British Pound Forecasts Downgraded by Morgan Stanley

- Written by: Gary Howes

Morgan Stanley believe that the longer-term outlook for the pound sterling (GBP) is turning increasingly uncertain.

The investment bank looks for a gradual GBP/USD decline to 1.49 in 12 months, but take our bear case down to 1.36.

Morgan Stanley’s Ian Stannard has confirmed to clients that he is becoming more cautious on the pound’s outlook.

The investment bank had previously made the case for GBP remaining supported in the near term ahead of the first BoE rate hike, which their economists expect to come in February 2016.

Traditionally the pound would rally in such an environment, of which we currently are in.

“Six months ahead of a hike, GBP had a tendency to rally. However, the pre-hike rally may have already run its course, exposing GBP to minternational and domestic risk factors. Hence, while in the near term GBP could still be influenced by swings in relative rate expectations, we believe that the longer-term outlook for GBP is becoming more challenging, says Stannard.

Four risks to the GBP’s outlook are now of concern:

Slower pace of rate hikes:

Moderating growth and fiscal headwinds are likely to lead to a slower path of tightening than previously assumed as inflation struggles to reach target. "Once the BoE has delivered the first rate hike and emphasised the gradual and limited path, we would expect rate support for GBP to be eroded quickly," says Stannard.

Global risks:

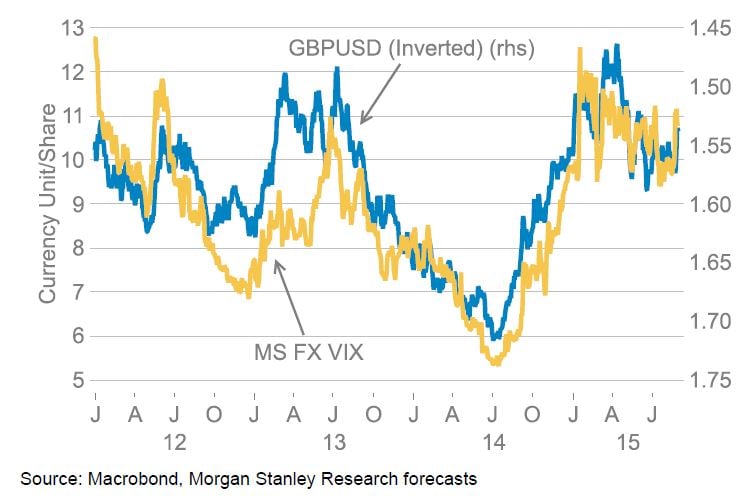

GBP is not a safe haven from global asset market volatility argue analysts - something that has become a major issue for global markets thanks to recent Chinese market stresses.

"In fact, GBP tends to come under pressure in higher-volatility environments," says Stannard, "equity market sell-offs have a negative impact on GBP, given the UK’s large financial sector."

Brexit debate:

Legislative debate regarding the EU referendum question, the Labour leadership election and the Conservatives negotiating terms for change within the EU are all putting focus back on the UK’s position within Europe.

"Opposition voices to the EU, while still in the minority, could grow stronger, impacting foreign investor confidence in UK assets and hurting GBP."

Slowing investment inflows:

Slowing cross-border flows as risk appetite is challenged leave GBP exposed, given the UK’s still large current account deficit.

"The EU debate has the potential to generate political uncertainty. In the past, such uncertainty has reduced investor inflows to the UK, undermining GBP support. An example of this was seen late last year and at the beginning of this year, when uncertainty surrounded the outcome of the May general election. At this time portfolio and FDI inflows to the UK slowed dramatically."

Pound to Dollar Forecasts Lowered

The investment bank looks for a gradual GBP/USD decline to 1.49 in 12 months, but take our bear case down to 1.36.

“While we continue to look for GBP to come under gradual pressure against USD over the next year, looking for 1.49 in 12 months’ time in our base case scenario, downside risks are Developing,” says Stannard.

Stannard believes that risks are now skewed to the downside and we have taken our bear case scenario for GBP/USD lower to 1.36 in 12 months.

Strategically analysts continue to recommend using rebounds to establish bearish strategies.

"We expect near-term GBP/USD corrections to be limited to the 1.5450 area, which will provide opportunities to enter short positions, with an initial target of 1.4800. Stops on such positions should be placed at 1.5600," says Stannard.

Srategists also suggest expressing bearish GBP views against SEK.

"The signs of a change in tone from the Riksbank towards the currency suggest that it may now be more tolerant of SEK strength," says Stannard.