical analyst with Commerzbank in London.

The pair's capitulation occured following the release of Non-Farm Payroll data in the United States which confirmed the US economy continues to grow jobs, and importantly, pay pressures are rising.

A break below the Monthly Pivot at roughly 1.4380, including a confirmation margin – so below 1.4275 - could signal further downside to the previous lows at 1.4079.

GBP to AUD Forecast

Still showing upside potential, particularly now that the Aussie dollar is being hit by the latest bout of risk aversion on global markets.

Both MACD and OBV indicators are converging bullishly with price which advocates for further gains.

The pair broadly remains in a short-term down-trending channel within a larger long-term up-trend.

Upside is capped by the 50-day MA and the upper border of the down-sloping channel at around 2.0600.

The S1 Monthly Pivot is situated at 2.0720, followed by the 200-day MA at 2.0827 – revealing several strata of strong resistance above the current level.

Ideally I would want to see a clear break above 2.0979 for more upside, with a target at 2.1225, the 61.8% extrapolation of the height of the channel from the predicted break.

Any further downside is stymied by the trend-line at 1.9970 as well as general round-number psychological support at 2.0000.

A clear break below the trend-line, which would be confirmed by a move below 1.9890, would probably signal a continuation of the bear trend to the S1 Monthly Pivot at 1.9737.

GBP to NZD Forecast

Appears to be resuming its down-trend – first stop the 2.1516 where the S1 Monthly Pivot is situated and the key 2.1512 lows four points underneath it.

A clear break below those key lows would probably elicit a deeper penetration all the way to the S2

Monthly Pivot at 2.1074, as the former down-trend resumed and gained significant traction and conviction.

Money Flow a little soft however as pace of decline fades pore-NFPs, however, this may not be indicative.

For confirmation of a break below the pivot and the lows I should ideally wish to see a clearance below 2.1390.

GBP to CAD Forecast

This pair is at the floor of a long sideways consolidation, box pattern, or possible double top.

Untypically for a reversal pattern, however, there is a lot of buying volume on the right shoulder, allowing for the possibility of a continuation higher eventually.

Money Flow is the lowest since April 2015 – a very bearish sign in a sideways market.

The mixed signals, however, make it difficult to predict in which direction it will break.

However, a clean breach of the neckline at 1.9732 - confirmed by a move below 1.9690 - would probably confirm a move down to support from the S1 Monthly Pivot and the trend-line at 1.9535.

Alternatively, a break above the pattern highs at 2.0949 would probably lead to a move up to resistance from the R2 Monthly Pivot at 2.1279 initially.

Bank of England Takes a Knife to Economic Forecasts

Bank of England economists see see inflation, which was 0.2 percent in December, at 1.2 percent in the first quarter of next year, down from a projection of 1.5 percent in November.

Price growth is forecast to gradually pickup after that, reaching 2.1 percent in the first quarter of 2018 and 2.2 percent a year later.

Wage growth was also revised down, with the MPC seeing pay of 3 percent this year, compared with a 3.75 percent forecast in November.

It also lowered its growth expectations, predicting an expansion of 2.2 percent this year, down from 2.5 percent in November. In 2017, the MPC sees growth of 2.4 percent and 2.5 percent in 2018.

The BOE’s forecasts were based on 25 basis-point rate increase in the second half of 2017 and the benchmark reaching 1 percent in the third quarter of 2018.

McCafferty had voted for a 25 basis-point increase between August and January. The majority of economists in a Bloomberg survey had expected him to maintain his call this month.