Pound Sterling Recovery against Euro, Dollar Boosted by Market Reaction to Latest U.S. Data, Fed Speak

- Written by: Gary Howes

Image © Adobe Images

The risk-sensitive British Pound was an outperformer on global currency markets after U.S. data came in softer than expected, keeping alive market expectations for an ultimate end to the Federal Reserve's rate hiking cycle.

The Pound extended a recent recovery against the Euro and Dollar after applications for U.S. unemployment benefits rose for the first time in six weeks.

"GBP remains highly sensitive to changes in risk appetite variables," says Stephen Gallo, Head of European FX Strategy at BMO Capital Markets.

However, the Pound was lower against those currencies that are even more reactive to risk sentiment; this includes the Australian and New Zealand Dollars as well as Norway's Krone.

Initial unemployment claims rose by 13K to 196K in the week ended Feb. 4, Labor Department data showed Thursday, the market had been expecting 190K applications.

Continuing claims, which include people who have already received unemployment benefits for a week or more, increased to 1.69 million in the week ended Jan. 28.

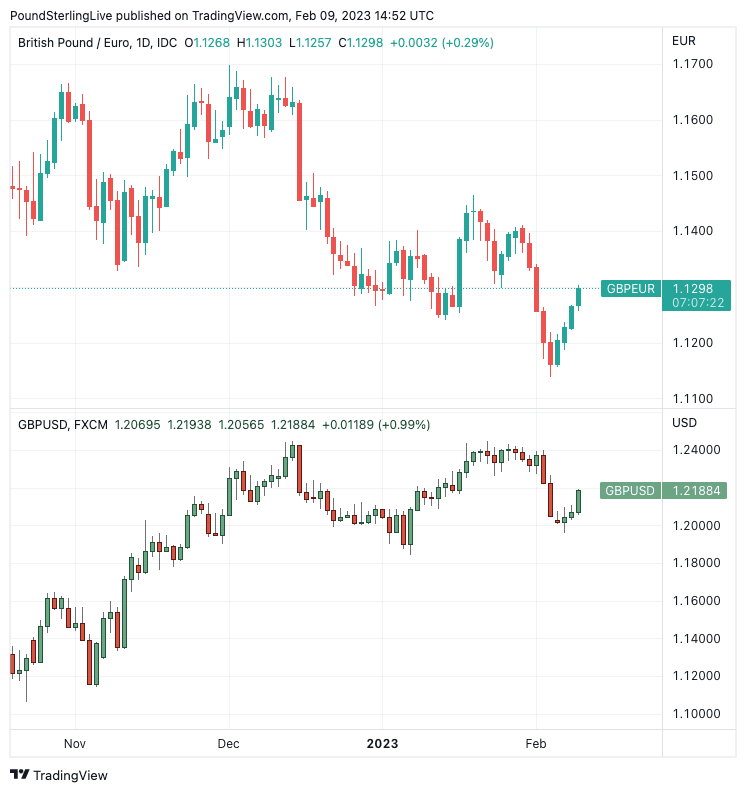

The Pound to Euro exchange rate rose above 1.13 again for the first time in a week while the Pound to Dollar exchange rate rose to 1.2150, levels last seen ahead of the fall that followed last week's Bank of England policy update.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The U.S. claims data come just days after an unusually strong U.S. labour report that showed the economy created in excess of 500K jobs in January, leading to investor concerns that the Fed would have to push interest rates higher than previously expected.

Stock markets tend to fall and investor sentiment deteriorates when faced with higher lending costs in the world's largest economy.

The Pound tracked markets lower and the Dollar rallied in the wake of Friday's strong non-farm payroll data, but the jobless claims data is consistent with a wider pool of data which shows the U.S. economy is slowing.

Expectations for a halt in Fed rate hikes, and then cuts later in the year, undermined the U.S. Dollar in the latter part of 2022 and early 2022.

Above: GBP/EUR (top) and GBP/USD at daily intervals. Consider setting a free FX rate alert here to better time your payment requirements.

Should the theme continue then the Pound can likely extend higher against the Dollar and Euro but come under pressure against the New Zealand and Australian Dollars.

Meanwhile, Richmond Federal Reserve President Thomas Barkin said on Thursday that the effects of the Fede's policy tightening have been substantial.

Barkin - who is not a voting member of the Fed's interest rate setting body - said it would make sense for the Fed to steer "more deliberately" from here due to lagged effects of policy.

"Inflation is likely past its peak but still elevated, will take longer for a pullback in demand to further slow the pace of price increase," he said.

Barkin indicated he was confident that Fed has its foot unequivocally on the brake.

"While average inflation has peaked, the decline has been distorted by a few goods, median has stayed high," he added. "Data continue to push back recession risks."

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks