Stalling UK Economy Poses Fresh Risks for Pound Sterling into Year-end

- Written by: Gary Howes

Picture by Lauren Hurley / No 10 Downing Street

Keir Starmer's 'shower of gloom' is being felt: the CBI and IoD report a slowing economy amidst deteriorating business confidence, which will pose risks to Pound Sterling's 2024 outperformance.

Private sector growth expectations softened in September and consumer services companies said they anticipate "a sharp fall" in employment numbers, reports the Confederation of British Industry (CBI) in its latest Growth Indicator survey.

Private sector firms reported to the CBI they expect no change in activity over the next three months (weighted balance of 0%). September's findings end a run of seven consecutive surveys in which growth expectations had been positive.

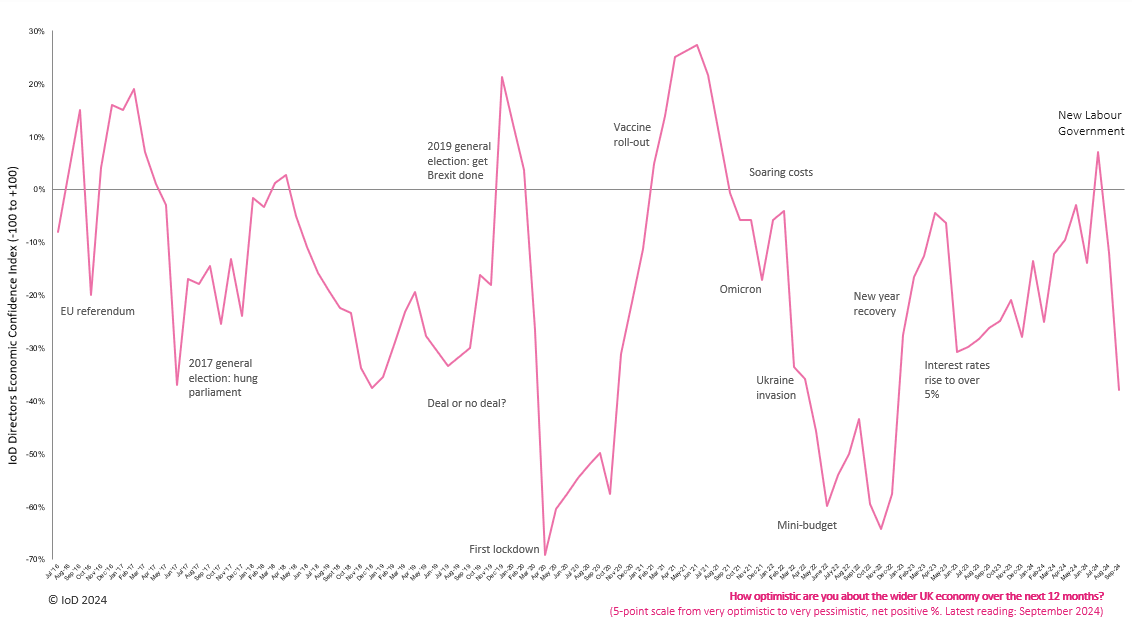

The Institute of Directors (IoD) also said on October 01 that it's Economic Confidence Index, which measures business leader optimism in prospects for the UK economy, continued to fall in September to -38, from -12 in August 2024.

This is the lowest result that the Index has registered since December 2022 (-58).

"The recent data flow from the UK has increased the likelihood that the BoE could deliver faster and deeper rate cuts which would take some of the shine off the GBP's outperformance so far this year," says a note from MUFG Bank Ltd.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

UK economic outperformance and expectations for a slow pace of interest rate cuts at the Bank of England propelled the Pound to Euro exchange rate to a high of 1.2012 in September. This backdrop, when combined with a 50bp rate cut at the Federal Reserve, helped the Pound to Dollar exchange rate hit a peak of 1.3430.

"A softening in the outlook comes after activity fell in the three months to September (-15%). The decline was broad-based, with all three major sectors reported falling volumes," says Alpesh Paleja, CBI Interim Deputy Chief Economist.

UK businesses are feeling the chill of a slowdown in the Eurozone economy, but the new government of Keir Starmer's Labour Party are likely the biggest culprit.

Starmer and his ministers have warned of pain to come in October's budget, which will include a number of tax rises while there has been no commitment to maintaining existing tax reliefs for some sectors of the economy.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

The new government is also set to introduce new employment legislation that will make it more onerous for businesses to employ staff.

"Business confidence and investment expectations both took a further and larger dive in September. IoD members cite ongoing concerns over likely tax increases, the cost of workers’ rights, international competitiveness, broader cost pressures and the general outlook for UK economic growth," says Anna Leach, Chief Economist at the Institute of Directors.

Economists say the sombre tone of the new government risks triggering investor, business and consumer caution, which becomes a self-fulfilling prophecy as it hits growth.

Any slowdown in the economy will be acknowledged by the Bank of England, which could take a more 'dovish' stance and signal it stands ready to increase the pace at which it cuts interest rates.

The Bank will be particularly concerned to hear the CBI reports consumer services companies anticipate a sharp fall in numbers employed (-29%).

The IoD said the Headcount expectations component of its business survey continued on a downward trend, falling to +6 in September from +10 in August and +24 in July.

Regarding inflation, the CBI reports inflation expectations for business & professional services firms picked up somewhat (+13%, from +2% in August), and weakened for consumer services firms (+9%, from +17%).

This reinforces the view that UK inflation continues to prove sticky, which can limit the extent to which the Bank will be able to cut interest rates and risks raising the odds that the UK enters a stafflationary economic environment of low growth and high inflation.

Meanwhile, the IoD said business investment intentions registered their lowest level since September 2020 and their sharpest drop since the outset of the pandemic, dropping from +24 in July to +10 in August and now -6 in September.