Pound Sterling Extends Gains Against Euro on GDP Result, Still Under Pressure Against Dollar

- Written by: Gary Howes

Image © Adobe Images

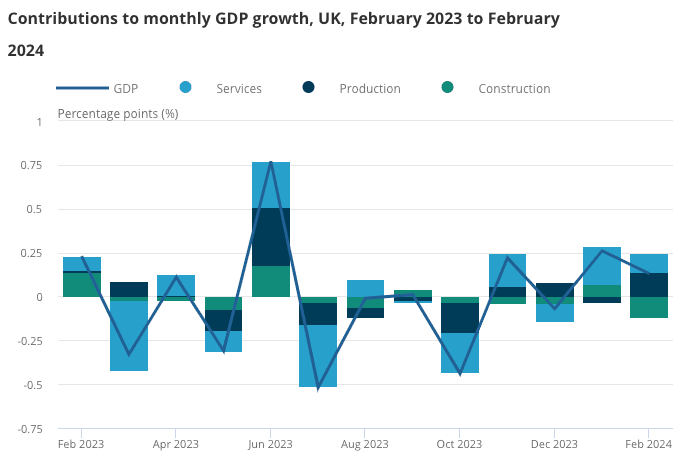

The British Pound was broadly supported after the ONS said the UK economy grew in February and revised higher its initial estimate for January's growth.

The Pound to Euro exchange rate returned to the 1.17 threshold after it was reported the UK economy grew 0.1% month-on-month in February, while January's figure was revised higher to 0.3% from 0.2%.

This almost guarantees the quarterly number will show a decent return to growth, bringing an end to the mild H2 recession. In fact, GDP would need to fall by an unlikely 1.0% m/m or more in March for the economy to contract in Q1 as a whole.

The Pound is up against the majority of its peers on the day, however, the Pound to Dollar exchange rate continues to struggle at 1.2538 in the face of the broader U.S. Dollar rally that dominates play in FX following the release of strong U.S. labour market and inflation data.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Driving the UK GDP upside was production output, which grew by 1.1% in February 2024 and was the largest contributor to the growth in GDP in the month.

The services sector - the largest sector of the UK economy - grew by 0.1% in February 2024, following growth of 0.3% in January 2024.

The Pound's upside potential stemming from these GDP figures will likely be limited for the simple fact that we are not seeing the kind of growth needed to stimulate inflation materially.

In short, we need to see a run of extraordinary GDP prints to suggest the economy can generate the kind of upside inflation surprises we have seen in the U.S. of late.

This would mean the Bank of England will likely cut rates in June or August, as the market has expected for some time now.

Because the fundamentals around rate cut expectations largely remain unchanged, the Pound's upside potential in the short term will be limited.

"Though the UK appears to be entering a slightly more positive period, the economy is still sluggish, and given inflation recently fell to 3.4%, the Bank of England will be facing ever mounting pressure to begin cutting rates," says Richard Carter, Head of Fixed Interest Research at Quilter Cheviot.