Pound Sterling Feels Weight of Rising Rate Cut Odds

- Written by: Gary Howes

Image © Pound Sterling Live

The British Pound is weaker across the board as the odds of a Bank of England rate continue a steady rise, with the market now odds-on for a cut to be announced tomorrow.

Money market pricing, gleaned from the Overnight Index Swap market, shows that the probability of a hike is now over 60%.

This is up from 40% earlier in the month when markets judged strong services inflation figures would mean the Bank would have to wait until September before cutting.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The rise in odds for an August 01 cut has correlated with a steady fall in the value of the Pound from recent highs against both the Euro and Dollar.

Should the Bank proceed with a cut, further Pound Sterling weakness as the gap between reality and expectations closes fully. "A cut could thus be seen as a slightly more dovish outcome than currently expected by the markets and thus weigh on the GBP," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

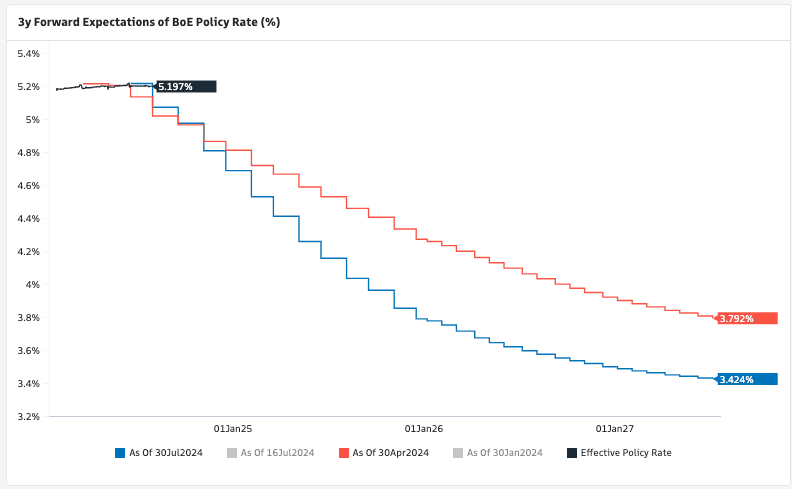

Above: The markets see a deeper path of rate cuts than was the case back in April. Image courtesy of Goldman Sachs.

"We expect the BoE to vote 5-4 to cut the Bank Rate by 25bps at its meeting this week. We highlight that it is a close call," says Sonali Punhani, an economist at Bank of America. Punhani's colleague, FX strategist Kamal Sharma, says, "risks are skewed asymmetrically to GBP weakness if BoE cuts."

The Pound can rebound if the Bank leaves rates unchanged, but we would anticipate strength to be limited. This is because if the Bank opts to keep rates unchanged in August, the decision would be accompanied by clear guidance to expect a September rate cut.

Therefore, the Pound would be held back by rising odds of a September cut.

"We expect the Monetary Policy Committee will keep Bank Rate on hold at its next meeting on August 1," says Andrew Goodwin, Chief UK Economist at Oxford Economics. "We expect the MPC to use the Monetary Policy Report and press conference to tee up a September rate cut."

Economists at Barclays expect the Bank of England to pull the trigger on the cutting cycle this Thursday, based on "the revealed preference in June by the core of the MPC to start easing soon."

However, Barclays' currency strategists think the downside to the Pound will be limited. "A hawkish cut by the MPC is an opportunity for the pound."

"Rate differentials should not be much affected by the reallocation of cuts across the cycle, implying limited damage for the pound. Instead, demand resilience and a willingness to re-engage with the EU are far bigger positive influences for the pound, in our view, and we look to re-engage on the long side on any further weakness," say strategists.