Pound Can Rise Against Dollar, Euro, Yen and Franc Says BofA

- Written by: James Skinner

Image © Adobe Images

BofA Global Research says Pound Sterling can rise further against the Dollar, Euro, Japanese Yen and Swiss Franc.

The call comes as the Pound stages a recovery from early August lows, encouraged by data suggesting the UK economy continued to grow strongly last quarter and that the labour market remained in good health in recent months.

Retail sales have remained strong, meanwhile, and despite the Bank of England’s restrictive monetary policy continuing to bear down on growth and inflation, the latter of which underwhelmed economist expectations for July on Wednesday.

BofA Global Research strategists say the Pound can still rise further and that it should reach 1.35 against the US Dollar by year-end, and 1.20 relative to the Euro and Swiss Franc.

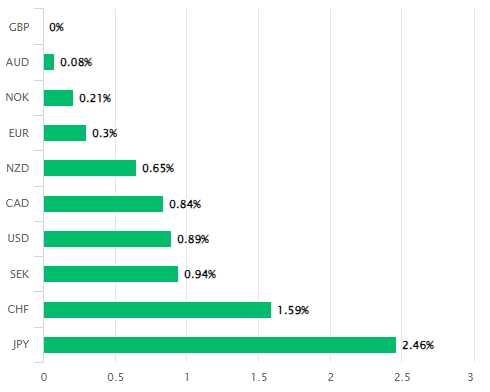

“GBP remains the best performing G10 currency year-to-date. The fundamental/secular positives remain the same and we are reassured that recent weakness has not been a reflection of the UK outlook,” they said.

Above: Pound Sterling performance relative to G10 counterparts this week. Source: Pound Sterling Live.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

“All else being equal, the case for higher GBP vs EUR, JPY & CHF remains compelling, but this leaves GBP vulnerable to any near-term volatility shock,” they added in a Thursday briefing.

Perhaps even more notably, the Pound is seen rising to 213.60 relative to the Japanese Yen, which would be its best level since the eve of the global financial crisis back in 2008.

Sterling’s comparatively high yield offering and a continued market appetite for ‘carry,’ - the positive difference between any two interest rates in a currency pair - is expected to remain a magnet for speculative traders.

The carry offering is highest in relation to low-yielders like the Euro, Swiss Franc and Japanese Yen, hence why selling those and buying Sterling appears most “compelling” for BofA Global Research strategists.

However, this kind of market activity can lead speculators to accumulate large positions that are susceptible to liquidation in times of market stress and investor risk reduction, hence the concern about volatility shocks.

Above: GBP/USD, GBP/CHF, GBP/EUR and GBP/JPY shown at daily intervals.