Pound Sterling: Soft Markets and Bank of England Enforces Retreat against Euro and Dollar

- Written by: Gary Howes

- GBP ends limps into the weekend

- Outlook remains challenging say analysts

- Hampered by uncertainty on global markets

- Bank of England ready to exit rate hiking cycle

Image © Adobe Images

The British Pound limped into the weekend hamstrung by uncertainty on global equity markets and a Bank of England that will likely deliver fewer interest rate increases than the market had been expecting.

And foreign exchange analysts say the currency will likely continue to underperform until at least the second half of the year.

"Sterling will be at the mercy of global risk sentiment and interest rate pricing," says George Vessey, FX & Macro Strategist at Convera.

Global equity markets have struggled over recent days amidst fears the U.S. Federal Reserve and European Central Bank will raise interest rates to levels that will squeeze the life out of the global economy.

The Pound has a positive correlation with investor sentiment, meaning it tends to struggle against the Euro and Dollar when markets are in decline. It does however offer some upside potential against currencies such as the Krone, Australian and New Zealand Dollars which are even more sensitive to sentiment.

But the prospect of an end to the Bank of England's interest rate hiking cycle later this month appears to be of greater relevance to currency markets, say analysts.

"The BoE remains a negative factor for pound performance in the near-term," says Lee Hardman, Senior Currency Analyst at MUFG.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Pound to Euro exchange rate rose to a high of 1.1423 on Tuesday before stumbling back to where we find it ahead of the weekend at 1.1293.

A good portion of the recent fall owes itself to Bank of England Governor Andrew Bailey's warning that there was no cast-iron commitment to raising interest rates this month, let alone again in subsequent months.

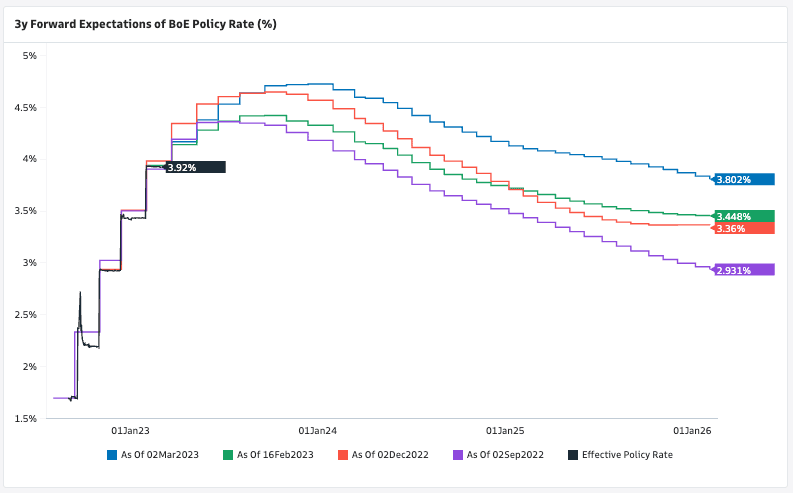

The comments fly in the face of market expectations that show investors are priced for a far higher peak in Bank Rate:

Above: Money market pricing showing the evolution in expectations for Bank Rate. Image courtesy of Goldman Sachs.

Bailey emphasised in a speech midweek that the next sets of wage and inflation data would matter when formulating future decisions and that in his view the economy was evolving as expected.

The Bank said in February it expected inflation to fall sharply in 2023, therefore it would not be required to raise interest rates as sharply as markets were expecting.

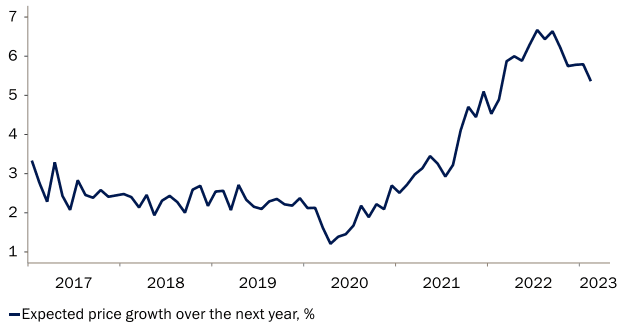

The message was bolstered by the latest Decision Maker Panel survey of UK CFOs - one that the Bank follows closely - that showed another step-down in inflation expectations.

This meant firms might be less inclined to pursue higher prices, therefore vindicating the view of some members of the Bank of England that enough had already been done by way of interest rate hikes.

"Yesterday’s Decision Makers Panel survey signalled that firms now expect to raise prices and wages at a slower pace, which favours a more cautious monetary policy approach," says Francesco Pesole, FX Strategist at ING Bank.

Raphael Olszyna-Marzys, International Economist at J. Safra Sarasin, says the Bank's latest Decision Maker Panel survey "is encouraging".

It shows companies expecting prices to grow by 5.4% over the next year, from a peak of 6.7% reached last summer.

"We expect the BoE to hike by 25bp in March, and then stay put for the rest of the year," says Olszyna-Marzys.

Above: "Inflation expectations have come off their peak" - J. Safra Sarasin. Chart: DMP price expectations component.

ING thinks the Bank will hike by 25bp on 23 March and the market’s pricing for an additional 50bp of tightening after that seems too aggressive.

At the start of February UK money markets showed investors were prepared for Bank Rate to peak close to 5.00%.

But following Bailey's speech the expected peak for the terminal rate has retreated to 4.75%.

But analysts say the peak will likely be 4.25%, suggesting more scope for rates to come down, which could weigh on the Pound.

"We now expect the BoE to deliver one more 25bps hike this month," says Hardman.

The Pound's outlook against the Euro is particularly challenging, given the European Central Bank (ECB) is clear significant further hikes are likely. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

"The ECB’s narrative has fallen more convincingly on the hawkish side compared to the BoE’s," says Pesole.

"We expect the ECB to stick to their hawkish policy stance when they meet this month. Another larger 50bps is done deal and we expect the guidance to leave the door open to another 50bps hike in May following further upside inflation surprises in the eurozone," says Hardman.

The relative monetary policy divergence would likely boost Eurozone bond yields relative to UK counterparts, creating currency flows in favour of the Euro.

Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole says interest rate differentials and a troubled economy are likely to keep the Pound under pressure over the coming months.

"The deteriorating UK external imbalances as well as worries that the BoE is falling behind the curve could come to haunt the GBP again in the coming months. We therefore keep our cautious stance on the GBP

in the next 3-6M and expect a cautious and rather tentative recovery only in H223," he says.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes