Pound to Aussie: Rebounding Off 2.0470; Long-Term Still Bullish

Pound-Aussie has hit major support at 2.0470 and is bouncing, however, its too early to call this a recovery..

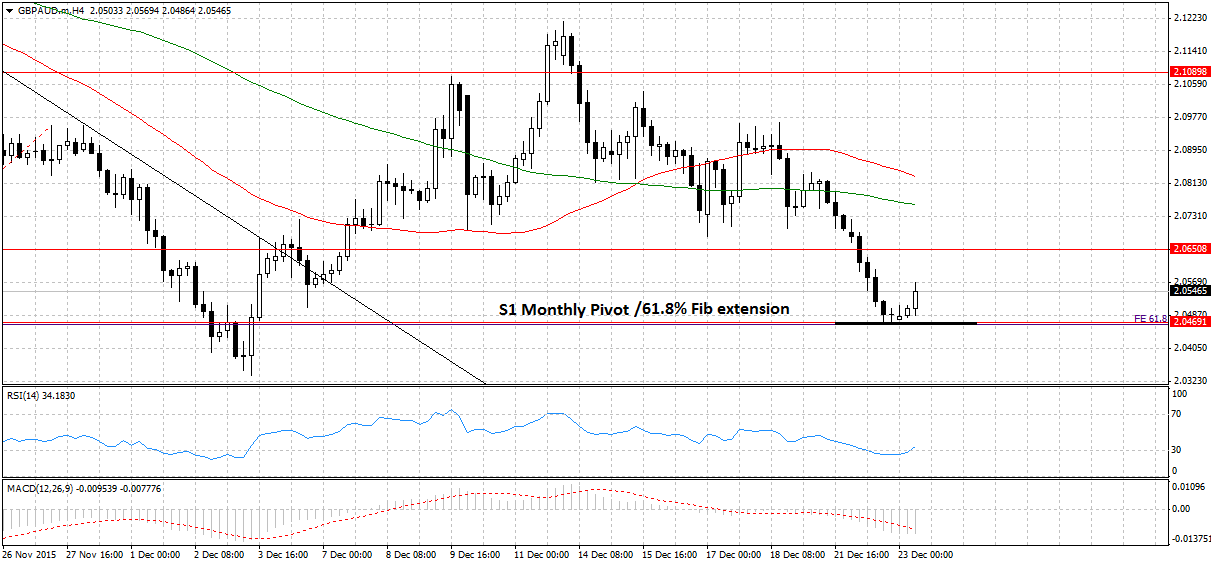

The Australian dollar-pound pair has bounced off a strong support level at 2.0470.

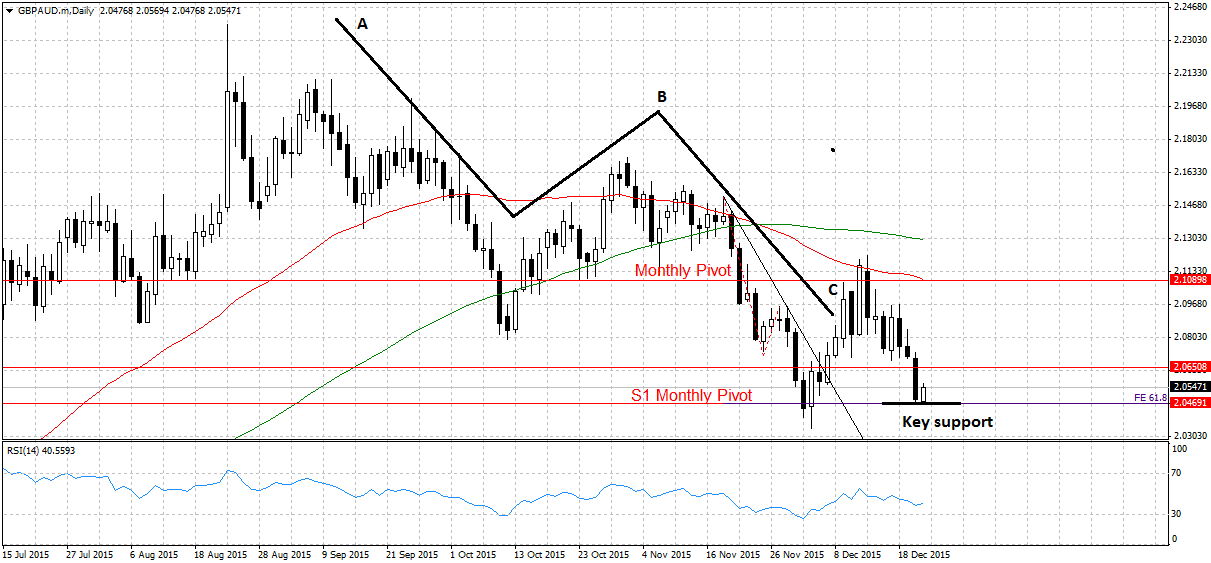

This key support cluster is made up of a double-lock of the S1 Monthly Pivot and the 61.8% Fibonacci extension of the A leg of the A-B-C correction down (see chart below).

The pair has bounced to a high of 2.0569 today, currently it is trading at 2.0540.

It is too early to say whether the bounce will extend further yet.

The 4-hour chart below shows the bounce off the support cluster more clearly.

RSI has moved above the oversold line providing a short-term buy signal.

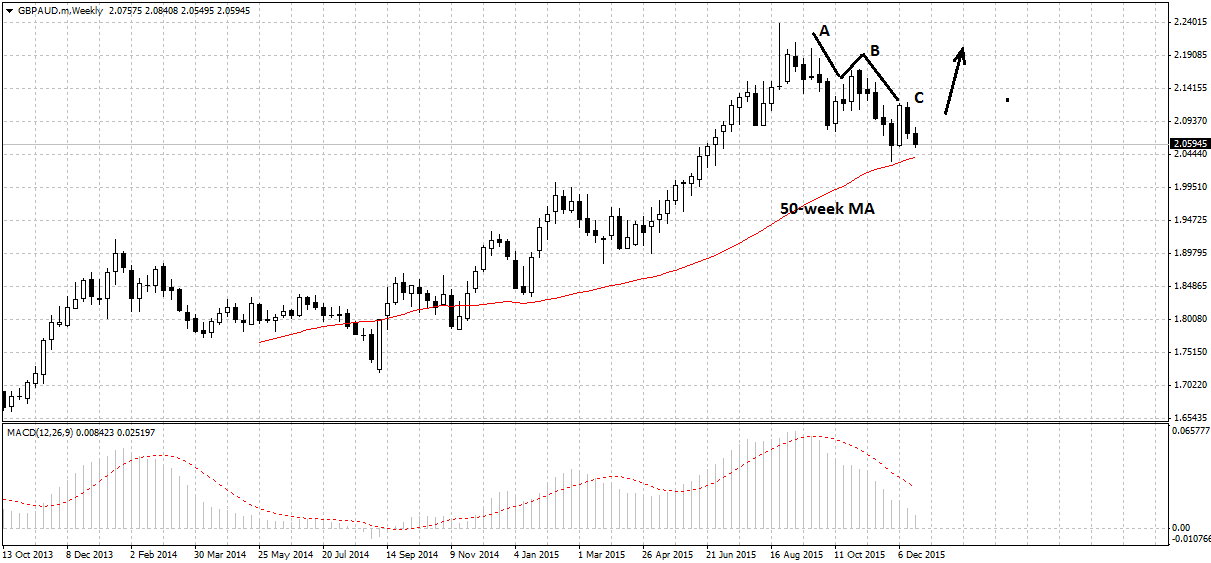

The weekly chart clearly shows the longer-term up-trend.

In September 2015, the pair peaked and started moving lower in what looks like an A-B-C correction.

This found support at the 50-week MA and the exchange rate has since recovered reaching highs of 2.1215, last week.

Since then, there has been a pull-back; however, upside strength remains convincing, and, in conjunction with the A-B-C correction, indicates a broader recovery move may be on the horizon, with a rally back up towards the 2.2384 highs, a possibility longer-term.