How Pound Sterling Might React to the U.S. Vote Result

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling edges lower against the Euro and Dollar amidst uncertainty surrounding the U.S. Presidential vote outcome.

Election day is here and calling the winner is nigh impossible, owing to a dead heat in the polling and convergence in betting market odds that denies both Donald Trump and Kamala Harris the favourite tag.

This uncertainty will hang over financial market behaviour, tending to favour 'safe haven' assets such as the U.S. Dollar, Yen and Franc while weighing on stock markets and 'high beta' currencies such as the Australian Dollar.

The Pound to Euro exchange rate (GBP/EUR) also tends to lose value when market anxieties rise, and we saw the pair retreat from the week's opening level at 1.1928 to as low as 1.1870 over the past 24 hours.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

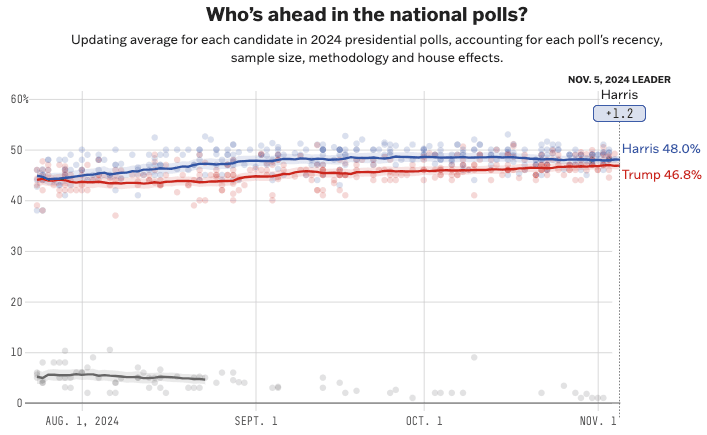

Five Thirty-Eight's final poll of polls shows Harris on 48% and Trump on 46.8%, which is well within the margin of error and effectively a statistical tie.

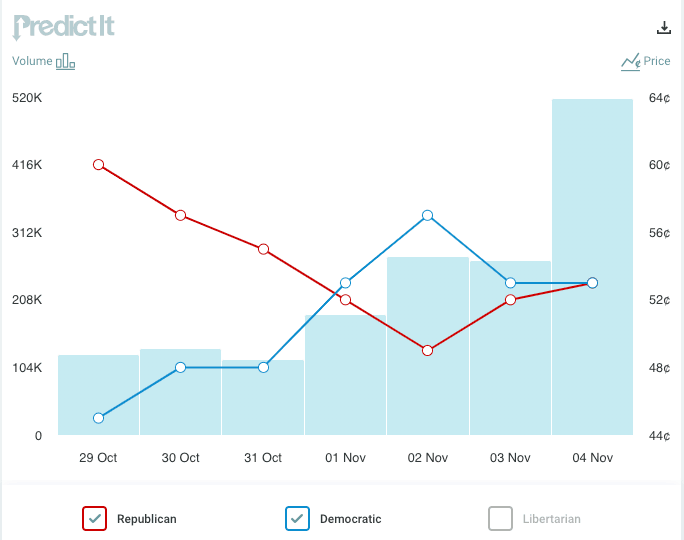

Betting markets have seen Trump's lead over Harris fade over the past ten days, and PredictIt has the odds at even on voting day. Trump was the bookies' favourite through October, which boosted the Dollar. However, the race has tightened more recently, and the USD trades below recent highs.

"The market continues to unwind ‘Trump trades’ on the back of the latest Des Moines Register US election poll which gives Harris a lead over Trump in Iowa. ‘Trump trades’ favour the greenback given the higher inflationary implications associated with the former president’s tariff and tax cut policies," says Jane Foley, Senior FX Strategist at Rabobank.

Above: Five Thirty-Eight's poll of polls.

Uncertainty over the outcome should prevent financial markets from making major moves, and we could potentially see some action tonight as the first results start coming in.

If early results show Trump doing well, we would expect the Pound to Dollar exchange rate (GBP/USD) to fall back below 1.30, with the move accelerating into any confirmation that he has won.

"If Trump wins, the market reaction is more uncertain," says Rupert Thompson, Chief Economist at IBOSS. "A Trump victory is likely to lead to a rather stronger dollar and higher government bond yields because his plans to raise tariffs sharply would boost inflation and reduce the willingness of the Fed to reduce rates."

Regarding the Pound, we would expect the likes of GBP/AUD and GBP/NZD to also rise under such an outcome as investors would begin to fret over U.S.-China relations, which has implications for the antipodean currencies.

"AUD is already trading at a discount due to concerns about a Trump win’s impact on China," says Kit Juckes, Chief FX Strategist at Société Générale.

The impact of a Trump win on GBP/EUR would be more contained, and the pair could even rally, particularly if we get a stock market relief rally.

At issue for the Euro is whether Trump pushes for trade tariffs on the Eurozone, which could weigh on EUR/USD more than it does on GBP/USD, meaning the GBP/EUR cross exchange rate can rise.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

"A Trump ‘clean sweep’ and a Harris win without a clean sweep remains the two most likely outcomes, in our view, and equally likely. These are the most bullish and most bearish outcomes for the dollar, respectively," says Juckes.

The momentum has been with Harris in recent days, with polling showing she has made gains in the late stages of the race and betting market odds have reflected this. Financial market expectations have tended to follow betting market outcomes and the net result has been a softening in the Dollar.

If Harris does well, expect further Dollar weakness, which would accelerate if she is declared the victor.

Citibank warns if initial results indicate Harris is doing better than expected, there will likely be a panicky unwind of USD longs (tariff trades like USD vs EUR, CNH, MXN, KRW).

Stock markets would also do well here as uncertainty fades and a return to 'business as usual' settles anxieties, bolstering the likes of AUD, NZD, and EUR.

We could see GBP/EUR come under pressure as EUR shows relief that the Eurozone won't have a potential tariff war with the U.S. on its hands.

There is a third way for markets to consider, whereby the tight polling and betting market outcomes are reflected in the final vote and we get a draw, similar to what we saw in the race between George W. Bush and Al Gore in 2000.

That race was settled in courts, which made for a protracted period of legal intrigue and market limbo.

Trump is already claiming voter fraud, a sign he is intent on sowing discord in the event the outcome is not decisive.

Markets won't like this, and we think this would favour the Dollar and weigh on risk-sensitive currencies. The GBP/EUR would also struggle under such an outcome, and we would expect it to make a more determined move below 1.19.

Citibank's pre-election analysis says the vote count will be faster than 2020, but counting in a few of the larger counties could run into later in the week.

Pennsylvania polls close at 20:00 ET, and Nevada polls are the last to close among swing states. Analysts expect Georgia, Michigan, North Carolina, and Wisconsin results potentially on the night but may need to wait until the following day for Arizona and Pennsylvania, given historical timing and electoral processing rules.

"Early voting is less partisan for 2024 so far, suggesting a more mixed mirage effect. Recounts rarely change the election outcome," says Citibank.

Citi says some early market action could centre on some key County vote results that could offer a glimpse into broader trends.

Expect volatility to rise when these trades start to come in.