Pound Rises As Bank of England's Message Hits Home Says BofA

- Written by: Gary Howes

Image © Pound Sterling Live

The British Pound is finding support as "the message is getting through" that the Bank of England is serious about keeping interest rates at 5.25% for longer than the market expects.

This is according to a new analysis from Bank of America, which finds that improved UK data outcomes are helping reinforce the Bank's 'higher for longer' message.

"Higher for longer rates helped by data bounce & critical for further GBP recovery," says Kamal Sharma, an analyst at Bank of America in London. "GBP should trade at top of reset range."

The call comes after a concerted effort by members of the Bank of England's Monetary Policy Committee have spoken out against expecting anything close to the scale of rate cuts 'priced in' by markets.

It also follows a run of recent above-consensus economic data outturns.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

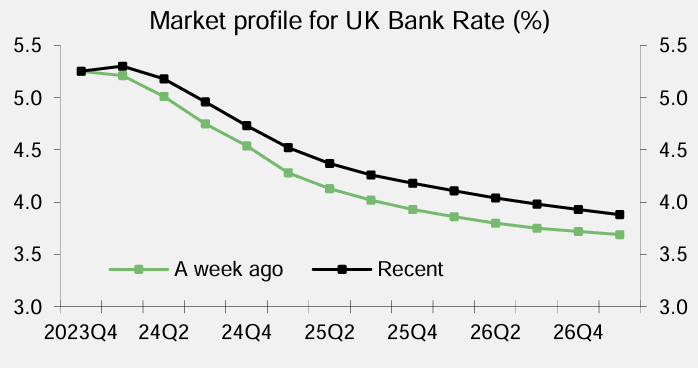

At the start of last week, the market was expecting up to 80 basis points of cuts, with pricing showing the first cut could fall as soon as May.

But Bank of England Governor led the Bank's charge against these expectations, telling Parliament's Treasury Select Committee that Bank Rate would be paused at 5.25% for an "extended Period".

"The Bank of England (BoE) has been at pains to stress to markets that UK rate pricing for cuts in 2024 is misplaced," says Sharma.

Above: Bets for rate cuts in 2024 have been reduced recently. Image courtesy of Lloyds Bank.

Bailey reinforced the message on Monday when he told a regional newspaper that he was concerned the fight against inflation would get tougher, with the move from 4% to 2% likely harder to achieve than the move from 6% to 4%.

The message is getting through to the market, which has reduced its expectations for rate cuts over recent days, which has supported UK bond yields and helped the Pound recover against the Euro and Dollar.

"The message finally appears to be resonating with markets," says Sharma.

Matt Lewis from TopMoneyCompare says that markets currently see a two-in-three chance of the BoE keeping rates at 5.25% through June 2024, after a hawkish shift in expectations.

The Pound to Euro exchange rate has risen to a multi-week high of 1.1550 in response to the messaging, while the Pound to Dollar rate has peaked at 1.2667.

Jonathan Haskel is the latest member of the Bank of England to warn there is no prospect of a rate cut over the coming months as the UK's labour market remains too "tight".

Haskel told an audience at the University of Warrick that the still-high degree of labour market tightness continues to impart inflationary pressures on the economy.

"This will need higher rates for longer to get inflation sustainably to target. This is why I have been voting for higher rates at recent meetings," he said.

Bank of England Deputy Governor Dave Ramsden said in a television interview on Tuesday that UK inflation is becoming more "home-grown" and will be “challenging to squeeze out of the system."

Ramsden said monetary policy would have to stay "restrictive for an extended period of time".

Bank of America says UK interest rates will likely remain elevated through much of 2024.

"It has taken some time for this to resonate with the UK rates market, but we are finally seeing signs that the message is being heard," says Sharma.

Concerning Pound Sterling's outlook, a further lifting of expectations can continue as Bank of America's UK economics team believes that the Bank of England is likely to stay on hold for the majority of 2024, "which clearly challenges even the current repricing of the curve".

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes