Optimism in Pound Sterling Hits Record Levels

- Written by: Gary Howes

Image © Adobe Images

According to the latest data showing how global investors view the currency, investor optimism in the British Pound has reached record levels.

Weekly data from the Commodity Futures Trading Commission (CFTC) shows that the 'long' position on the Pound has risen to 0.183M contracts.

"GBP net long positions increased for the third consecutive week, in dramatic fashion," says Jane Foley, Senior FX Strategist at Rabobank.

Long positions refer to the contracts taken out by investors, real-money traders and speculators (hedge funds) that would offer a positive return if the Pound rises further. It is why positioning data offers a key insight into sentiment and potential future direction.

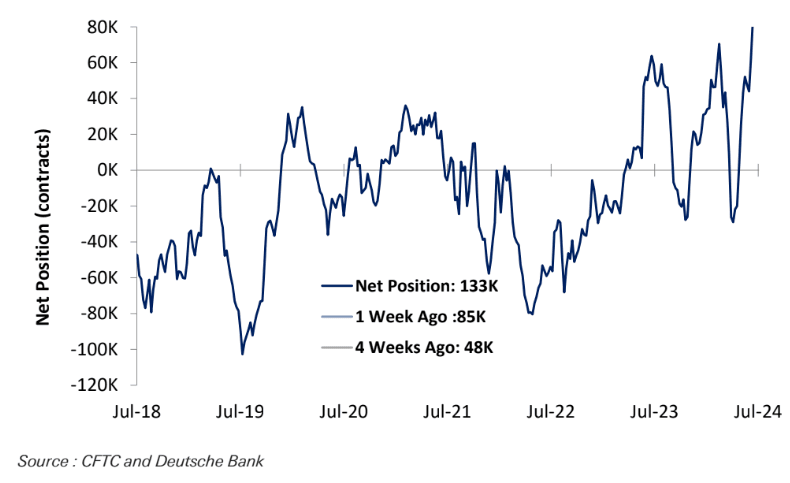

Above: GBP futures spec net positions. Image courtesy of Deutsche Bank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"GBP longs increased by 48K to 133K, a record high," says Elsa Lignos, Global Head of FX Strategy at RBC Capital Markets.

The Pound is 2024's best-performing group-of-ten currency, having surpassed the Dollar to take the crown in July.

"The confluence of a few different factors – Labour’s landslide, the Bank of England’s caution of cutting rates, and political uncertainty elsewhere, among others – is driving positive sentiment on the pound," says Nigel Green, CEO of deVere Group.

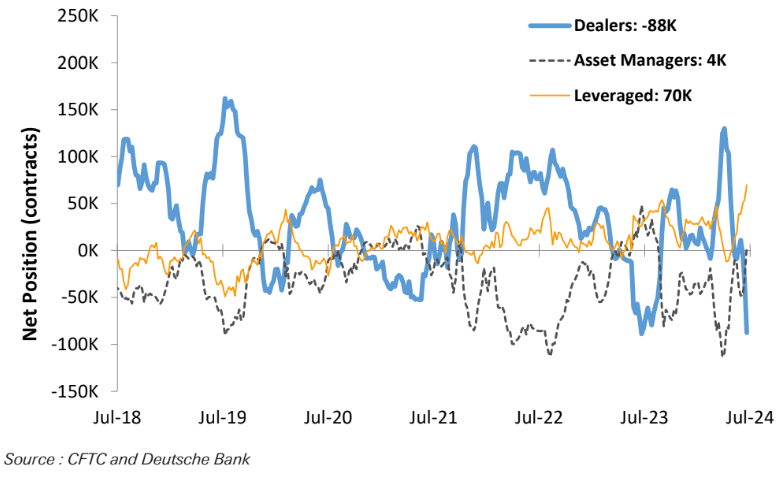

Above: GBP futures by trader type

There is a chance that positioning in the Pound has become stretched, which means it is at risk of a sharp pullback in the near term, particularly if data or the August 01 interest rate decision at the Bank of England prove unsupportive.

"While we remain of the view that the pound can continue to pick up support, we see this as a less straightforward call now that the market is holding long GBP positions. This positioning implies that the pound may become more sensitive to disappointing news or to dovish takeaways from the BoE which indicates scope for more volatility," says Foley.

Although positioning looks stretched by historical standards and raises near-term risks of a downside correction, it doesn't necessarily mean the Pound's broader, multi-month uptrend is at risk.

“A growing number of investors are likely to pile in, further pushing the currency’s value in the near term," says DeVere's Green.

DeVere predicts Pound-Dollar can reach 1.40 by March.