Pound Sterling Buries the 'Emerging Market Currency' Tag

- Written by: Gary Howes

Above: The post-Brexit vote era has, at various points, seen the Pound labelled an Emerging Market currency. Image © Adobe Images.

Pound Sterling is very much a Developed Market currency, according to a new research note from the FX research team at investment bank Nomura.

What should be an obvious statement is worth repeating, given the fondness of analysts to tag it as an Emerging Market currency at various points in the post-Brexit vote era.

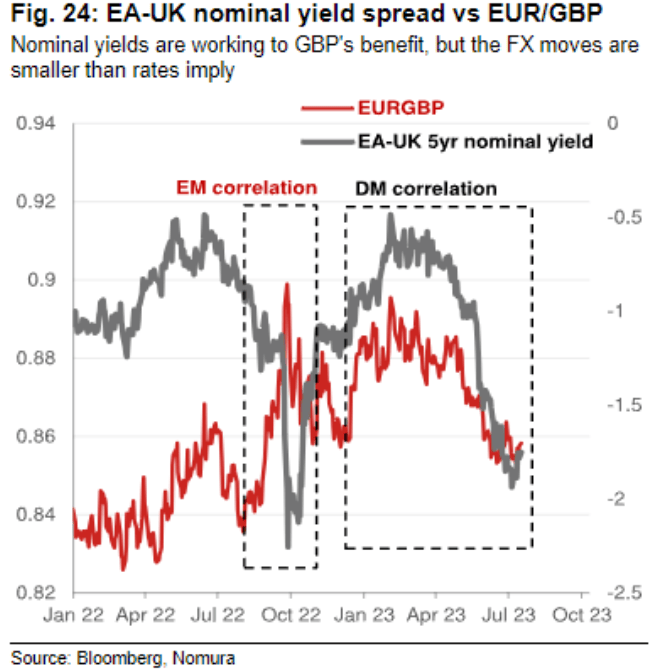

The last time we witnessed an explosion of Sterling EM headlines was around the time of the Liz Truss mini-budget, which led to a blow-out in UK bond yields that would typically boost the Pound (DM currency behaviour), but the opposite happened with the Pound dropping sharply (EM currency behaviour).

Nomura analyst Jordan Rochester says the periods of EM-like correlations for FX and rates are evidence of capital flight out of the UK in periods of stress.

"However, that proved fleeting, with policymakers acting to eventually stem the flow (e.g., BoE interventions, Liz Truss resignation)," he says.

Rochester deals with the "recurring EM question" in a new note on July 18. "Is GBP acting like an emerging market?" he asks, "no, it is not," is his answer.

"In terms of trading, we currently see the opposite: GBP is acting in a very DM-like manner, following its rate spreads tightly," he adds.

The above chart shows the shift in correlations between GBP and UK bond yields.

Looking at the UK's risk profile going forward, the analyst says the UK's external financing risks are evident for the UK government, with 28% of gilts held abroad. 64% of UK corporate bond issuance is issued in hard currency.

"That sounds like a lot but that’s nowhere near as extreme as actual EMs such as Latin America, the UK credit market is relatively small and the hard currency exposure is due to the UK’s exposure to the global energy, mining and financial sectors (with revenues in USD making it less of an FX risk)," says Rochester.

Nomura is looking for a gradual and limited depreciation in the Pound-Euro rate into year-end but a firmer Pound-Dollar conversion.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes