Retail Sale Surprise Boosts the British Pound

- Written by: Gary Howes

The pound sterling enjoyed all-round gains on Thursday the 21st of May following the release of UK retail sales figures.

With elections out of the way currency markets are able to focus purely on the performance of the economy and the simple dynamic applies once more – a strong economy supports a strong currency.

April retail figures were impressive, Core Retail Sales (YoY) (Apr) read at 4.7%, analysts had forecast a reading of 3.7%. Retail Sales (MoM) (Apr) read at 1.2%, compare this to expectations for just 0.4% and it looks rosy next to the previous months -0.7% outcome.

“Sterling jumped by around one cent against both the dollar and the euro on Thursday following the release of retail sales numbers for April – the strongest since November. After a surprise fall in March, consumers were clearly in the mood to spend in April as the warm weather resulted in the strongest clothing sales in four years,” notes Andy Scott, associate director of FX advisory services at foreign currency specialists HiFX.

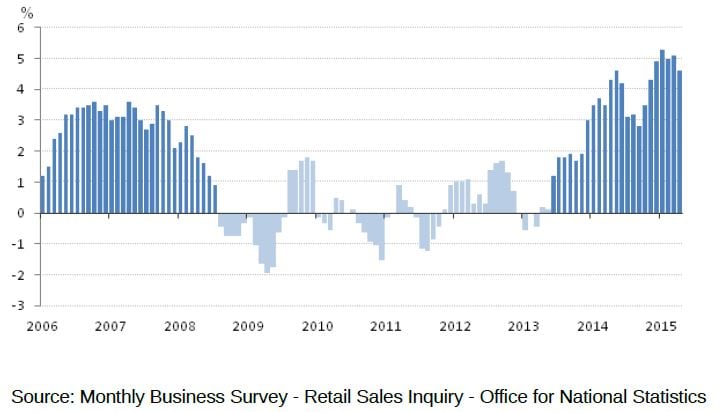

Below: 3 month on 3 month a year earlier growth in the volume of retail sales, 3 months leading to January 2006 – 3 months leading to April 2015:

The pound dollar exchange rate rose to 1.5650 confirming that 1.55 will now be the new zone of support from which further advances will be based. The pound euro exchange rate broke above 1.40 once more. We do however note that sterling tends to struggle at these levels and the bulls will be wanting some certainty that this rate can be sustained before attacking a higher exchange rate.

Scott points out that with the recent uptick in the housing market after a winter lull, and consumer confidence at its highest for several years, there’s good reason to be upbeat about the outlook for consumer spending in the months ahead.

When looking at the GBP-USD, contrast the UK data with May’s Federal Reserve minutes from their last meeting which highlighted concerns over the health of the U.S. economy and all but ruled out the first hike being at their June meeting.

They will continue to monitor the data in the months ahead but we continue to favour them to hold off hiking rates this year.

“As a result of them delaying a rate rise, we expect to see GBP/USD to move back above 1.60 this year. Against the euro, we favour sterling to continue to struggle on any moves above 1.40 and for the euro to strengthen as the euro zone recover continues, pushing GBP/EUR back towards 1.30,” says Scott.

That note on the pound euro rate is an interesting one – most analysts are forecasting a higher rate of exchange and any alternate views are always welcome for consideration. At the very least it confirms that these are good levels to buy euros with pounds.